Litecoin

Litecoin’s 18% plunge attracts whales – Better things coming?

Whales continued to buy Litecoin while its price dropped, suggesting potential long-term bullish sentiment.

- Litecoin’s price dropped by 18% in the last 30 days.

- A few metrics hinted at a trend reversal.

Litecoin [LTC] bears dominated the coin’s price action last month as it shed a substantial amount of its market capitalization.

The drop pushed LTC to the 20th spot on the list of top cryptos by market cap. However, whales have now started to accumulate LTC.

Litecoin’s double-digit drop

According to CoinMarketCap, Litecoin’s price declined by more than 18% over the last 30 days. The massive price drop pushed the majority of LTC holders into losses.

AMBCrypto’s look at IntoTheBlock’s data

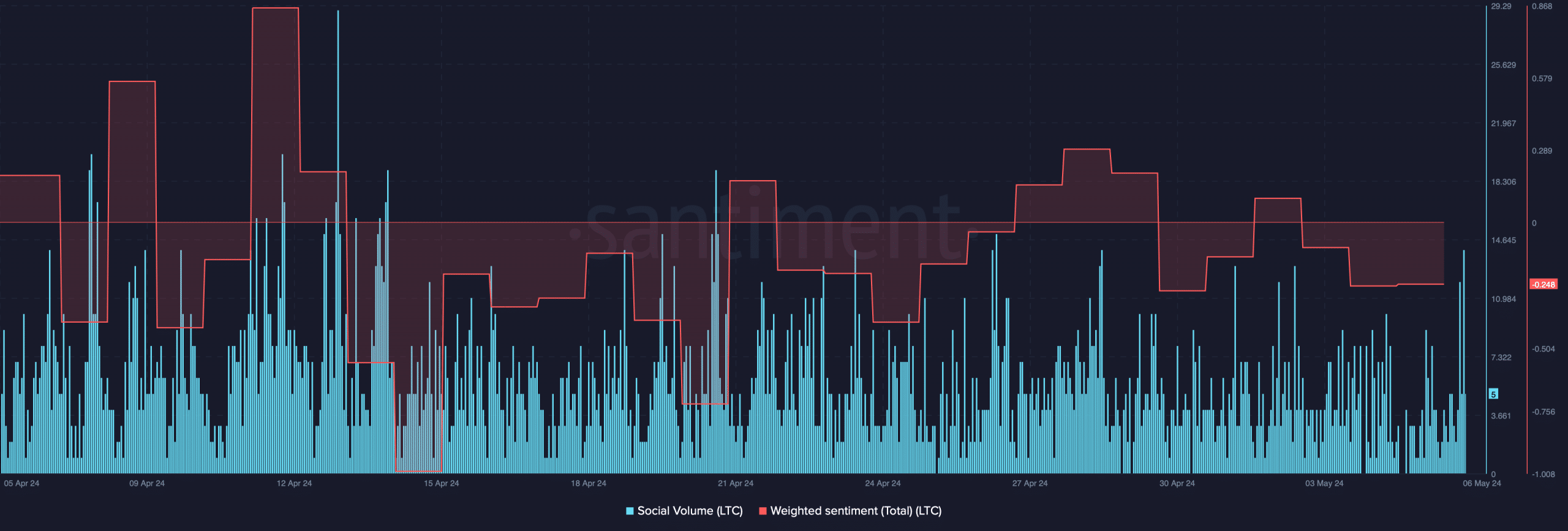

revealed that only 43% of LTC holders were in profit. The declining, precise action also took a toll on the coin’s social metrics.AMBCrypto’s analysis of Santiment’s data revealed that Litecoun’s social volume remained low.

Additionally, its Weighted Sentiment remained in the negative zone for most of last month. This indicated that bearish sentiment around the coin was dominant in the market.

However, while the coin’s price dipped, whales used the opportunity to buy more coins. This was evident from the rise in the number of addresses holding 10,000–100,000 LTC.

Apart from that, AMBCrypto also found that long-term holders were reluctant to sell LTC, as its Hodler Net Position Change chart remained green.

Tthe Hodler Net Position Change shows the monthly position change of long-term investors (HODLers).

The green chart gave a long-term bullish notion, as it suggested that the whales and LTHs expect LTC’s price to rise in the coming weeks or months.

Whale activity is paying off

The buying pressure on LTC from whales might have played a role in LTC’s trend reversal as the market turned bullish. The coin’s price increased by 1.5% in the last 24 hours.

At the time of writing, LTC was trading at $82.17 with a market capitalization of over $6.1 billion. The coin’s Fear and Greed Index indicated that the market was in a “fear” phase.

Whenever the metric reaches that level, it hints at a price uptick. The recent price uptrend was accompanied by a rise in its Open Interest, indicating that the bullish trend might continue further.

To better understand whether this trend would last, AMBCrypto then checked Litecoin’s daily chart. We found that the MACD displayed a bullish crossover.

Read Litecoin’s [LTC] Price Prediction 2024-25

The coin’s price was also near its 20-day exponential moving average (EMA). A successful breakout above that resistance could allow LTC to recover from its last month’s price drop.

But not everything was bullish, as the Chaikin Money Flow (CMF) registered a drop. This indicated that LTC might not be able to go above its 20-day EMA.