LUNA volume surges 295% as LUNC rises 14% – What’s going on?

- LUNA’s 295% volume surge following USTC burn proposal signals a potential bullish rally in the market.

- LUNC sees a 14% price rise amid a 275% jump in volume, driven by community-led USTC burning efforts.

The Terra Luna Classic [LUNC] community recently introduced a new USTC burning proposal.

This proposal targets the burning of 46.55 million USTC through contract migration, specifically focusing on wallets linked to the Mirror Protocol.

While past burning efforts had minimal impact on pricing, the current proposal aims to reignite investor interest in both LUNA and LUNC tokens.

Despite initial reactions, the price movements of both assets have shown some correlation with this initiative.

LUNC jumps 14% amid volume surge

LUNC has similarly shown a price increase, trading at $0.00009694 with a 24-hour trading volume of $172,117,904.

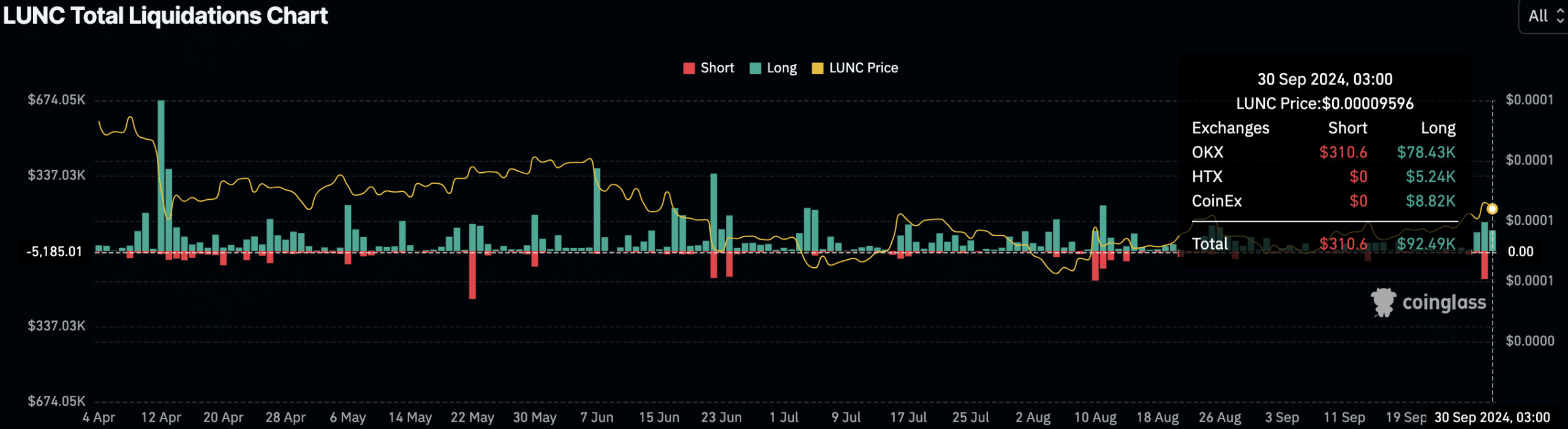

Over the last 24 hours, LUNC has risen by 3.13%, with a 14.50% rise in seven days. Coinglass data showed that trading activity has surged, with a 275.11% increase in volume and a 21.61% rise in Open Interest.

Liquidation data also indicated bullish market pressure, with $92.49K in long liquidations, compared to only $310.6 in shorts.

LUNA’s 295% volume surge signals bull run?

LUNA has also seen a steady rise in price, reaching $0.4317 at press time with a 24-hour trading volume of $203,145,216. This represented a 1.6% increase in the last 24 hours and a 14.44% rise over the past week.

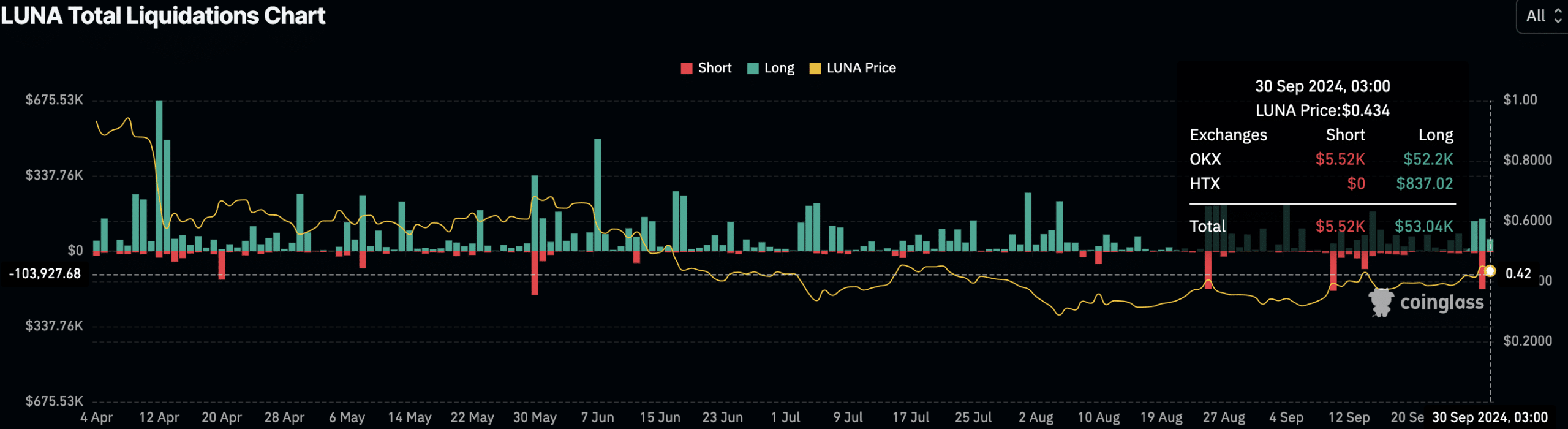

Market activity has also surged, with LUNA experiencing a 295.94% jump in volume and a 14.22% increase in open interest, according to Coinglass data.

Liquidation data reveals a notable imbalance, with $53.04K in long liquidations and only $5.52K in shorts.

These metrics suggested that bullish sentiment dominated the market despite volatility spikes that have led to liquidations, especially among leveraged traders.

In fact, the steady rise in trading volume and open interest may indicate renewed confidence among investors.

While the USTC burning proposal primarily targets Terra Classic assets, the impact on LUNC’s price has been noticeable.

The rise in volume and Open Interest pointed to heightened market participation, likely spurred by renewed community efforts.

Both LUNA and LUNC have seen parallel price increases following the announcement of the USTC burning proposal.

In terms of market activity, LUNA witnessed a larger percentage increase in trading volume compared to LUNC, with both tokens showing strong bullish sentiment in their respective liquidation data.