MakerDAO revenues, fees hit fresh records – Good news for MKR?

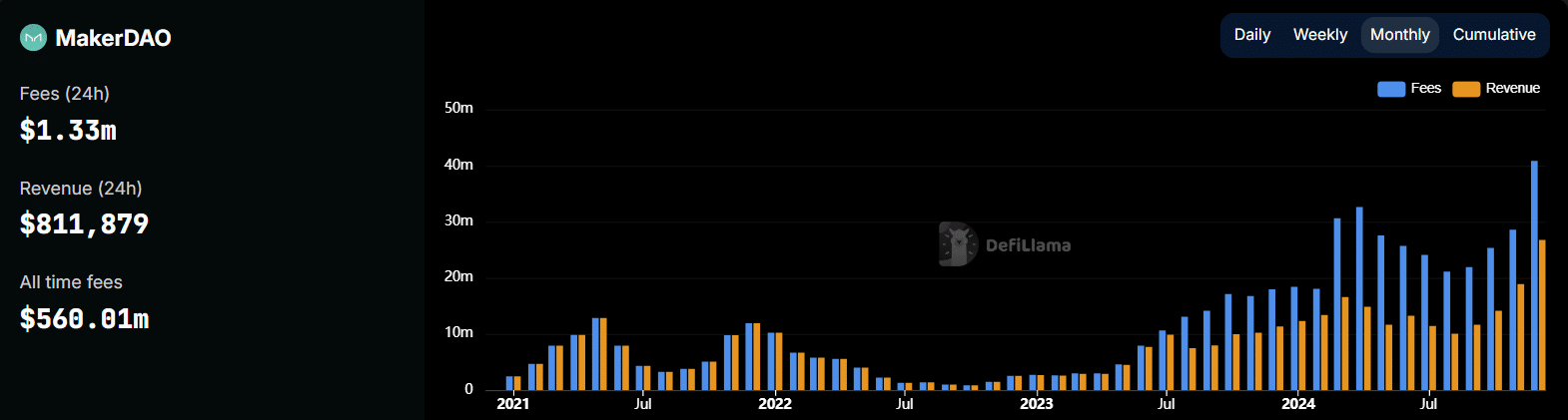

- MakerDAO monthly fees and revenues have surged to record highs, suggesting increasing network usage.

