Litecoin’s transfer history reveals this about the present and future of LTC

- Years of Litecoin growth culminates into billions worth of transactions on the network.

- LTC bears put up strong defense near the $100 price range, however whales stand divided

There is no doubt that Litecoin [LTC] has achieved noteworthy success over the years. But just how much has the network grown and will it continue with the same momentum at least for the next five years?

Is your portfolio green? Check out the Litecoin Profit Calculator

Analyzing the value worth of Litecoin transferred over the years is perhaps one of the best ways to determine the level of growth and adoption. Interestingly, the value transferred in Litecoin transferred recently crossed the $7 billion mark.

To put things into perspective, the total value transferred a year ago was $4.3 billion and less than $100 million three years ago.

$7 billion in Litecoin transferred today

1 yr ago = ~ $4.3 billion

2 yrs ago = ~ $4.6 billion

3 yrs ago = ~ $92.3 million

4 yrs ago = ~ $240 million

5 yrs ago = ~ $560 million

6 yrs ago = ~ $23 million

7 yrs ago = ~ $6 million1,166.66% 24 hour volume increase from 2016 to 2023 pic.twitter.com/5NHGhfwgtv

— David Schwartz (aka – Dasch) (@DaddyCool1991) April 17, 2023

The above observations underscore the robust growth and adoption that the network has achieved so far. The $7 billion transaction milestone especially in such a limited time could be considered as an example of Litcoin’s ongoing growth.

This was further reflected in LTC’s price action. For example, LTC achieved a healthy bounce after the bearish pullback that it embarked on since the second half of February.

Litecoin’s $99.31 press time also represented a 51% bounce from its March lows. Its press time position was particularly worth noting because LTC has been struggling to stay above the $100 price level.

LTC’s Money Flow Index (MFI) also revealed that there have been outflows in the last three days. This also reflected sell pressure manifesting near the resistance line, hence the price could witness a struggle to push back above the $100 price level.

Litecoin’s current state of demand

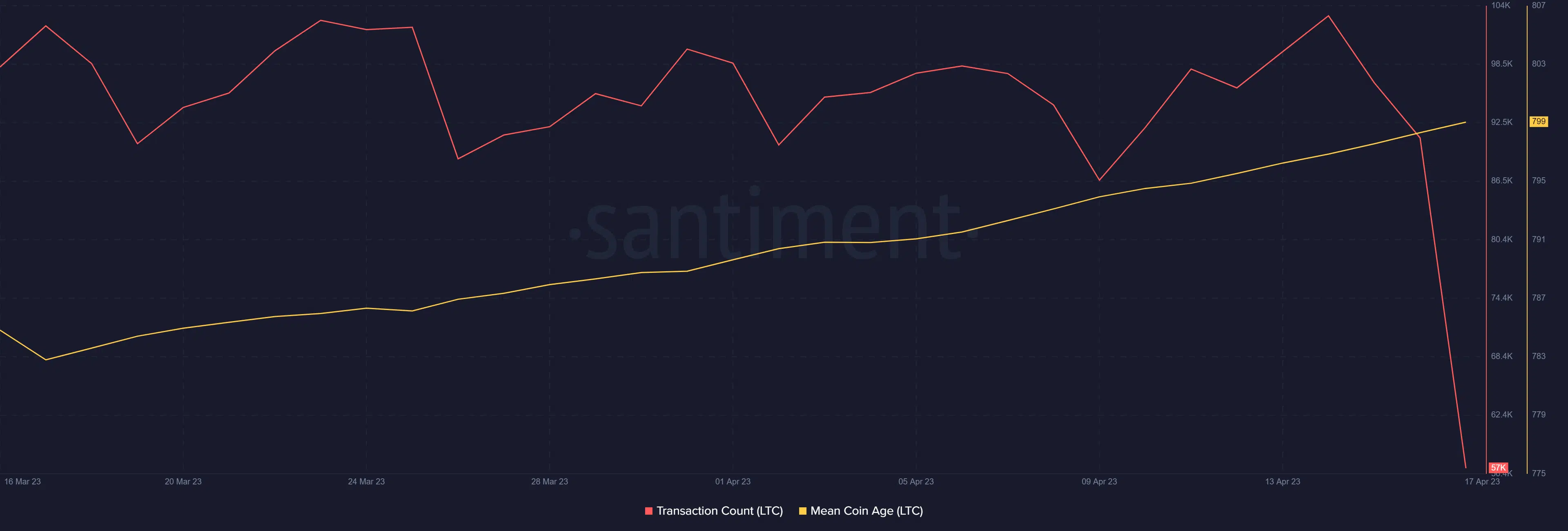

Litecoin’s mean coin age maintained a steady upward trajectory since the last four weeks. This could be taken as confirmation that several buyers during this time were hodling and remained focused on long-term gains.

LTC also maintained healthy network activity for the most part up until 14 April when transaction count dropped and is currently at four-week lows.

