Litecoin stalls at $95 ahead of FOMC Minutes

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- LTC rallied over 20% between 12 May- 17 May.

- The rally cooled off at $95 ahead of FOMC Minutes on 24 May/BTC fluctuations.

Litecoin’s [LTC] strong rally last week eased ahead of FOMC minutes and persistent Bitcoin [ BTC] fluctuations. The asset posted over 20% gains, rising from $77.7 to $95.1, and its correlation to BTC dropped.

Is your portfolio green? Check out the LTC Profit Calculator

Despite signs of declining correlation, LTC still succumbed to BTC’s whipsawing. At press time, sellers depreciated the asset below $90 but could face some resistance.

Apart from the FOMC minutes, a considerable number of BTC options are set to expire on 26 May, per Deribit data. As such, overall market volatility could increase this week.

Will sellers extend for more gains?

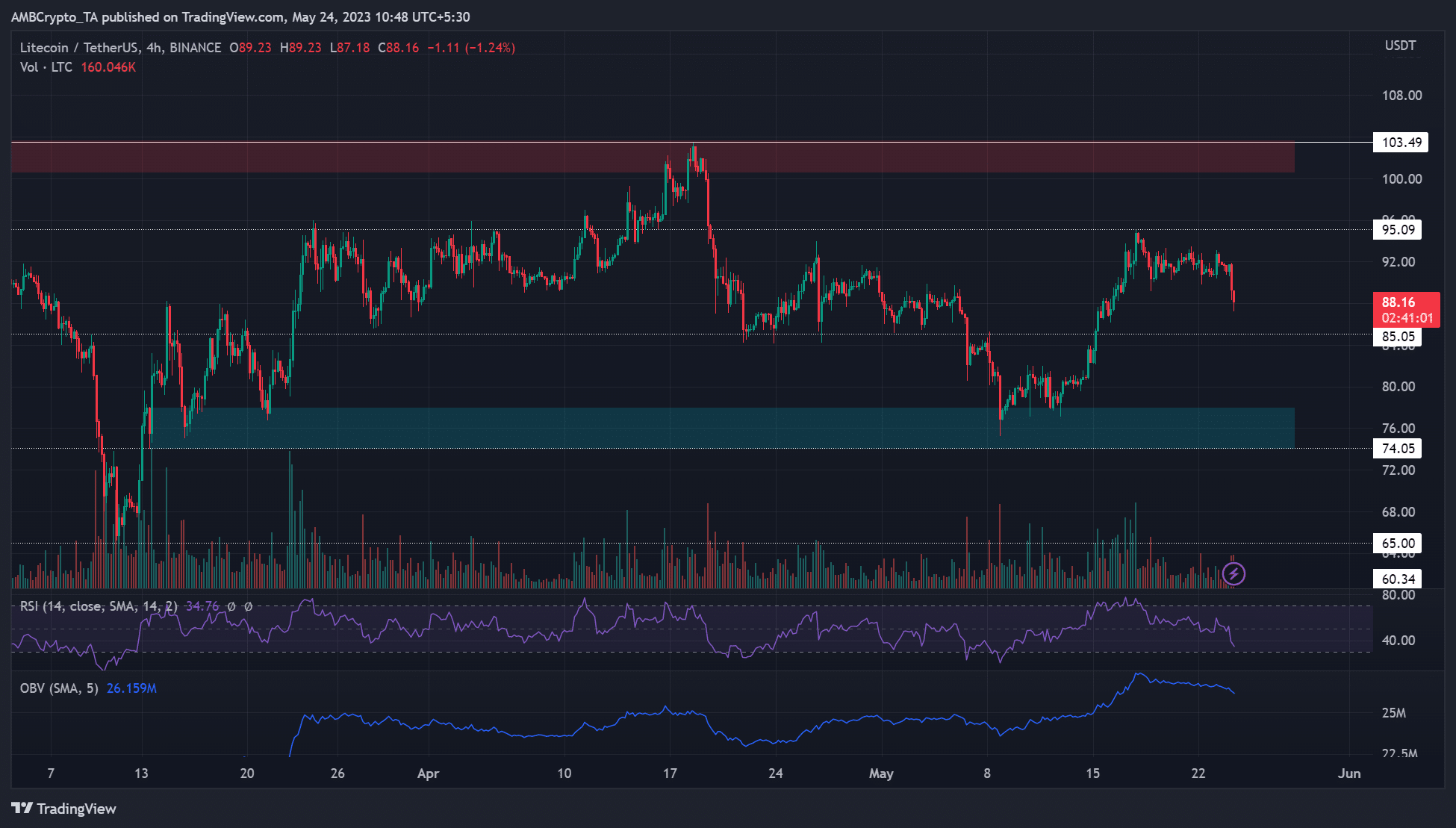

Sellers gained entry at the $95 price level, a sticky resistance level in late March and early April. However, price action approached another key support level of $85, and bulls could have a chance if it doesn’t crack.

