Long-Bitcoin logs outflows totaling $2.6m while ETH, SOL register…

The cryptocurrency market has faced some of the toughest times in the year 2022. However, the market, on the whole, has been showcasing signs of recovery.

Bitcoin [BTC], in particular, has been recuperating, although the overall rallying is much slower than anticipated. The same has been highlighted in the latest CoinShares report.

Not such a rare sighting

The recent Digital Asset Fund Flows Weekly report on 19 July touched on different narratives concerned with the ongoing crypto market. One thing remains clear — ‘Inflows into short-bitcoin continue but lowest volumes since October 2020.’

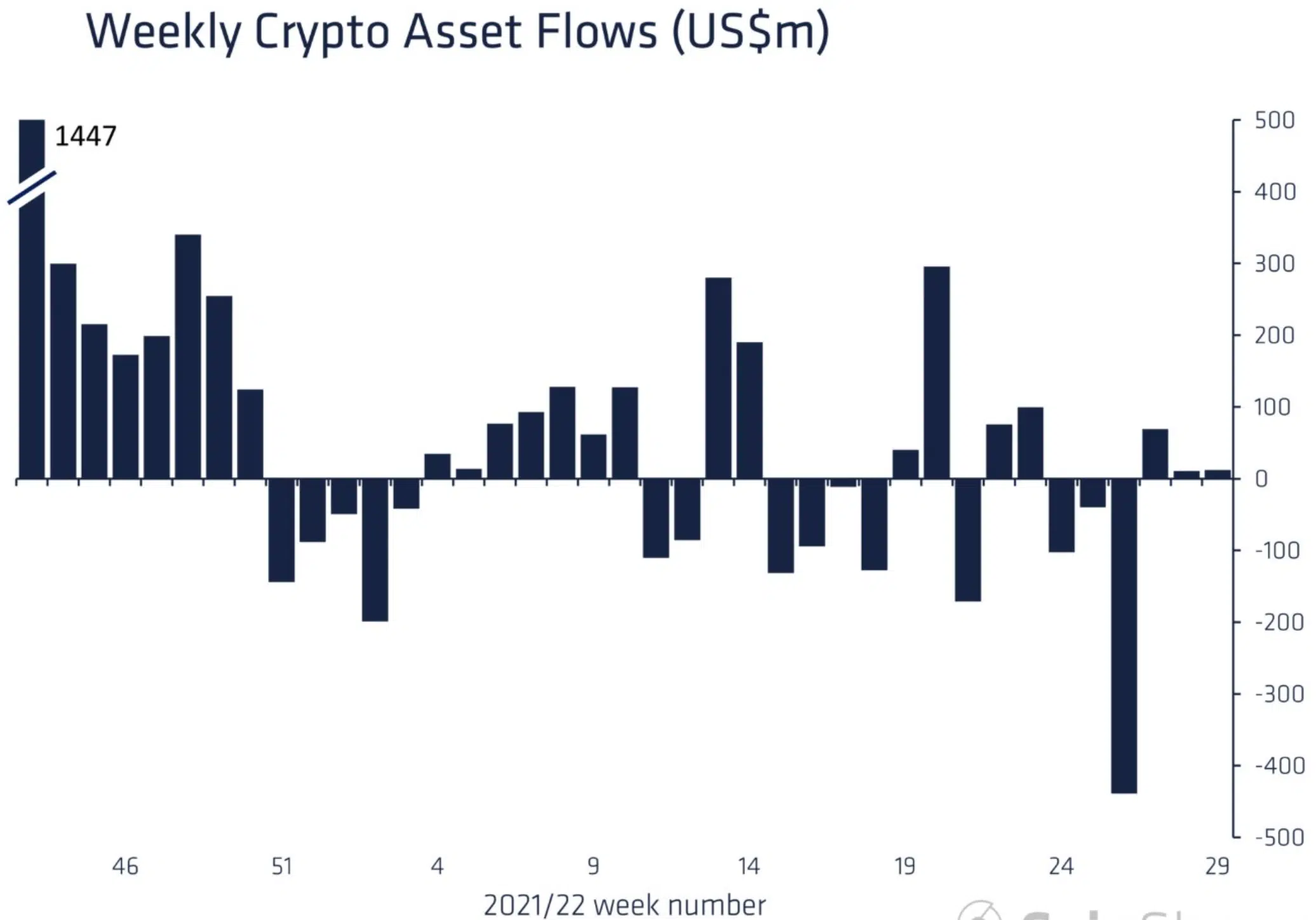

Last week digital asset investment products saw a mere $12 million worth of inflow. Unfortunately, this marked the third consecutive week of meager inflows.

