LUNC eyes a 600% breakout despite Gemini delisting – Here’s how!

- LUNC defies Gemini’s delisting with a price surge, eyeing a potential 600% breakout.

- Tightening volatility signals a possible LUNC breakout toward $0.000593 despite delisting concerns.

Terra Luna Classic [LUNC] was trading at $0.00008363 at press time, with a recent 24-hour trading volume of $25,259,192. Over the past 7 days, LUNC has shown a price increase of 8.55%, with a notable 3.75% rise within the last 24 hours.

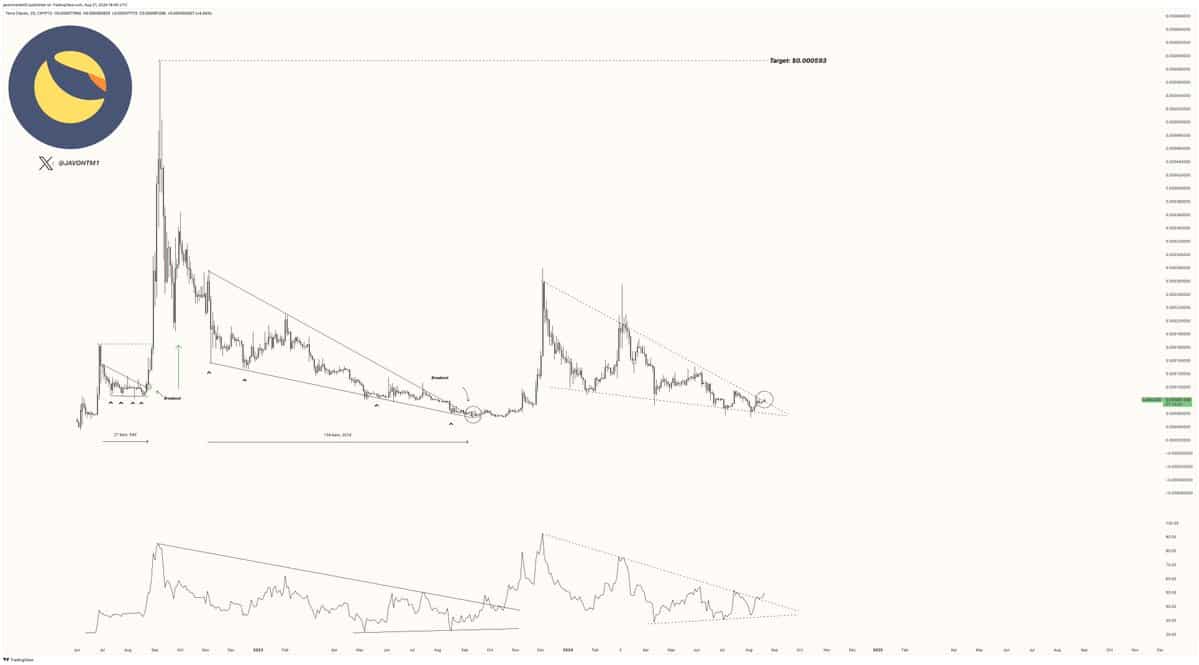

Crypto analyst Javon Marks anticipates a breakout toward $0.000593. This target would represent a gain of over 600% from current levels, drawing attention from both traders and investors in the crypto market.

According to Javon Marks,

“$LUNC (Terra Classic) is currently holding another BREAKOUT. The target is $0.000593, which is over 612% upside from here.”

Such projections have fueled excitement within the trading community, with many waiting to see whether LUNC will meet these expectations.

Source: X

Tightening volatility in LUNC: Will It trigger a major breakout?

The Bollinger Bands indicate tightening volatility, suggesting a potential shift in price direction. The price is currently near the middle band, signaling a possible breakout toward higher levels.

Should LUNC push above the upper band, this could trigger a bullish rally, although failure to break through could result in further consolidation around the current price levels.

Other technical indicators, such as the MACD, also hint at bullish momentum. A crossover has been observed, with the MACD line moving above the signal line, which often suggests growing market optimism.

However, the strength of this uptrend remains moderate, as indicated by the relatively low MACD histogram values.

Source: TradingView

At press time, the Relative Strength Index (RSI) for LUNC was at 57.17, reflecting mild bullish sentiment. This level places the RSI in a neutral zone, leaving room for upward movement without the risk of being overbought.

Traders are watching these metrics closely to gauge LUNC’s potential for further gains, particularly in light of the forecasted breakout towards $0.000593.

LUNC defies Gemini delisting news

In a recent development, the Gemini crypto exchange announced plans to delist several digital assets, including Terra Luna Classic (LUNC). The delisting is scheduled to take effect on September 20, 2024.

Users holding LUNC are advised to transfer their assets to other wallets before this deadline. Despite the news, LUNC’s price saw a 3% increase, reflecting broader market recovery trends.

Gemini has stated that its decision followed a routine review, concluding that certain assets did not meet the exchange’s listing criteria. While the reasoning behind the delisting remains unclear, it has not had a major impact on LUNC’s performance as of now.

Traders remain cautiously optimistic, focusing on potential short-term gains and the broader market’s recovery trajectory.

Adding to the recent developments, Terra disclosed that a Plan Confirmation Hearing for the Chapter 11 bankruptcy cases of Terraform Labs Pte Ltd (TFL) and Terraform Labs Limited (TLL) will take place on September 19, 2024.

Is your portfolio green? Check the LUNC Profit Calculator

The hearing will focus on the company’s bankruptcy restructuring process.

This event may influence market sentiment around both LUNA and LUNC in the coming weeks, as investors await the outcome of the legal proceedings.