Litecoin’s tick-tock to 2142 and here’s what investors shouldn’t miss out on

Litecoin [LTC] is known as silver to Bitcoin’s gold for a reason. Since the former was built on the latter’s code, both tokens share a similar mechanism of the proof-of-work (PoW) consensus and limited supply.

But, here’s the catch, Litecoin’s supply is quadruple of Bitcoin’s; set at 84 million LTC, it is soon coming to an end.

Know this

Before Litecoin runs out of LTC, the token can be minted for approximately 120 years. Primarily, the token will take a vast amount of time before all the LTC is mined thanks to the current rate of minting and remaining supply.

Now, considering Litecoin’s limited use cases, the quickly advancing web3 space, and the demand for web3 compliant options, Litecoin might not even make it till 2142.

However, that is a thought of the future. What’s more important at the moment is- if LTC can even recover the losses it witnessed over the last month; the answer to which is sadly not ‘yes’.

The fluctuating price action, mixed with the recent crash has resulted in 10 straight weeks of red candles on the charts.

Litecoin price action | Source: TradingView – AMBCrypto

While Bitcoin made an achievement on 6 June by not closing in red for 10 straight weeks, Litecoin didn’t seem to be bothered by the king coin’s movement. It closed in red for the tenth week.

At press time, the token was trading at $61.26, down by about 6.11% over the last day. However, the token was trading 3.6% above the opening price of $63 at $66 on 6 June, which didn’t do much for the token and was just another moody Monday.

To add to the aforementioned information, LTC isn’t really convincing when it comes to rallies. This is why the altcoin hasn’t seen a new all-time high for more than a year now.

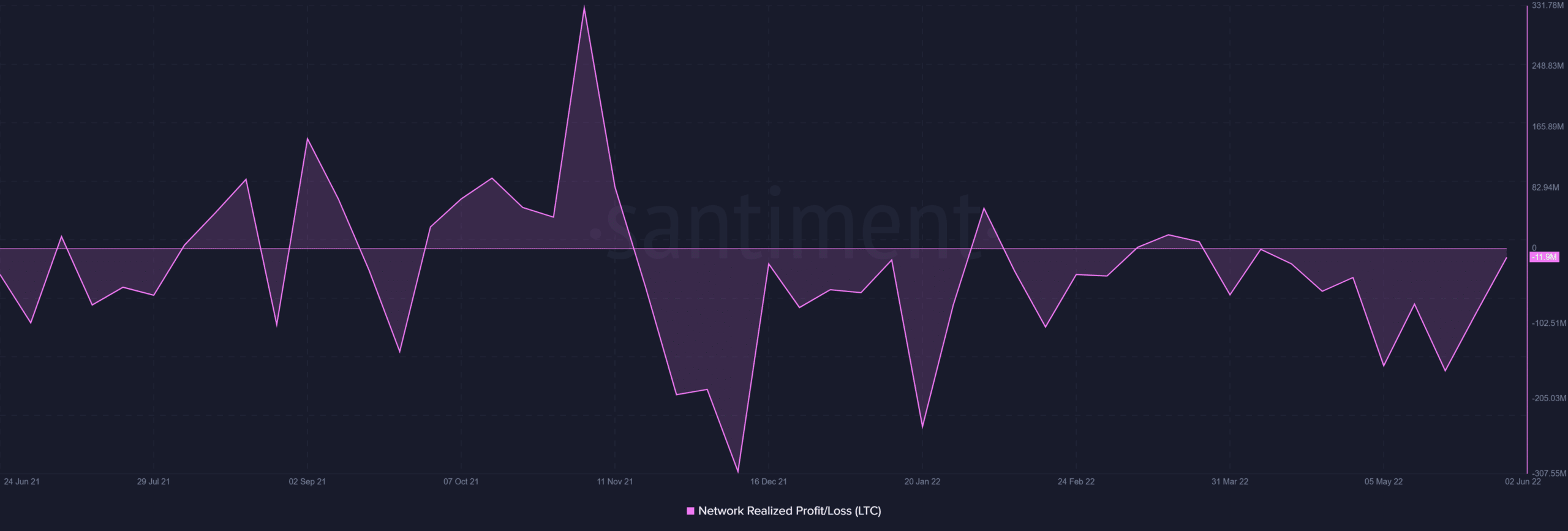

This is also the reason why investors have been noting losses for nine straight weeks. Altogether, the 10-week-long streak of downfalls resulted in cumulative losses running up to 617 million LTC worth over $40.5 billion.

Litecoin investors in losses | Source: Santiment – AMBCrypto

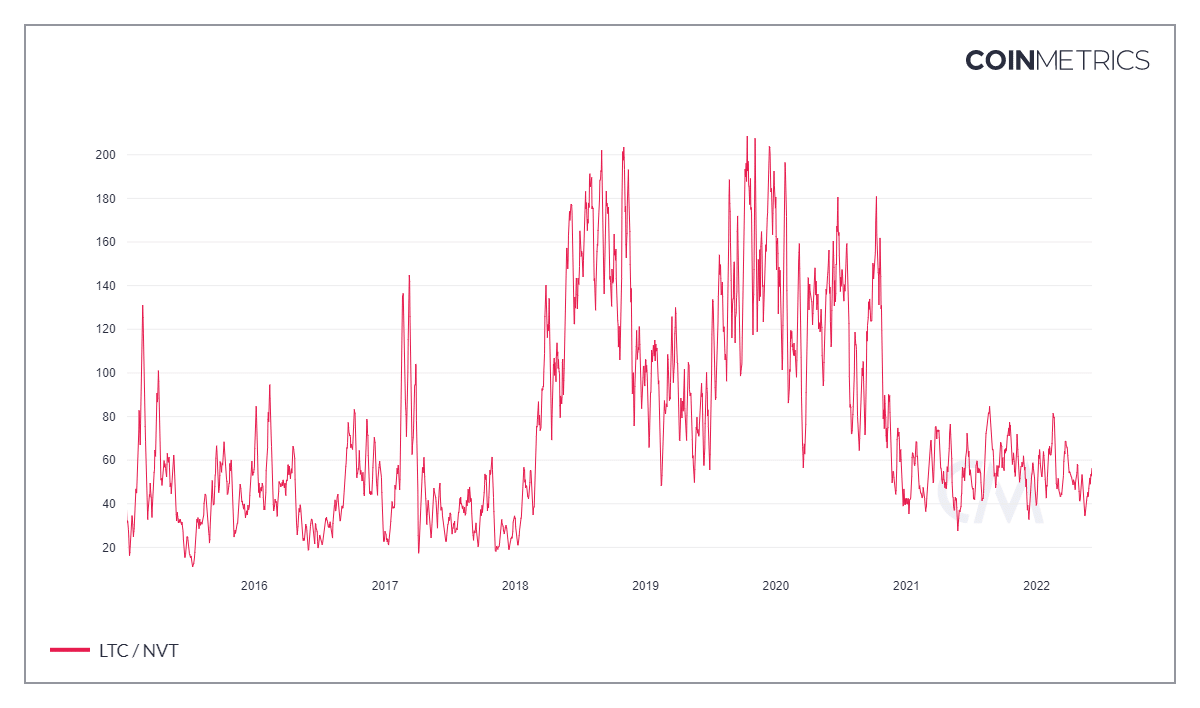

But, LTC does have the opportunity to increase its value, given the asset gradually is considerably undervalued right now.

Although on the micro-scale, it may appear to be overvalued, the macro scale indicated that the asset still has significant room to grow.

Litecoin network value | Source: Coinmetrics – AMBCrypto