MakerDAO’s actions against Aave had these repercussions on the DeFi platform

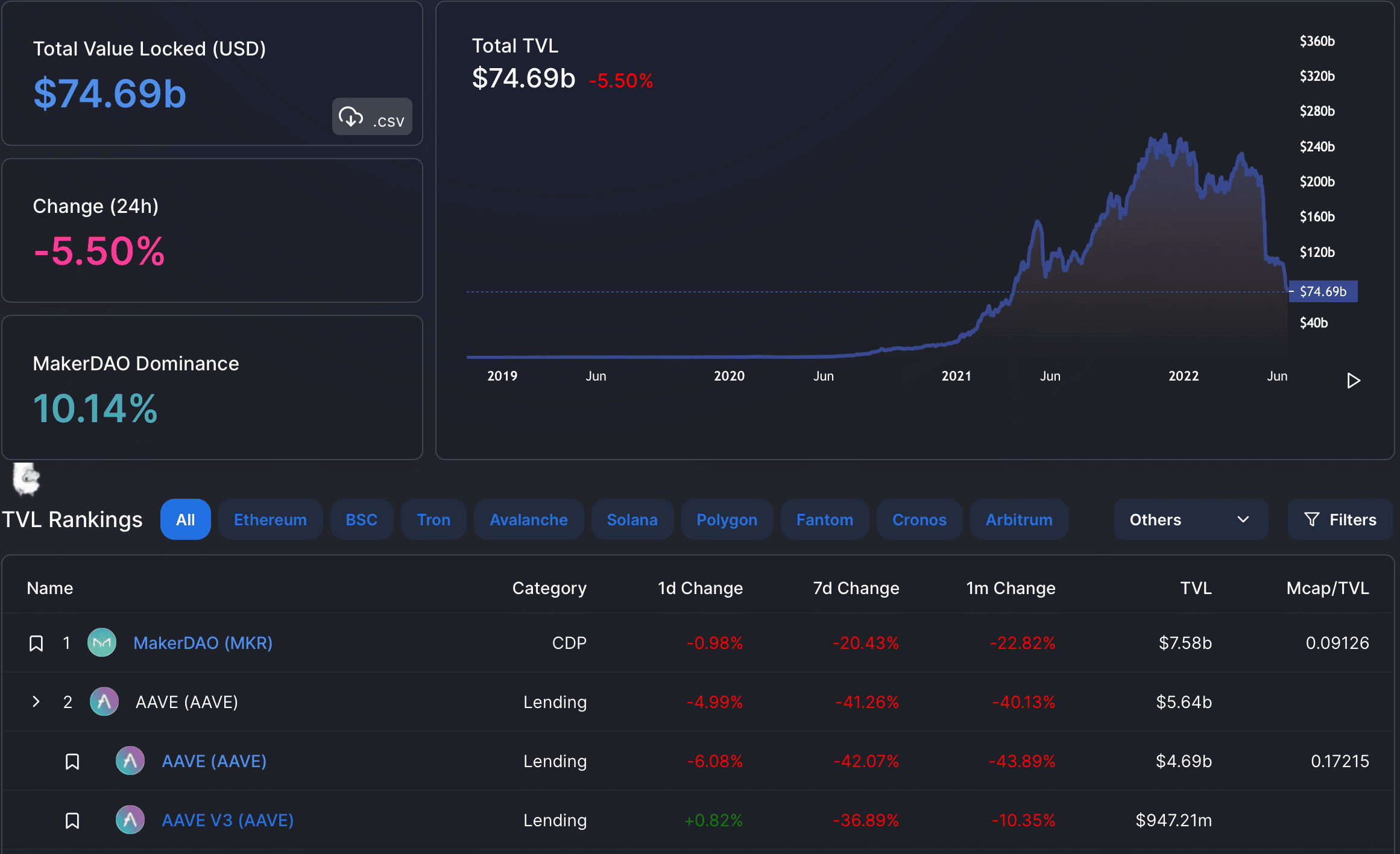

The crypto market continues to take heavy blows across the bearish market. Due to the current market turmoil, DeFi’s total value locked (TVL) decreased by 55% since the end of April. In fact, at press time, the total TVL decreased significantly this month. Recording a 10% decline (stood at $75 billion) in its TVL in the last 24 hours.

