Looking at Solana’s ‘Ethereum killer’ status after 164% rise

Solana has been at the forefront of the crypto race for a long time now. At one point, given the blockchain’s functionalities, it was also deemed to be an “Ethereum killer”. After establishing a new all-time high today, here’s where Solana stands and how it compares to Ethereum when we consider numbers.

Solana at $62!

That is the new all-time high that SOL registered on the daily charts today. Back in May, the coin set the ATH at $52 but failed to ever breach it in the following months. However, in the early hours of trade on August 16, SOL touched $62. This is the result of the recent rally which took the coins price up by 164%. Yesterday alone, it rallied by 21%, its highest single-day rally in over 2 months.

Solana’s 164% hike | Source: TradingView – AMBCrypto

When compared to ETH, Solana’s rally may have triumphed but it falls when it comes to on-chain values. Real volumes of ETH standing at $2.3 billion are higher than SOL’s $1.12 billion.

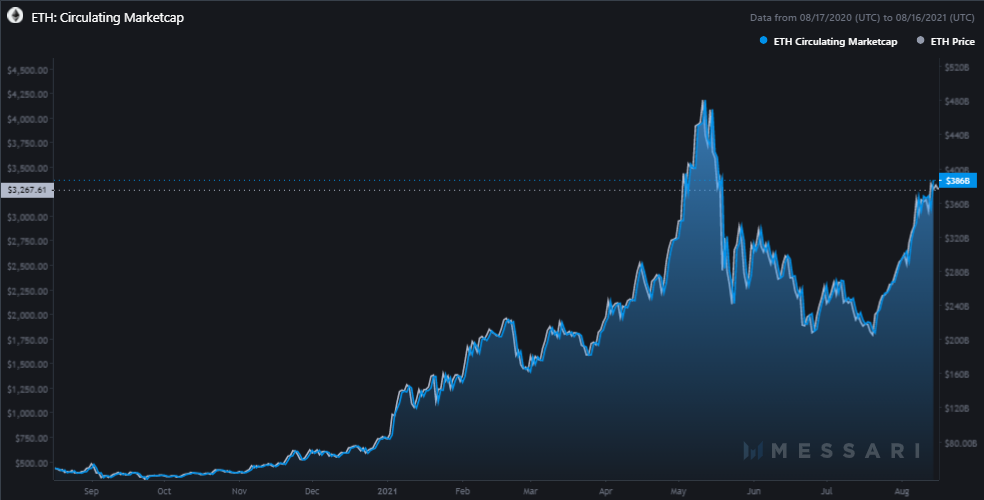

The circulating market capitalization, which is basically the price of asset multiplied by the circulating supply, for Ethereum is also magnitudes bigger than Solana, the former being at $386 billion while the latter is at a mere $12.7 billion. A huge contributor to this is ETH’s high prices even though it has ways lesser supply than SOL.

Ethereum’s circulating market cap | Source: Messari – AMBCrypto

Additionally, Sharpe Ratio shows that, at the moment, Ethereum promises better and higher returns than Solana. SOL’s figures did manage to climb back to May highs of 3.6 but ETH stands at 7.6.

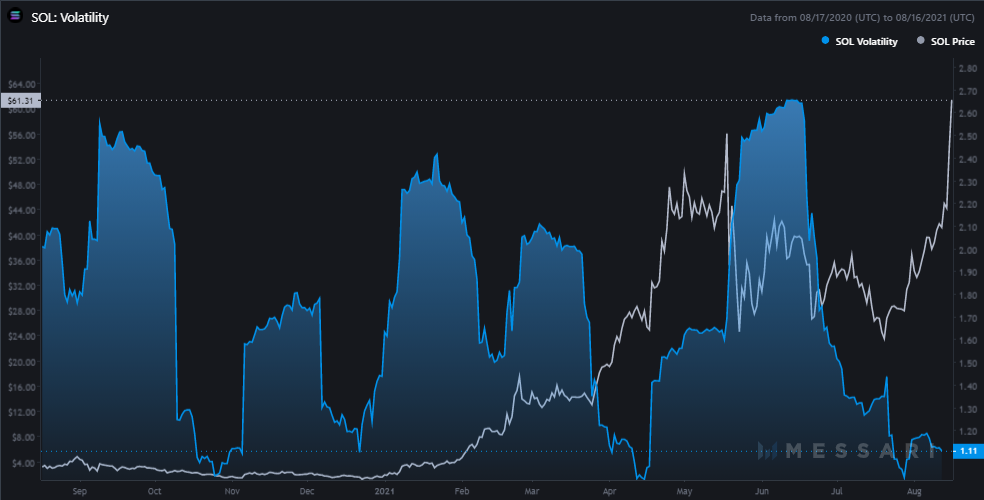

Finally, in figuring out the probability of any price swing going forward we look at volatility, and at the moment, Solana’s volatility is pretty low at 1.11. Ethereum’s volatility is low too at 0.75, which means that for both the coins no sudden price fall is imminent.

Solana’s volatility | Source: Messari – AMBCrypto

Are investors leaning towards Solana?

At the moment, given Ethereum’s popularity and a stronger network presence, it can’t be said that Solana is pulling investors away from it. However, with the recent London hardfork and introduction of fee burn mechanism, some miners could move away from ETH. Solana is already known for its capability of processing over 1000 transactions per second (TPS) which is exceptionally higher than ETH’s 14 TPS, but because of its different programming language, it is yet to be mainstream.

The network although is preferable by a lot of developers still, as just recently a Solana blockchain-based decentralized exchange (Dex) raised $70 million in a token sale this Wednesday.