Maker: As bulls lend a hand to MKR, traders can expect this in coming days

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Active bulls rescue MKR from falling into a bearish downtrend.

- Shorts caught out by unexpected bullish price action.

Maker [MKR] posted a strong bullish candle on the daily timeframe to sustain its upward momentum. Previously, MKR had experienced a price dip from $1348 to $1200.

Realistic or not, here’s MKR’s market cap in BTC terms

The surge of liquidity providers moving to MakerDAO could help extend MKR’s strong bullish outlook with the lower timeframes offering more buying opportunities.

Recovery at critical Fib level maintained a bullish outlook on a daily timeframe

Between 2 August to 7 August, MKR registered a 14% dip after the price soared above $1300. This could have been a result of the significant decline in whale transactions at the beginning of August.

However, this dip didn’t derail bulls, as shown by the Fib retracement tool on the daily timeframe. Buyers rallied strongly from the 50% Fib level ($1186) to keep MKR above the $1200 price level.

The on-chart indicators highlighted the bullish outlook. The Relative Strength Index (RSI) dipped out of the overbought zone but retained the buying pressure with a reading of 61. The On Balance Volume (OBV) also continued to trend higher, showing good demand for MKR.

Based on the Fib levels, buyers can target profit levels at $1287 (23.6% Fib) and $1350, just below the $1378 resistance level. On the flip side, a price rejection at any of the Fib levels above the current price could swing the momentum in favor of bears.

Sellers caught out by bullish price action

Is your portfolio green? Check the Maker Profit Calculator

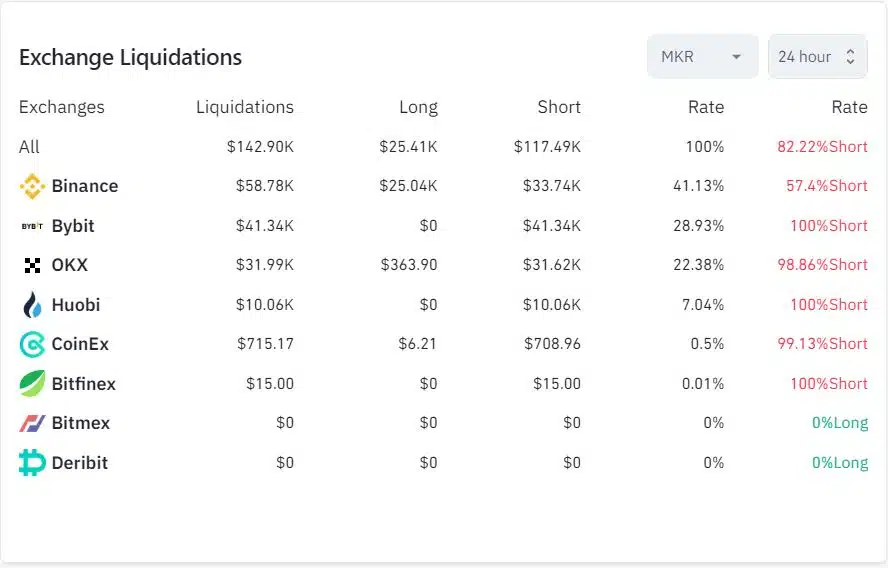

Market speculators with short positions in the futures market were caught out by MKR’s bullish price action over the past 24 hours. Data from Coinglass revealed that shorts suffered liquidations worth $117.49k. This amounted to 82.2% of the total liquidations within the period.

Overall, MKR looked poised to continue its bullish uptrend, despite the fluctuating nature of Bitcoin’s price action.