LUNC’s fate turns bleak as new attack drains liquidity from Terraport Finance

- Terra Classic encounters a major bump on its road to recovery.

- LUNC’s prospects dwindle as the hack undermines recent rally attempts.

The Terra Classic [LUNC] community suffered yet another another blow to their recovery plans from last year’s black swan. Recent reports reveal that the network, as of 10 April, was nursing a very recent attack on its Terraport liquidity wallet.

Is your portfolio green? Check out the Terra Classic [LUNC] Profit Calculator

Terraport Finance confirmed the attack on its liquidity wallet. An update from the Twitter account Terraport Finance also revealed that the attacker drained the funds in the DeFi platform’s liquidity wallets. Thus, leading to significant losses.

Terraport did not disclose the actual sum of the LUNC that was lost. However, rumors suggested that roughly $4 million worth of LUNC was lost.

UPDATE:

Sadly during the last few hours a hacker drained liquidity pools from Terraport.

We are currently working with community members and major exchanges to secure as many of these funds as possible and blacklist wallets. All funds have been tracked.

Thank you for your…— Terraport Finance (@_Terraport_) April 10, 2023

The Terraport liquidity wallet attack comes as the latest blow to Terra Classic’s recovery attempts after the rough events of June 2022.

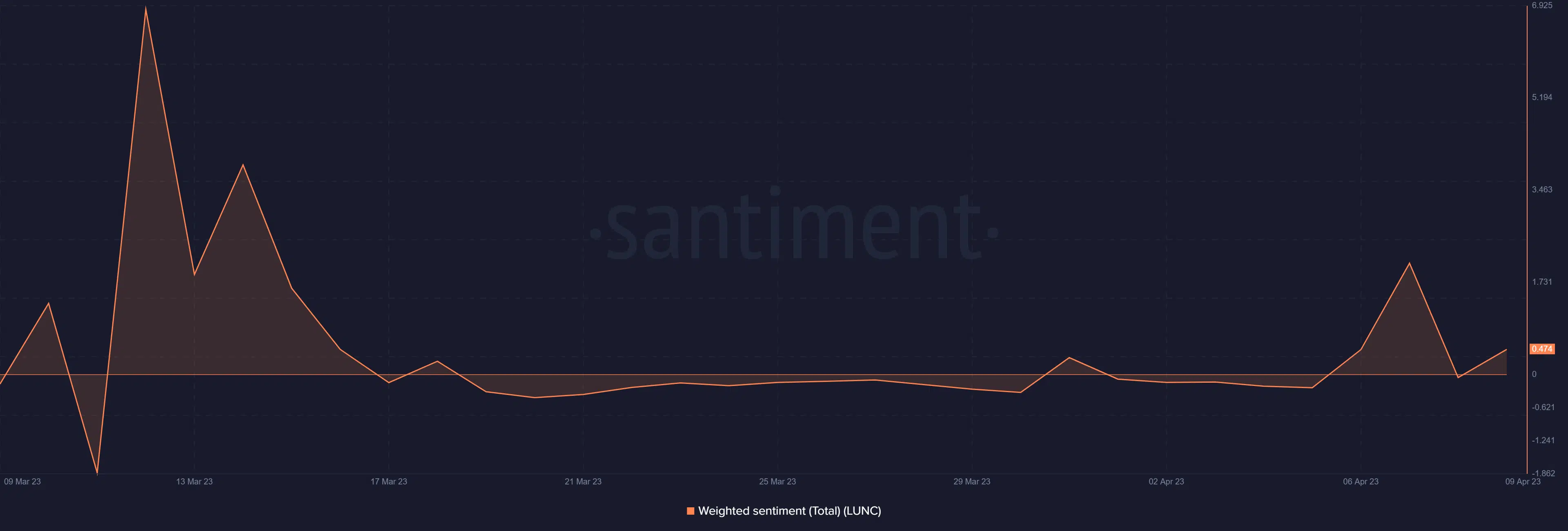

Not only does this mean that thousands of users are down on their luck, but this new attack may place a huge dent on investor confidence. However, contrary to the ongoing situation, LUNC’s weighted sentiment demonstrated some growth in bullish expectations.

So far the weighted sentiment didn’t indicate any major reaction, likely due to the timing of the incident. A more pronounced impact will likely be evident in the next few hours.

Another bearish week for LUNC?