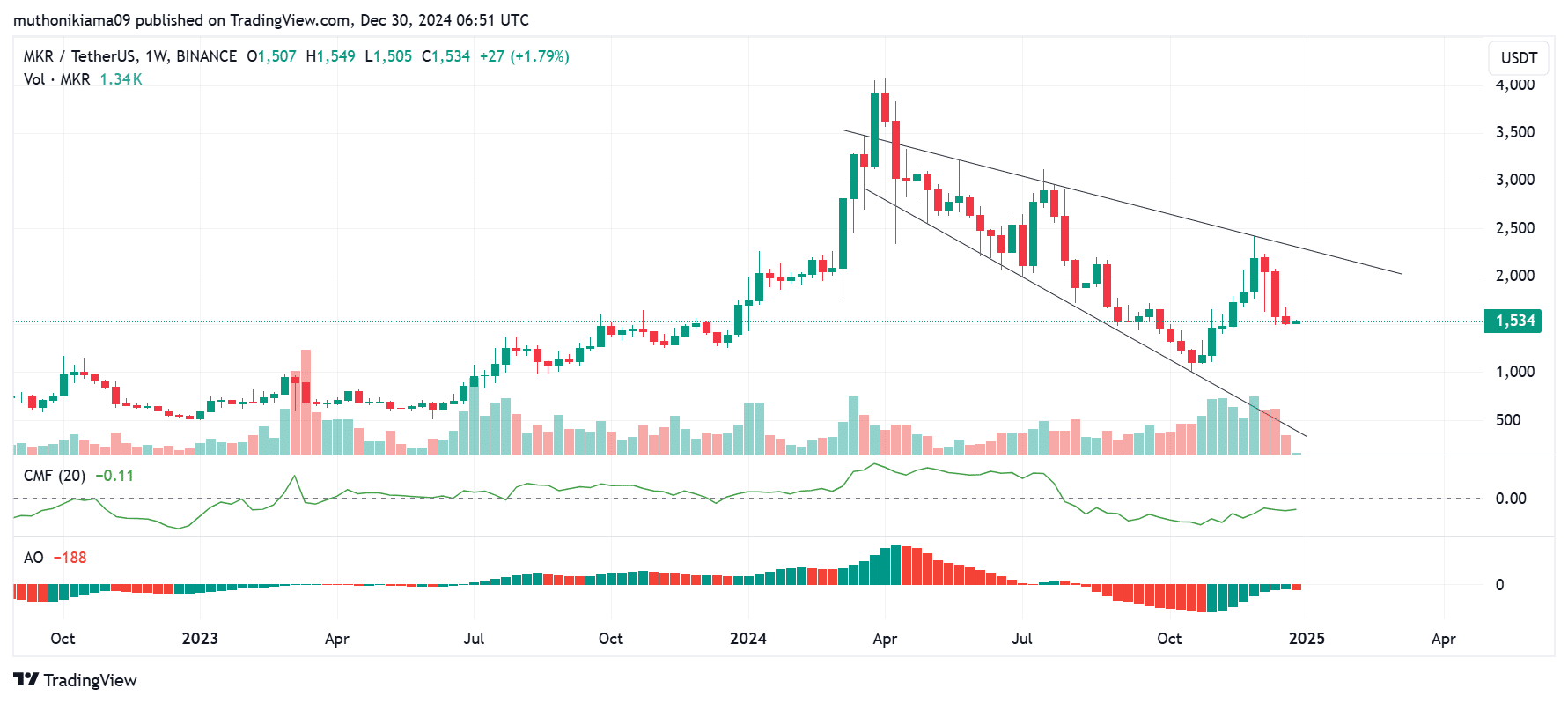

- MKR’s weekly chart shows mixed signals as the altcoin traded within a falling broadening wedge pattern.

Maker [MKR], at press time, traded at $1,523 after a slight 0.58% drop in 24 hours. The token has failed to match the performance of top altcoins this year.

In fact, its market capitalization has dropped from $3.66 billion recorded in April to the current $1.3 billion.

Despite the weak performance, the MakerDAO network recorded significant growth in December.

According to DeFiLlama, monthly fees on the network have hit a fresh record of over $40 million, while monthly revenues have surpassed $26 million.

If this growth continues, it could bode well for MKR’s price. However, the altcoin’s weekly chart shows mixed signals.

MKR price analysis

Maker has been trading within a falling, broadening wedge pattern on its weekly chart. This pattern often suggests that the selling pressure is weakening, setting the stage for a bullish reversal.

For MKR to recover from the bearish pressure, buyers need to enter the market. However, the Chaikin Money Flow (CMF), with a negative value of -0.11, shows that is yet to happen.

In fact, the CMF has been oscillating in the negative region for five months, an indication that sellers have been in control of the price action.

The Awesome Oscillator (AO) also showed that the momentum remained bearish due to the negative histogram bars.

The upper boundary of the falling broadening wedge pattern is a strong resistance level. If MKR manages to break above this level as buyers gain strength, it could once again aim for the 2024 high above $4,000.