Meanwhile, the Relative Strength Index (RSI) headed to the oversold zone while On Balance Volume (OBV) dropped significantly. This highlighted that selling pressure increased while demand and volume for LTC declined.

As such, sellers could attempt to crack the $85 support, especially if BTC remains below $27k. LTC could be devalued to the bullish order block and next support zone (cyan) near $74 if the support cracks.

Conversely, bulls could secure the $85 support and reverse recent losses. However, they will only gain the upper hand if they push LTC above $95. Crossing the $100 mark could be feasible if they successfully clear the hurdle.

Sellers to prevail?

How much are 1,10,100 LTCs worth today?

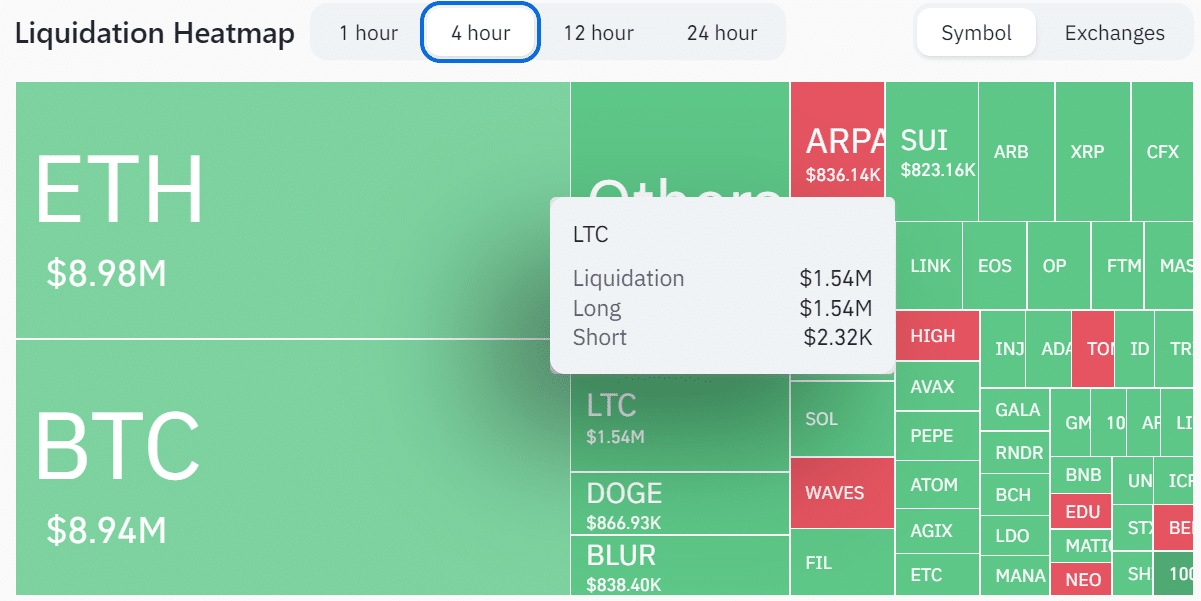

Coinglass’s liquidation data showed over $1.5 million worth of long positions liquidated in the past four hours alone. Yet less than $3k short positions were wrecked. The data paints a bearish short-term outlook for LTC’s futures market.

A similar sentiment could intensify in the spot market and push sellers to extend gains beyond the $85 support level. Traders should track BTC’s price movement and Friday’s BTC’s options expiry.