Litecoin’s latest performance might give you a clue of what not to expect

- Litecoin bears encounter friction along its ascending support line.

- State of uncertainty casts doubt on Litecoin’s next move.

Litecoin has been receiving a lot of attention recently for two main reasons. The first is the LTC20 standard which has resulted in more address activity. The second major reason is the hype around the upcoming halving which will reportedly take place in August.

Read Litecoin’s price prediction for 2023-2024

So far the aforementioned factors have contributed to Litecoin’s visibility, a situation that has also supported its price action. For example, LTC’s price has maintained resilience against the downside in the last five days.

This is contrary to the performance of the top cryptocurrencies which continued slipping lower.

Will Litecoin sustain its resistance against the downside? At some point, the hype that strengthened LTC bulls in the last few days will run its course.

However, this is not the only reason why the cryptocurrency has sustained its upside. Its price action has been trading at a long-term support level where investors are likely to avoid selling. Litecoin held its ground at the $80.95 price level, at press time.

Although Litecoin’s current support seems to be holding up well, the halving is still more than two months away. This is enough time for the current momentum to run out of steam. In other words, there is still a significant probability of a push below support.

Is Litecoin losing bullish momentum?

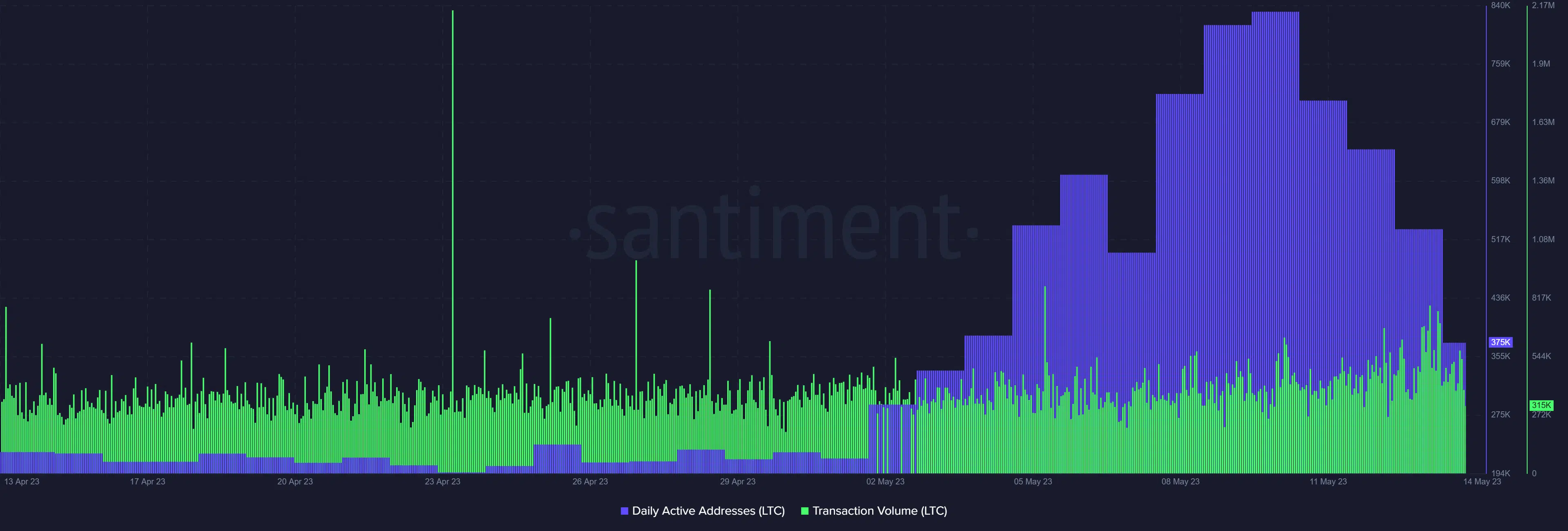

Litecoin’s transaction volume currently indicates a surge in trading activity in the last two days. Nevertheless, the excitement observed recently is notably dying down as indicated by the slowing down of daily active addresses.