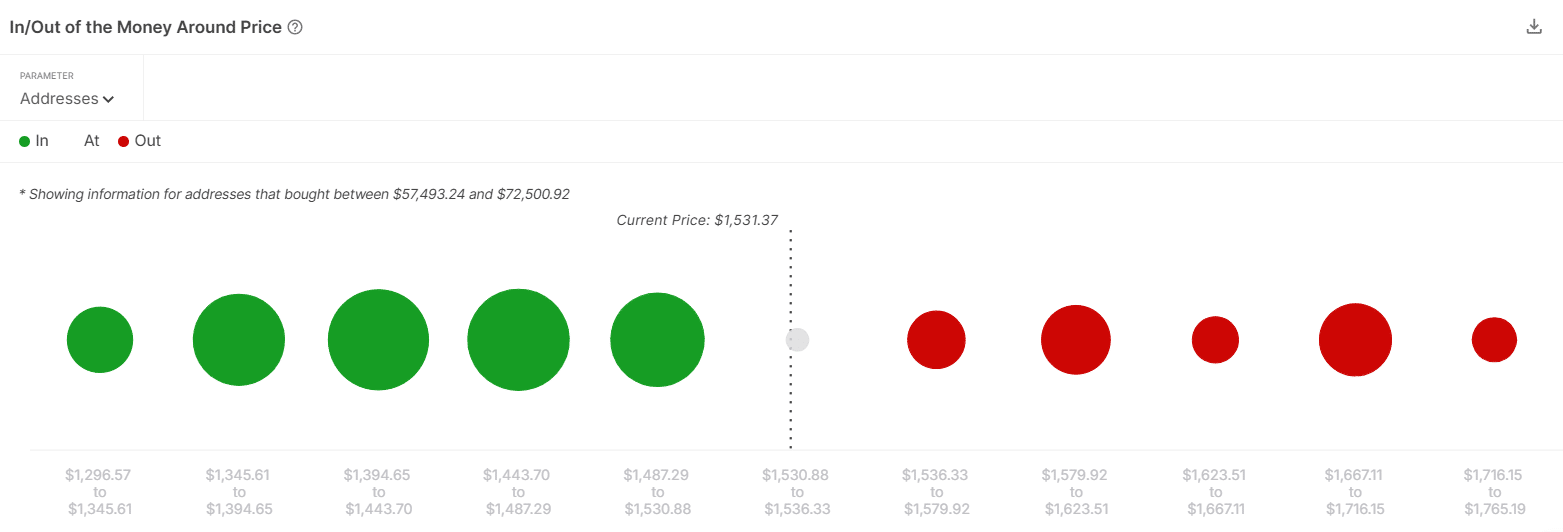

Analyzing key demand and supply zones

Maker’s demand zone lies at the $1,440-$1,480 price levels, where 2,530 addresses purchased the token. These buyers might defend this zone if MKR drops, making it a strong support.

Conversely, a rally past $1,700 might face resistance due to the 1,290 addresses that purchased MKR between $1,667 and $1,716.

These addresses might choose to sell once they become profitable, which could halt the rally.

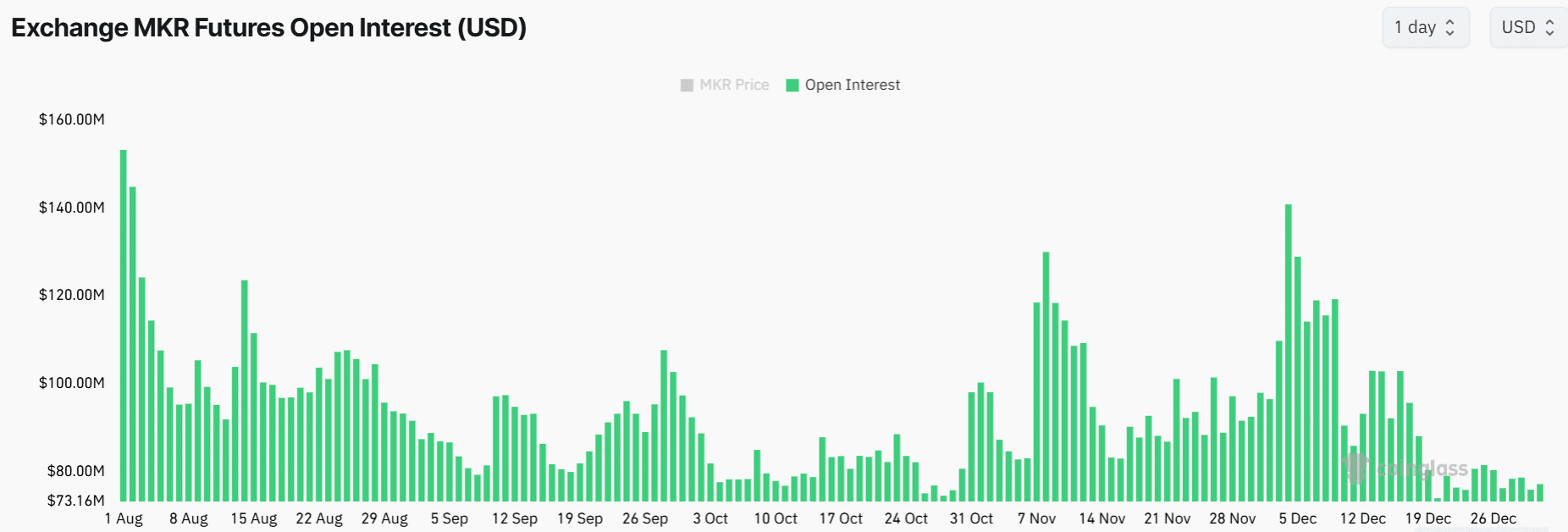

Speculative interest wanes

Data from Coinglass showed that speculative activity around MKR has waned due to the falling open interest.

After hitting a multi-month high above $140 million earlier this month, MKR’s Open Interest has since dropped by nearly half to $77 million.

Read Maker’s [MKR] Price Prediction 2025–2026

This drop suggests that fewer derivative traders are opening new positions on Maker, which could result in price consolidation.

This decline also shows a bearish trend due to less conviction among traders about future price moves.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)