Litecoin

Litecoin’s impressive mining stats fail to shield LTC

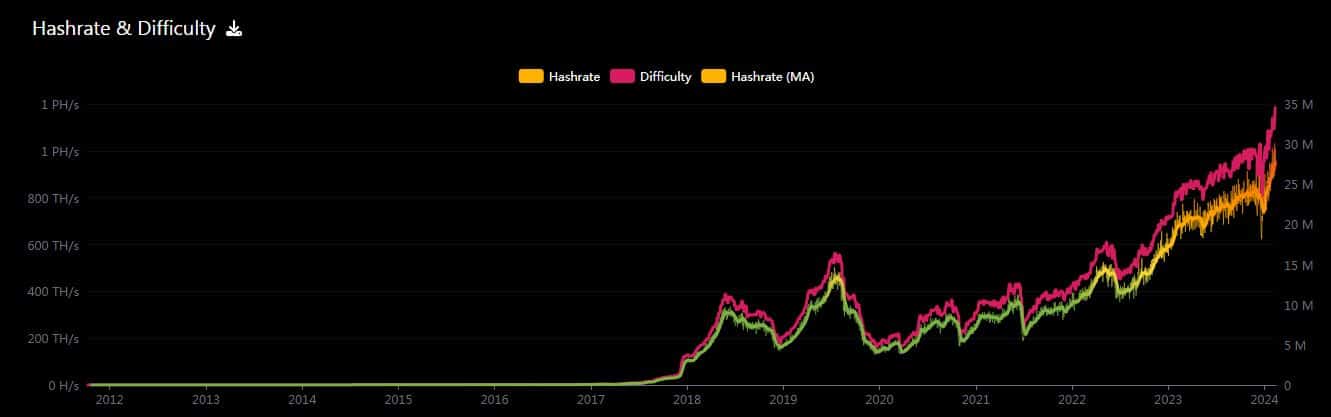

An increase in Litecoin’s hash rate and difficulty augured well for the security of the network.

- Litecoin saw a difficulty increase of 8.4% over the last week and over 20% YTD.

- The market sentiment towards LTC was negative as of this writing.

One of the largest proof-of-work (PoW) networks, Litecoin [LTC], saw its mining difficulty surge to all-time highs (ATH), making it harder for miners to validate transactions and push new coins into circulation.

According to AMBCrypto’s analysis of Litecoin Space data, the mining difficulty reached 34.58 million as of this writing. This marked a difficulty increase of 8.4% over the last week and over 20% year-to-date (YTD).

Signs of a secured network

The jump in mining difficulty came in response to a sharp spike in network hash rate, which recently peaked at 1.03 PetaHashes per second (PH/s).

Following a dip in mid-December, the hash rate has been steadily rising and was 21% higher YTD at press time.

As is well established, mining difficulty is periodically adjusted based on the total network hash rate.

This is done to ensure that the time taken to generate a new block remains constant, i.e., 2.5 minutes on the Litecoin blockchain.

On a broader scale, an increase in hash rate and difficulty augured well for the security of the network. This is because malicious players would find it tougher to manipulate transactions.

Additionally, the growing hash rate also reflected network growth, a bullish signal for native crypto LTC in the long run. At least, that’s what many optimistic LTC holders believed.

LTC investors aren’t impressed with mining indices

However, the recent price action didn’t inspire confidence. The “Digital Silver” fell 2.72% over the last month, and was trading 38% below its 2023 high, set shortly after its halving, as per CoinMarketCap

.The price slump caused the overall profitability of the network to fall. As per AMBCrypto’s examination of Santiment data, just about 46% of the total supply was in profit, down from 78% in July.

Moreover, the market sentiment towards LTC was negative as of this writing, impacting the coin’s upside potential in the near term.

Is your portfolio green? Check out the LTC Profit Calculator

A sign of good things to come?

However, there was a silver lining to LTC’s shrinking market cap. The NVT ratio, which is negatively correlated to transaction volumes, has been steadily declining over the past few months.

This meant that network utilization was outpacing market cap growth, historically interpreted as a bullish signal in the long run.