Altcoin

MakerDAO soars to yearly highs: What’s behind this surge?

MKR breaks yearly records, with whales accumulating and active addresses surging, signaling a dynamic shift in MakerDAO’s landscape.

- Three whales have accumulated over 4,000 MKR so far in September.

- MKR added over 8% to its price in two days.

MakerDAO [MKR] recently decoupled from the broader market, having experienced significant accumulation by whales. Are these two notable developments independent in themselves, or is there more than what meets the eye?

How much are 1,10,100 MKRs worth today?

MKR hits its highest price range in 2023

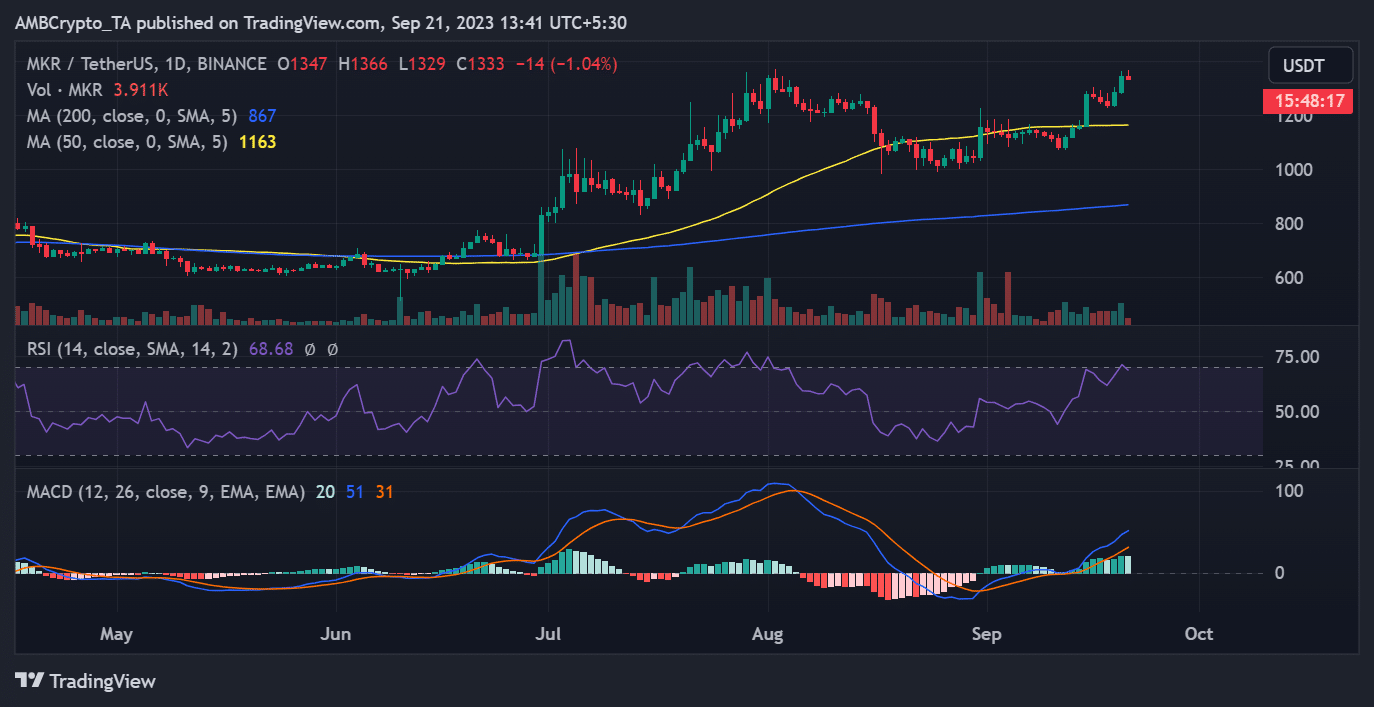

MKR has shown remarkable price movements in its daily timeframe. The chart below instanced that, at press time, MKR had reached its highest price level of the year thus far.

Between 19 and 20 September, there was a notable price surge of over 8%, propelling it to approximately $1,347.

However, as of this writing, MKR was trading with a slight price decrease of around 1%, hovering around $1,300. Despite this decline, it continued to trade within the highest price range of the year.

Furthermore, the upward trend in price pushed the Relative Strength Index (RSI) into slightly overbought territory. However, the recent price dip caused the RSI to drop just below that zone at press time.

Regardless of this drop, MKR remained firmly in a strong bull trend.

MakerDao sees a surge in volume

While the volume observed recently for MakerDAO is not the highest seen within the month, there has been a noticeable increase. This increase in volume commenced around 18 September, when the volume was approximately $65 million.

At the time of writing, the volume has surpassed $100 million. An upward trend in volume seems to be emerging, and it may continue as the trading day progresses.

Whales pile up more MKR

Alongside the surge in both volume and price, there has been a noticeable increase in the accumulation of MakerDAO. According to data from Lookonchain, three prominent investors, often referred to as whales, have been steadily accumulating MKR over several weeks.

The data revealed that one whale began accumulating the token around 4 September and has invested 1,194 ETH, which was valued at over $1.9 million, to acquire 1,700 MKR.

In a similar vein, another whale initiated their accumulation activities on 18 September, expending 992 ETH, equivalent to more than $1.6 million, to acquire 1,261 MKR.

Lastly, a third whale commenced accumulating on 12 September and spent 1,218 ETH, valued at over $1.9 million, to amass 1,683 MKR.

Realistic or not, here’s MKR’s market cap in BTC’s terms

MakerDAO’s active addresses spike

Data from CryptoQuant indicated a recent surge in the number of active addresses associated with MakerDAO. The chart below showed that as of 20 September, the number of active addresses had surged to over 600.

What stood out about this spike was that it represented the highest number observed in the past month. This observation suggested that the increase in activity extended beyond just whale participation; a growing number of addresses were becoming active in the MakerDAO ecosystem.