Analysis

Litecoin’s range movement persists: Will LTC sellers give up control?

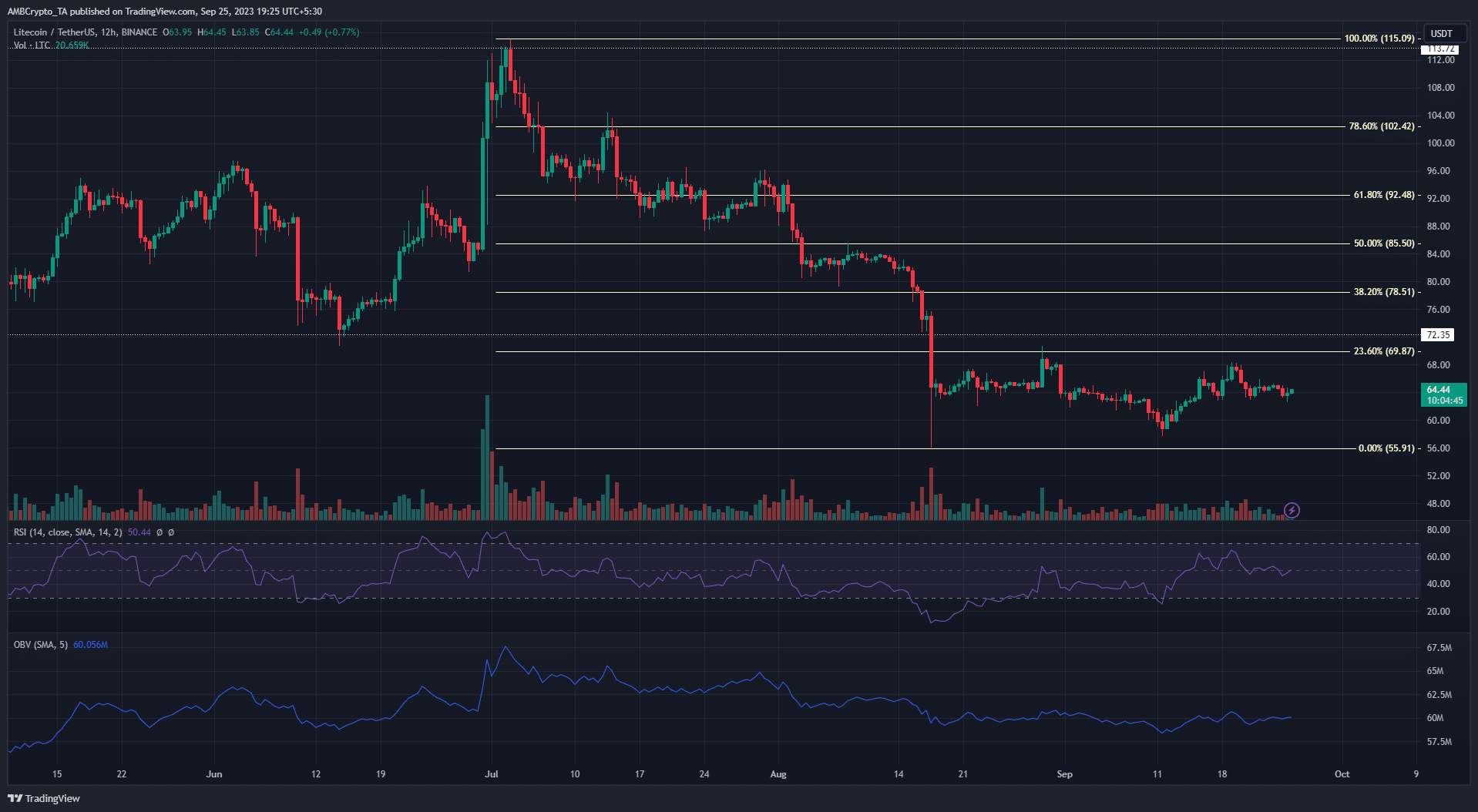

LTC’s price momentum on the 12-hour chart remained rangebound with low trading volume impeding a breakout.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Litecoin traded within a tight price zone over the past five days.

- Market speculators adopted a cautious approach with a decline in Open Interest.

Litecoin [LTC] extended its range formation, as its price hovered at the mid-range point of $64. The bullish recovery from the $55 price zone has been stuck below the 23.6% Fib level since 18 August with bulls lacking the buying pressure to break above the dynamic resistance.

Read Litecoin’s [LTC] Price Prediction 2023-24

Thus, LTC’s price action in September continued to be primarily bearish with sellers still in control.

Bulls remained trapped under selling pressure

LTC’s historic price action revealed a tendency for the altcoin to register volatile price swings. However, in recent times, LTC has followed the sideways price action in the market occasioned by Bitcoin [BTC] rising from $25k to $27k and then dropping to $26k.

At press time, Litecoin’s price remained stagnant at $64. It traded at this price for a five-day period which hinted that a breakout move could materialize soon. This was echoed by the Relative Strength Index (RSI) hovering at the neutral 50.

Similarly, the On Balance Volume (OBV) reflected the lack of significant price movement with its flat structure.

A bullish revival will require buyers to break above the 23.6% Fib ($69) with further gains lying at $78 to $80. For bears, an extension of the flat trading volume could see a drop to $60.

Lagging price action resulted in a drop in Open Interest

Market speculators reacted negatively to LTC’s sideways movement, as the Open Interest continued to drop. Data from Coinalyze

showed that the OI declined by $9 million within the past 48 hours.How much are 1,10,100 LTCs worth today?

Likewise, the Spot CVD trended lower with a lack of demand clearly evident in the futures market. Together, speculators preferred to remain sidelined, due to Litecoin’s volatile nature.