MakerDAO proposes additional $750M in U.S Treasury Bond investments

- MakerDAO has proposed allocating an additional $750M to invest in U.S Treasury bonds

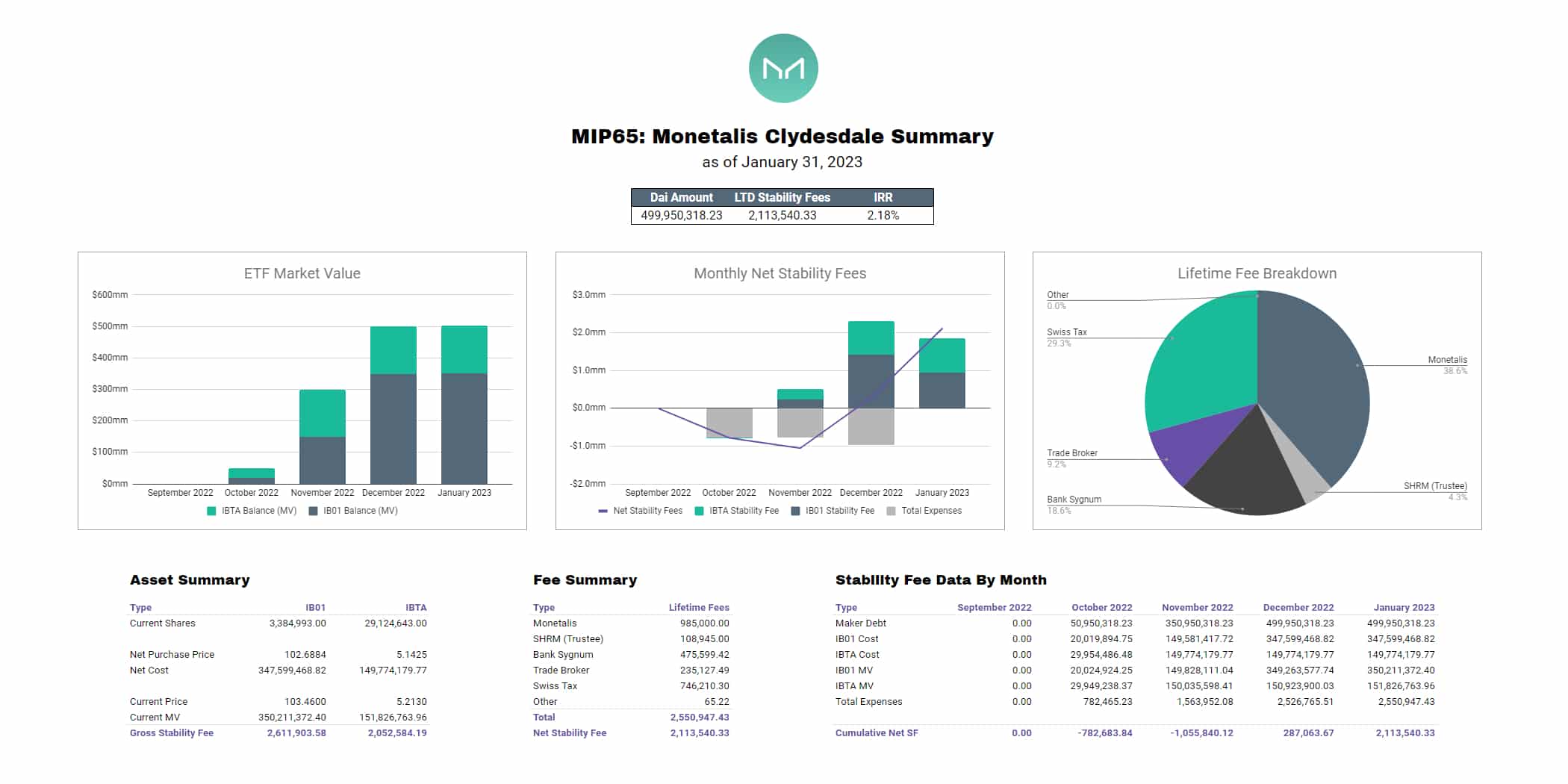

- As of January 2023, this investment strategy had generated $2.1 million in lifetime fees

MakerDAO, the decentralized autonomous organization (DAO) behind the DAI stablecoin, has proposed allocating an additional $750 million to invest in U.S Treasury bonds in order to capitalize on a favorable yield environment. The resolution, if passed, would add $750 million to the $500 million already approved in October 2022, bringing the total value to $1.25 billion.

As a part of the new proposal, the DAO would invest in six-month U.S Treasury notes via a ladder strategy with a bi-weekly rollover. This would imply that the maturities of the purchased notes would be evenly distributed over the entire period. Maker would be able to switch to a more complex or different ladder scheme, if necessary.

Maker wants this allocation to happen as soon as possible so that it can take advantage of the current yield environment as much as possible.

A decision to allocate $500 million to Treasury funds was first announced in June last year. It was noted at the time that it could assist Maker in reducing counterparty and credit risk – Necessary given the market turmoil. Maker’s first investment in the Treasury was intended to help further stabilize its DAI stablecoin, which was already over-collateralized at the time.

A sound strategy for MakerDAO

As of January 2023, this investment strategy had generated $2.1 million in lifetime fees for the Maker Protocol.

Monetails CEO Allan Pederson claimed that his team found the solution of laddering U.S Treasury over a six-month period with bi-weekly maturities, presenting a strong, flexible, and an effective solution for Maker. He mentioned the low costs, tax efficiency, and inherent liquidity as benefits of the strategy.

Maker has continued to grow and is now one of the most powerful entities in the DeFi space. The MakerDAO community voted 73% against Cogent Bank’s bid to borrow $100 million from its platform. The community, on the other hand, had approved a similar loan of $100 million to another bank, Huntingdon Valley Bank, bringing in more traditional financial entities.