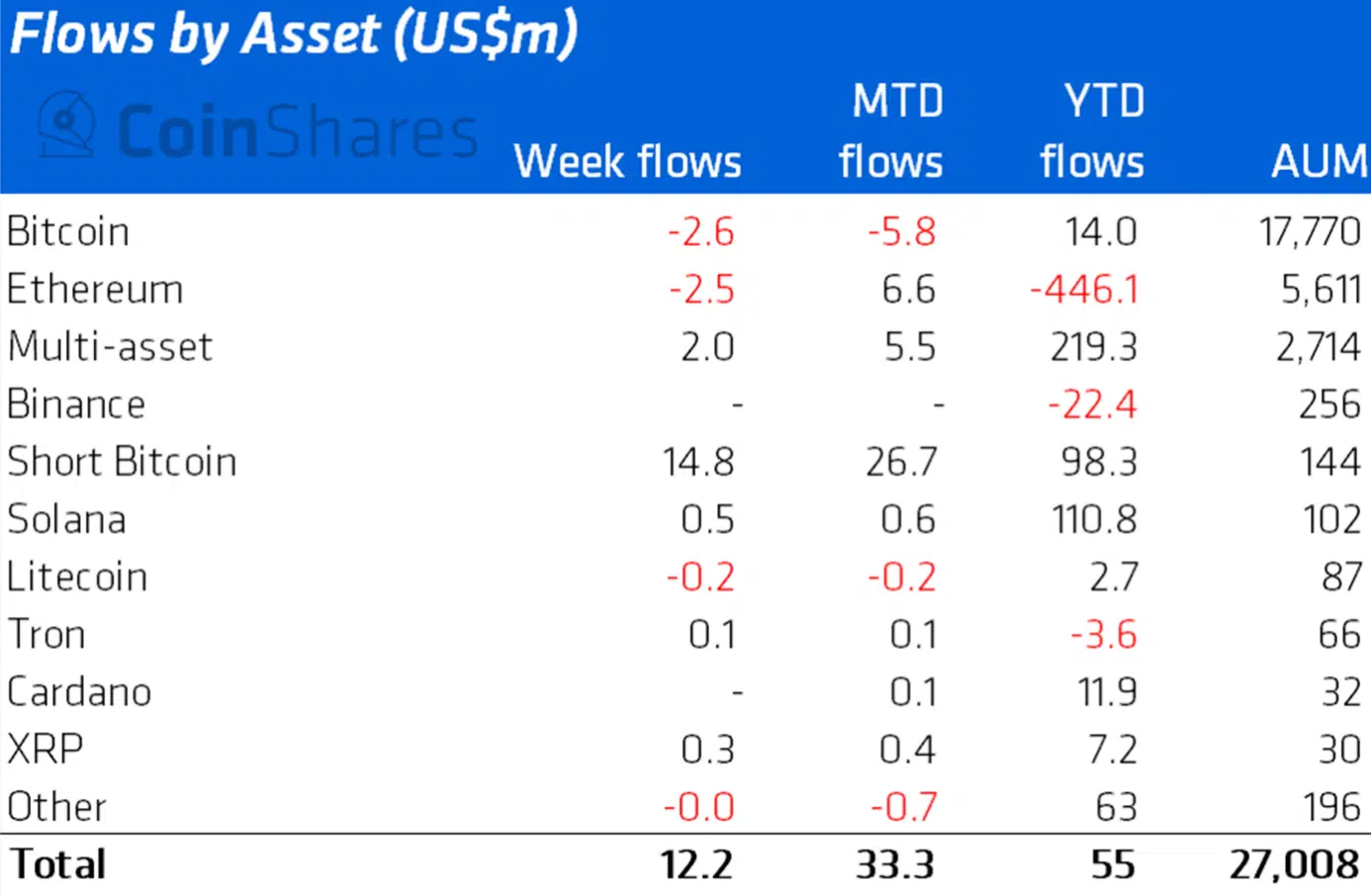

Herein, the short investment products saw the most activity as they amounted to $15 million. However, long investment products witnessed outflows. This is further depicted in the table given below.

Long-Bitcoin saw outflows totaling $2.6 million while total assets under management (AuM) rose from 11.4% since the end-June low to $17.8 billion.

Interestingly, investors are still adding to short-Bitcoin positions, with inflows totaling $15 million last week, bringing inflows to a record four-week run totaling $88 million (61% of AuM).

This sheds light on an important but grim scenario. New investors expected further price downside, while those currently invested are not selling out of positions, believing crypto prices are close to a bottom.

The ‘Alt’ scenario

The altcoins too painted a similar picture. Ethereum [ETH], the largest alt, saw minor outflows totaling $2.5 million, ending a three-week run of inflows.

Although, month-to-date flows remain positive at $6.6 million.

Other altcoins saw very little action, apart from Solana [SOL] and XRP, with inflows of $500,000 and $300,000 respectively. On the other hand, multi-asset products rose above the rest at $5.5 million in inflows. In this regard, the CoinShares report noted,

“Multi-assets investment products, the stalwart during this bear market from a flows perspective, saw inflows totalling US$2m, bringing year-to-date inflows to $219M, well above any other asset.”

Overall, investment product volumes remained very low, totaling $1 billion over the week, as compared to the year weekly average of $2.4 billion. It may, however, be safe to say that the ‘summer doldrums’ are here.