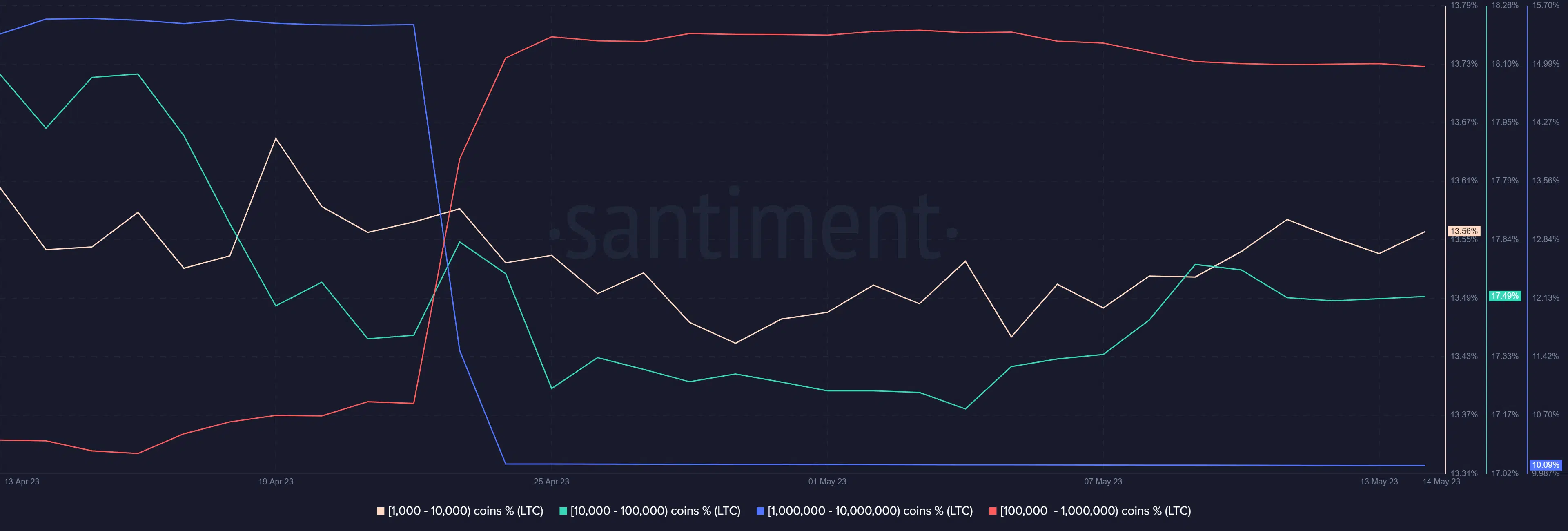

The slowing pace of daily active addresses suggests that Litecoin might pave the way for more price weakness. As such, it is important to assess what the whales are doing. So far the supply distribution reveals some accumulation activity from addresses in the 1,000 to 100,000 LTC range.

Higher whale categories remain relatively dormant. These findings may indicate that the market is currently waiting for directional clarity.

Prospects of Litecoin possibly reclaiming the $100 price level are high mainly due to bullish expectations ahead of the halving. On the network side, Litecoin is ideally positioned to take advantage of increased network activity.

Is your portfolio green? Check out the Litecoin Profit Calculator

Scaling might be the least of its concerns as is the case with Ethereum amid the latest increase in on-chain activity. This is because Litecoin leverages the Lightning network, the same network that facilitates scaling on the blockchain network.

The lightning network helps blockchains with scalability issues.

This layer 2 solution allows individuals to transact without having to record every transaction on-chain.

And it's not exclusive to #Bitcoin! Other cryptocurrencies such as Litecoin have also integrated it. pic.twitter.com/vPF1LEjPn7

— Binance (@binance) May 14, 2023