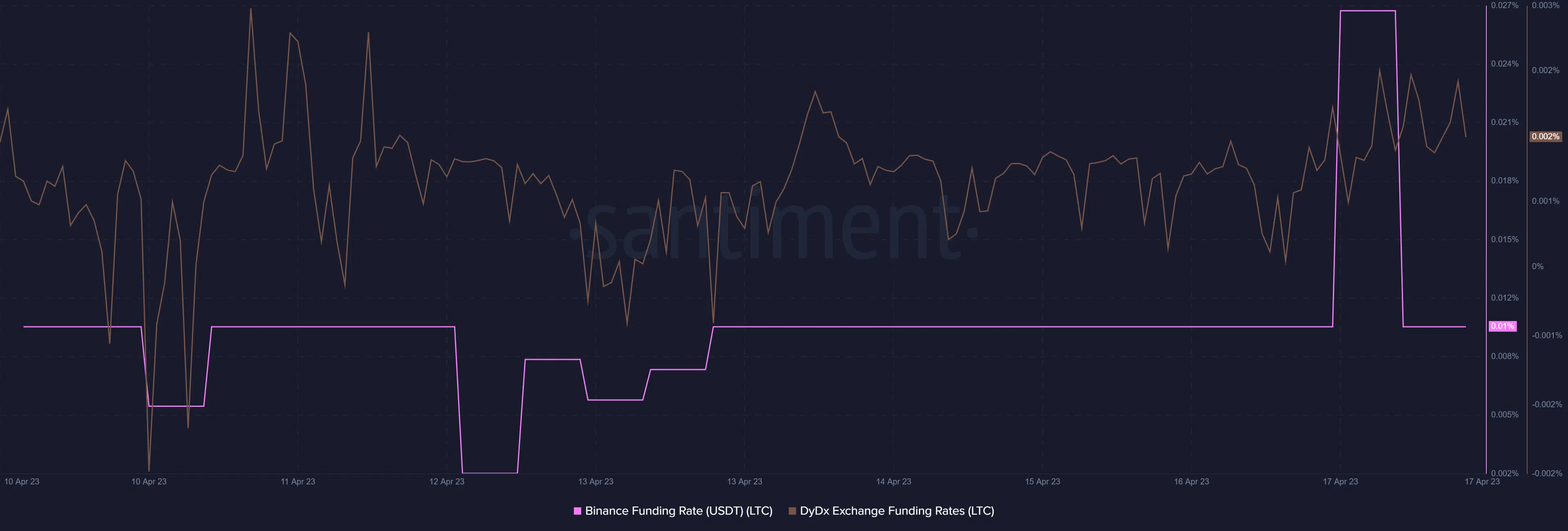

Lower transaction count suggested that investors might be on the edge about whether to take profits or to continue hodling. Note that there was a surge in the Binance and DYDX funding rates in the last 24 hours at the time of writing.

However, it is unclear whether this surge was associated with bullish demand or investors attempting to execute short positions.

How many are 1,10,100 LTCs worth today

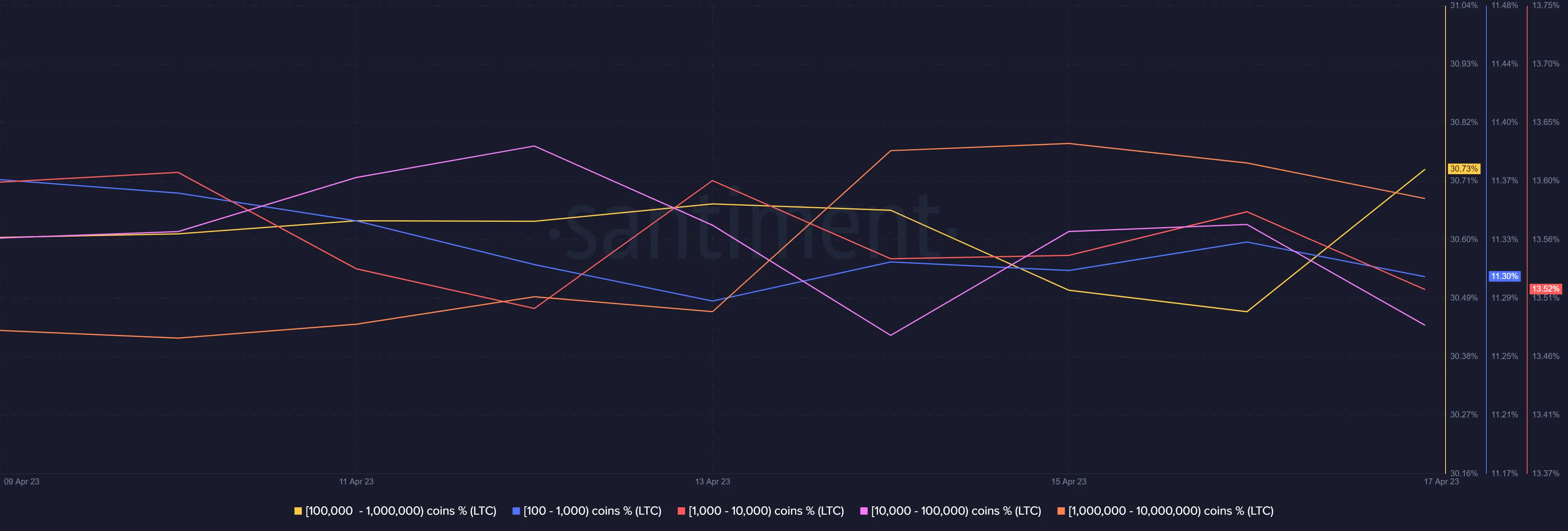

Perhaps a look at whale activity may offer some clarity. Switching gears to the Litecoin supply distribution metric revealed interesting findings.

The largest whale category consisting of addresses holding between 100,000 and 1 million ETC started accumulating in the last 24 hours. A healthy sign that the top whales were buying.

Despite accumulation by the largest whale category, the price still faced some sell pressure. This was because most other whale categories offloaded some LTC, hence the dampened short-term outlook.