Litecoin’s long-term prospects look bright, thanks to Grayscale

- Litecoin is attracting institutional investment which spells good times in the long-term.

- LTC is once again facing short-term headwinds as whales start taking profits.

If you are wondering whether to add Litecoin [LTC] to your portfolio, the answer may have just become much clearer. Aligning your portfolio with that of whales and institutions might be a good idea especially in light of the latest Litecoin-related announcement.

Is your portfolio green? Check out the LTC Profit Calculator

Grayscale, one of the largest institutions heavily invested in the crypto segment, is increasingly interested in Litecoin. So much so that the cryptocurrency will be included in the FTSE Grayscale Crypto Sector Index Series. The latter made its debut recently as part of a partnership between FTSE Russell and Grayscale.

BREAKING: @Greyscale introduces a new partnership with @FTSERussell! Debuting the FTSE Grayscale Crypto Sector Index Series (Crypto Sector Indices) a set of rules-based indices!

Just 4 assets are included, one of which is Litecoin⚡️ https://t.co/8KQZ86KYJw pic.twitter.com/JXdID4EsAL

— Litecoin (@litecoin) October 24, 2023

The index series was launched with just 4 cryptocurrencies and Litecoin happens to be one of them. While this may not necessarily point towards strong demand, it underscores the fact that institutional investors are interested in LTC. This could turn out to be a good thing for the cryptocurrency’s demand in the long term.

Litecoin bulls encounter short-term roadblock

Litecoin has been enjoying a relatively bullish period since slightly before mid-September. More so in the last seven days, during which it rallied by slightly over 20%. This marks Litecoin’s latest attempt at exiting its ranging performance that has prevailed since the second half of August.

A single LTC coin would set you back $68.98 at the time of writing. However, this price level is worth noting because it is the same range where Litecoin has been finding short-term resistance.

In addition, its latest bullish momentum has firmly pushed into overbought territory where it is likely to experience some sell pressure.

So, should traders expect the return of sell pressure? Well, that might be the case based on on-chain findings.

