Analysis

LUNC: Why predictions are pointing towards a price rally

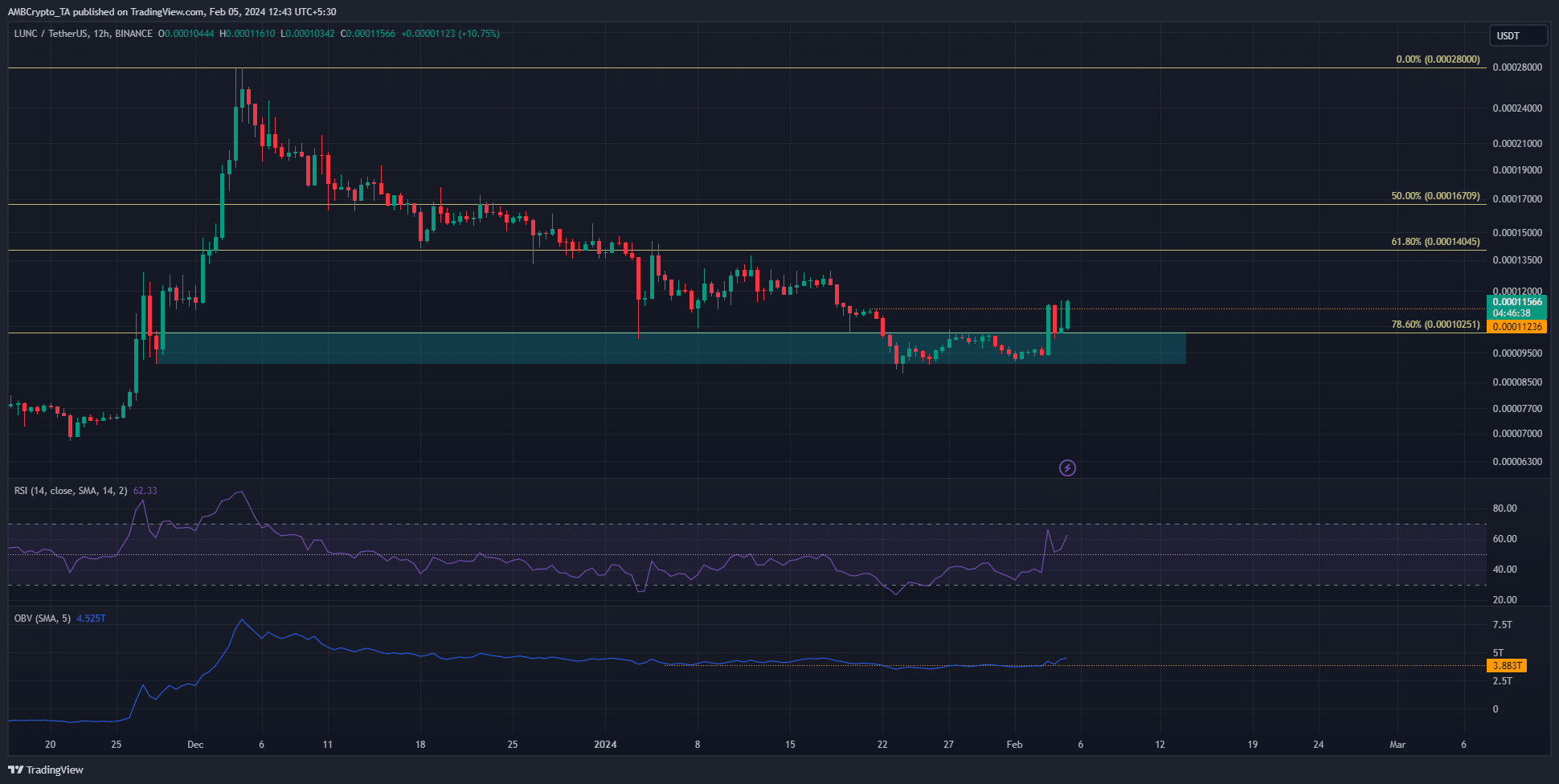

LUNC’s surge past $0.000112 broke the bearish market structure.

- LUNC saw a break of the bearish market structure recently.

- The bullish short-term sentiment reinforced the expectations of further price gains.

Terra Classic [LUNC] has managed to shift its market structure bullishly after the nearly 25% rally in February thus far. Technical analysis showed that going long would likely be profitable for traders.

The massive surge in trading volume that AMBCrypto

reported recently was indicative of a shift in sentiment and renewed confidence. The social metrics also spiked higher as engagement soared.LUNC’s long-term outlook showed strong bullishness

The Fibonacci retracement levels (pale yellow) were plotted based on LUNC’s rally in November and early December. From $0.00005419 to $0.00028, the rally measured 414% in 46 days, or nearly seven weeks.

The 78.6% retracement level was plotted at $0.0001025. Back in late November, the price consolidated beneath this area for nearly a day before rallying to $0.00028.

Over the past two weeks, the buyers were able to defend this demand zone.

The surge past $0.000112 represented a break of the bearish market structure. The RSI also climbed above neutral 50 and retested it as support, indicating bullish momentum was strong.

The OBV also began to trend higher. Therefore, the inference was that LUNC would likely rally toward the $0.00028 high in the coming weeks.

The short-term sentiment was wildly bullish

Source: Coinalyze

As discussed earlier, the higher timeframe price action chart (weekly and 12-hour) showed bullish pressure was on the rise. Analysis of data from Coinalyze pointed toward confidence from speculators too.

Realistic or not, here’s LUNC’s market cap in BTC’s terms

The Open Interest on Binance was soaring alongside the price, nearly doubling in the past two days. This was a firm sign of bullish sentiment.

The Funding Rate fell into negative territory when LUNC retraced some of its recent gains, but was positive once again.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.