Litecoin’s hash rate hits new high – Will it push LTC higher?

- Litecoin consolidation zone breakout underscores potential for a bigger rally in the second half of November.

- Litecoin hash rate hits new ATH while open interest demonstrates growing activity in the derivatives segment.

It’s been an exciting week for the market with multiple ATHs and Litecoin [LTC] was not left behind. The cryptocurrency has been on an overall uptrend in the last 10 days resulting in a pattern breakout.

Litecoin has been consolidating in an ascending pattern underpinned by support and resistance. It managed to push above the resistance line multiple times this week. This indicated that momentum might be building up for a bullish explosion as liquidity rotation takes root.

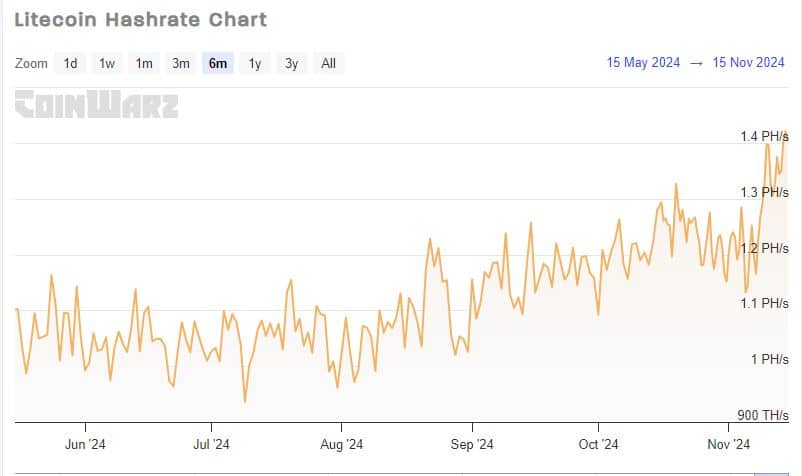

Litecoin hash rate soars to new high

Aside from holding on to its recent gains, there are a few other signs indicating that things were getting heated up for LTC. For example, the Litecoin hash rate just soared to a new all-time high of 1.42 PH/S.

The hash rate ATH suggests that miner profitability was on the rise, possibly driven by a surge in network activity.

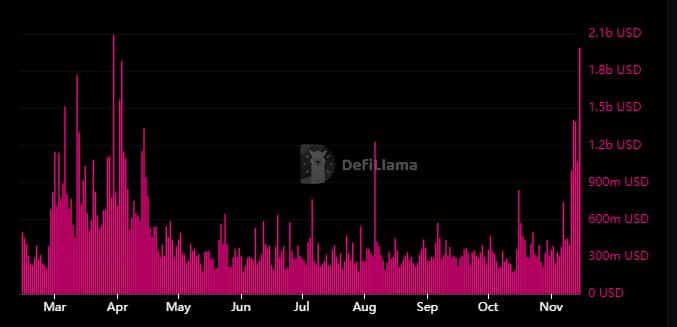

On-chain volume has been building up since the start of November. According to DeFiLlama, LTC token volume had its lowest levels in November at slightly below $250 million.

It has since experienced significant improvements to a monthly high of $1.98 billion in the last 24 hours at the time of observation.

The latest volume surge was the highest that the network has experienced in the last 6 months. This coupled by resistance against the downside could indicate that bullish momentum remains strong.