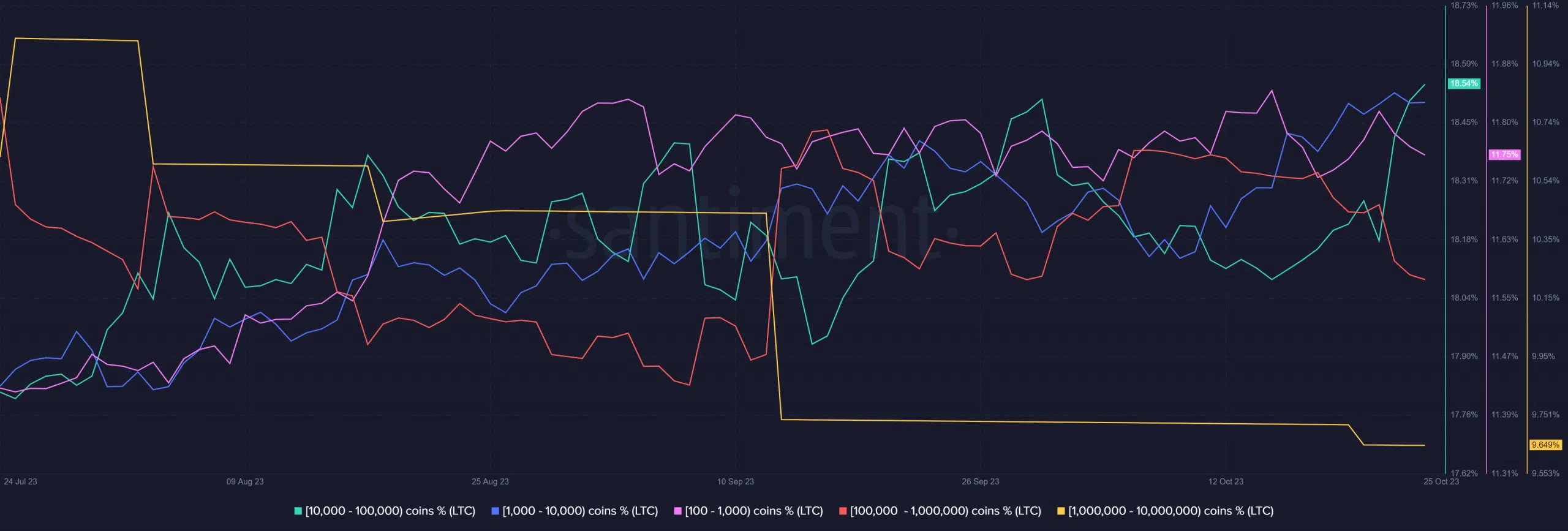

For example, the top LTC whales appear to be taking profits after the recent rally. Addresses holding between 100,000 and 10 million LTC (red and yellow indicators) have been selling for the last five days. This confirms profit-taking by whales.

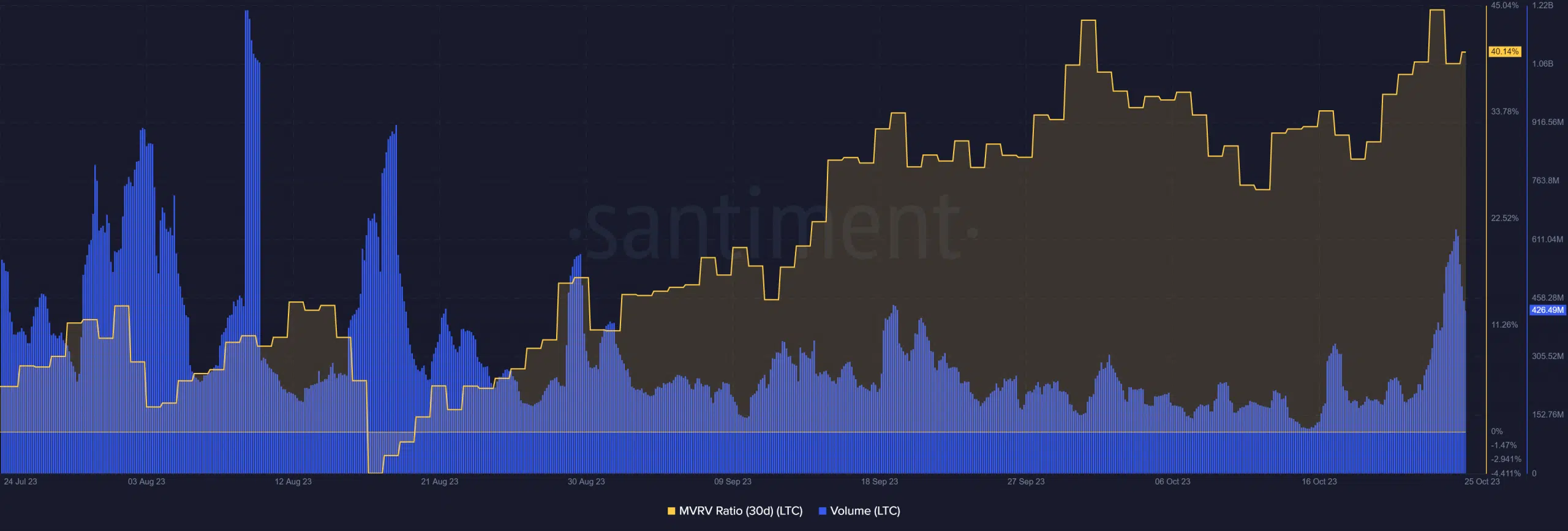

The above observation also aligns with the surge in volume in the last few days. This spike in volume could indicate that retail accumulation is making a comeback.

Interestingly, these findings indicate that this could be a classic case of whales looking for short-term opportunities by driving up the price enough to attract retail liquidity.

Read about Litecoin price prediction for 2024

While the sell pressure from whales increases the possibility of a retracement, it is also important to consider the level of hodling and sell pressure.

Litecoin’s MVRV ratio recently peaked at a new monthly high but has since experienced some retracement. A confirmation that coins held for some time are now exchanging hands.