Loopring [LRC]: $5 billion trading volume milestone can have these repercussions

LRC is among the biggest gainers after rallying by more than 27% over the last seven days while most of the top cryptocurrencies were stuck in a narrow range. The rally comes amid an important loopring development but it looks like it might be due for some more upside thanks to a major milestone this week.

Loopring just announced that it has surpassed $5 billion in total L2 trading volume. The announcement came a day after the launch of Gamestop’s crypto wallet which is integrated directly into the Loopring L2. LRC achieved a healthy rally in the days leading up to the announcement and has so far been in the green for the last five consecutive days.

Can the milestone keep the bulls in the loop?

Loopring’s trading volume milestone represents a significant achievement for the network. Such announcements provide investors with a rough overview of network adoption and it looks like Loopring is enjoying strong growth.

Meanwhile, LRC traded at $0.58 at the time of writing, which is currently up by more than 80% from its 12 May low.

LRC’s rally was underpinned by significant accumulation in the last few days. Its RSI is currently approaching the neutral zone, where it will likely experience some resistance. This means there is a significant probability that LRC will experience some resistance near the RSI neutral level.

LRC’s on-chain metrics

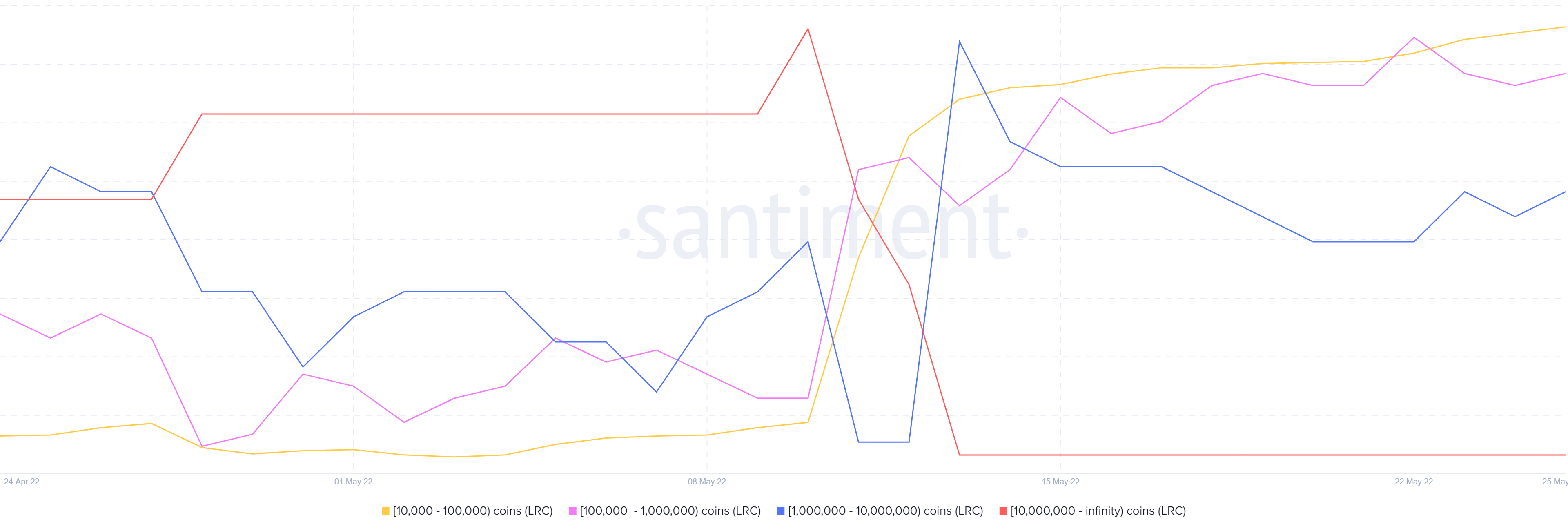

LRC’s supply distribution by a number of addresses shows a significant uptick in addresses holding between 10,000 and 10 million coins. They increased from 2172 addresses on 11 May to 2440 by 25 May. However, wallets holding more than 10 million coins dropped from 25 to 22 addresses during the same period.

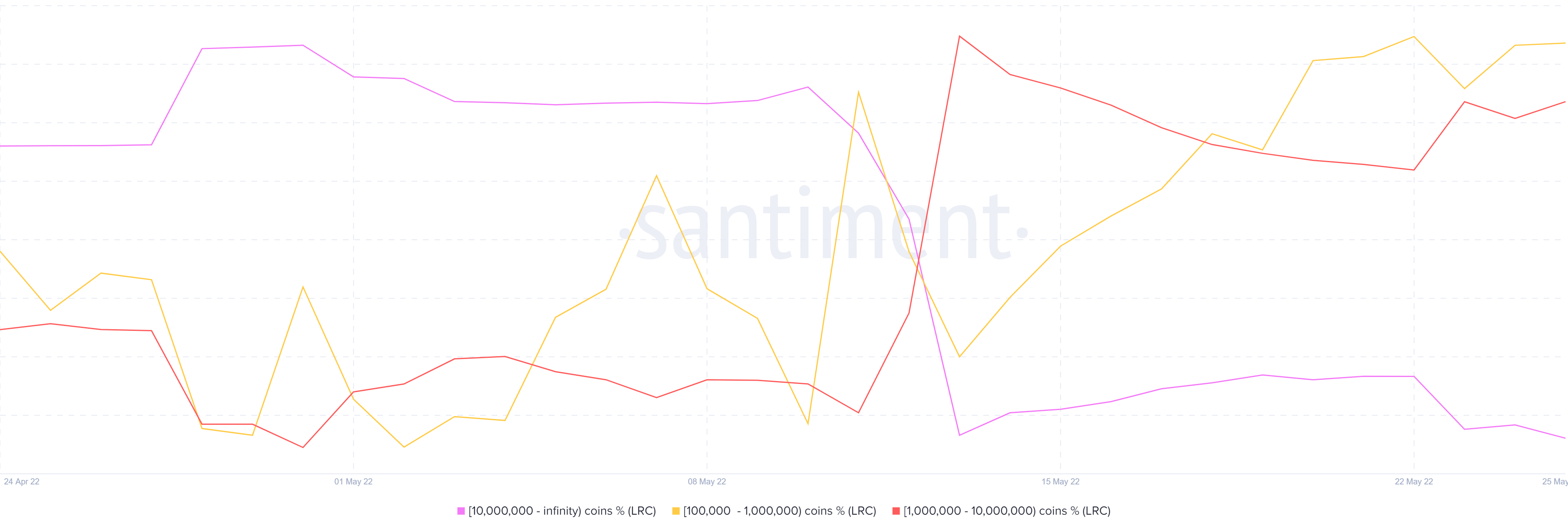

The supply distribution by the balance on addresses reveals interesting statistics supporting the latest performance. The addresses holding over 10 million coins dropped from 35.77% on 13 May to 35.01% by 25 May.

This means those addresses sold off a small number of their holdings. Those holding between one million and 10 million increased their holding from 31.35% to 35% between 11 May and 25 May, hence significant accumulation aiding the rally.

LRC’s supply metrics explain its bullish price action in the last few days and it currently backs the likelihood of more upside. However, it does not account for any rapid market changes that may shift the tides.