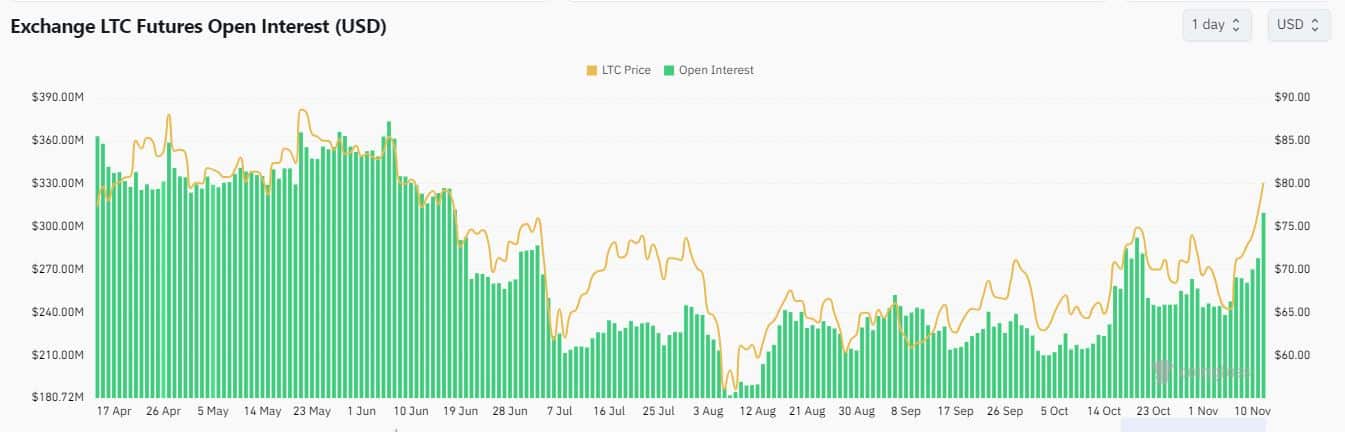

LTC open interest soars to 5-month high

Demand for Litecoin was also on the rise in the derivatives segment. For context, the level of open interest on all exchanges peaked at $309.87 million in the last 24 hours at press time.

The last time that LTC open interest was that high was in mid-June.

Despite this observation, open interest was still at a fraction of its potential especially compared to April levels. The cryptocurrency concluded March 2024 with over $708 million in open interest.

Read Litecoin’s [LTC] Price Prediction 2024–2025

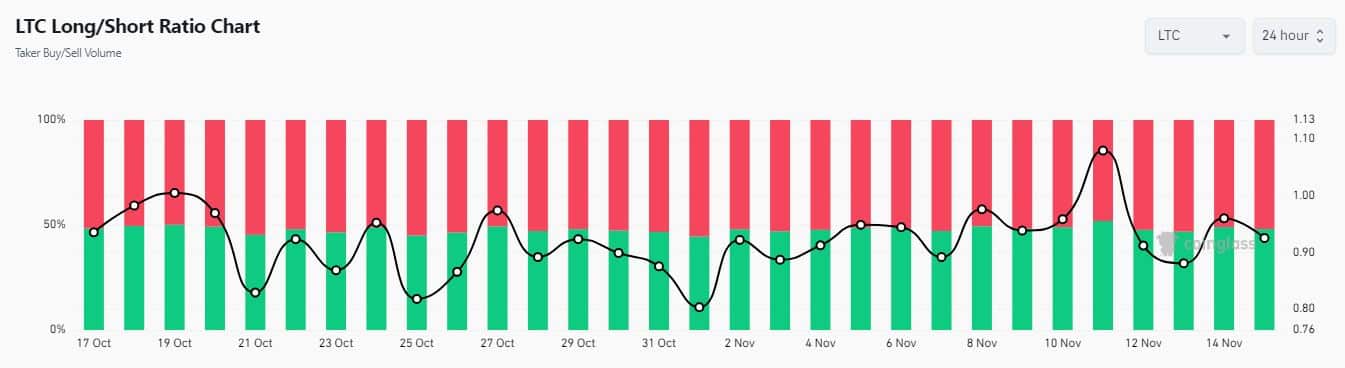

Since open interest cuts both ways, an assessment of longs vs shorts was necessary. The percentage of positions going long was higher in the last three days compared to shorts.

The above data suggests that more traders have been switching to the bullish camp. An indication of surging bullish optimism. However, the surge in sell pressure towards the end of the week may also set up LTC for another unexpected pullback.