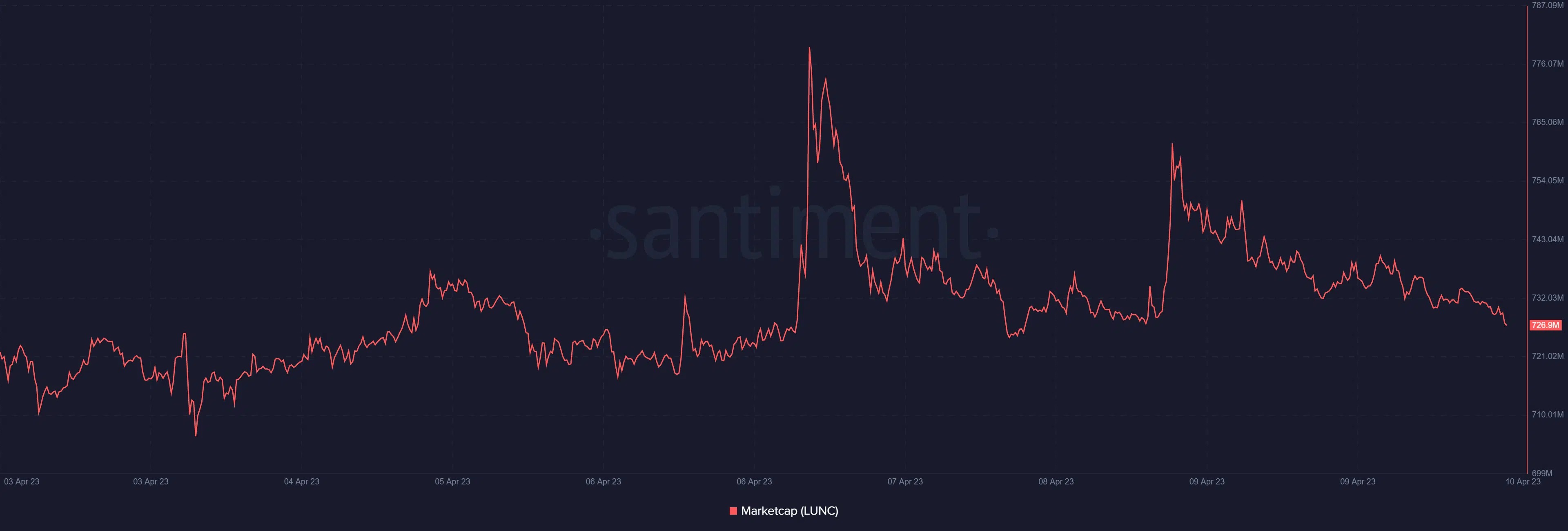

LUNC has been struggling to exit its lower range for quite some time. It bottomed out at $0.00011 on 11 March and has since been trying to recover. LUNC’s $0.00012 press time level represented a slight upside but it also underscored low buying pressure.

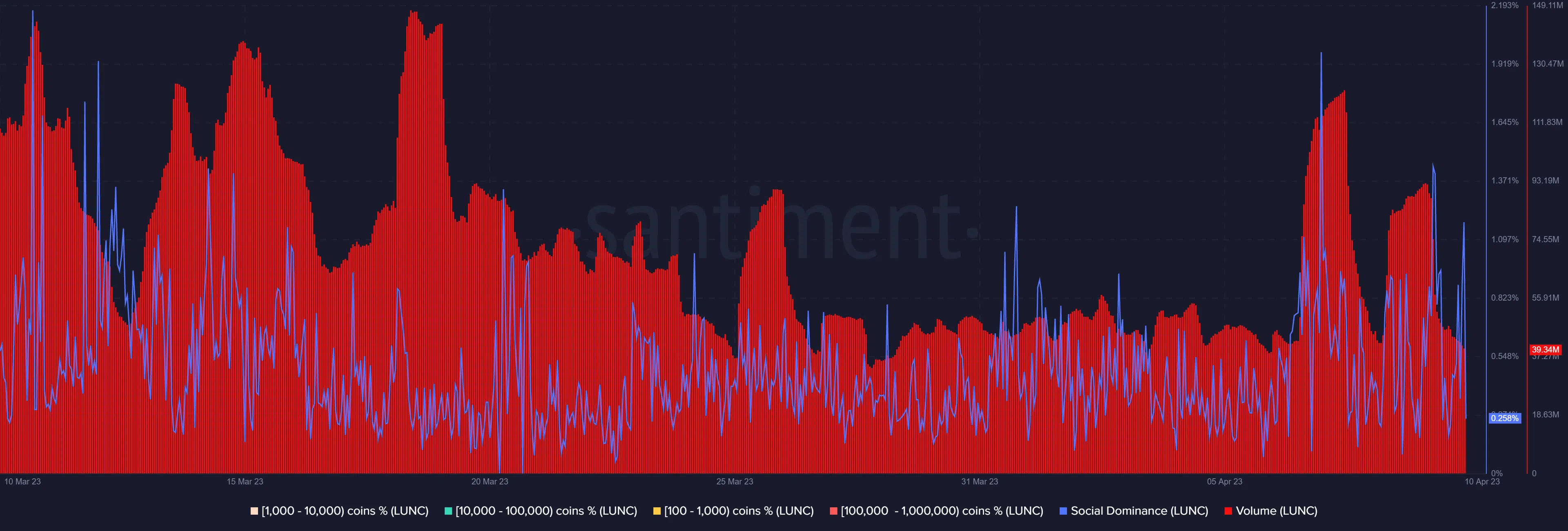

LUNC’s demand improved slightly in the last few days. This was evident by the improving relative strength, as well as the uptick in the Money Flow Index (MFI). Thus, confirming a slight increase in money flow.

Furthermore, these observations also suggested that the cryptocurrency was experiencing a surge in demand. It also reflected the slight surge in social dominance as observed in the last few days.

The social dominance stimulation also reflected a volume surge observed during the weekend. This was around the same time that the price saw a bit of an uptick but the subsequent sell pressure shot down those bullish attempts.

Realistic or not, here’s LUNC market cap in BTC’s terms

Despite the above observations, the news of the Terraport hack can surely not be considered as one to inspire confidence. At press time, LUNC had already lost roughly $33.8 million from its market cap in the last 48 hours.

Should LUNC holders anticipate more downside? While the latest events are more likely to cause FUD and potential downside, the lack of a sizable response may already offer noteworthy insights.

Ultimately, the extent of the hack on investor confidence should be clear in the next few days.