But looks like one platform suffered the most of the lot.

Sinking ship

Amongst the top five DeFi protocols with the largest TVL, Aave Protocol appeared to have suffered the most decline over the past 24 hours. In a month, the protocol witnessed a 41% correction and currently stood at a TVL of $5.64 billion and ranked second on the ranking of DeFi protocols.

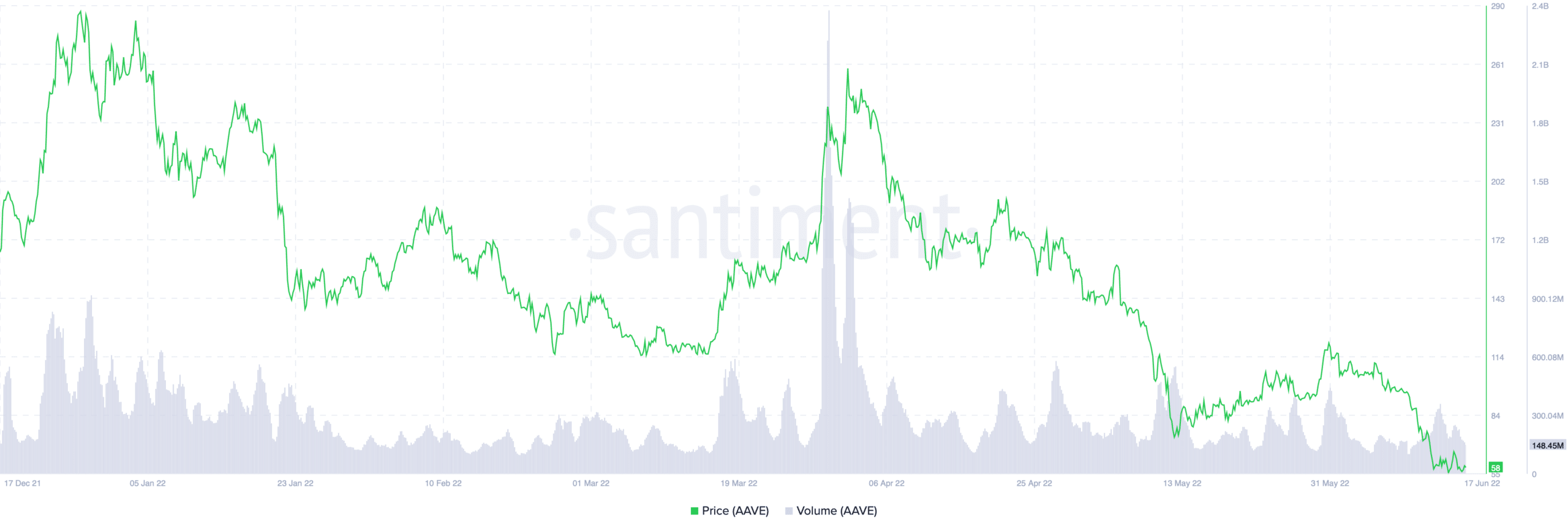

In terms of price, AAVE witnessed a fresh correction as it slid under the $58 mark- marking a massive decline. Around 6 June, the AAVE token broke past its crucial resistance level of $104 and proceeded to register a high of $111 during intra-day trading. However, this was immediately followed by a price retracement that caused the token to lose 21 % of the accrued gains.

Interestingly, AAVE holders were aware of a decline as they decided to book their profits the moment AAVE completed a 52% rally on 11 June, selling $17 million worth of AAVE. Since then, it has been a downhill journey for the token.

This is evident here in the graph above. Volume transactions stayed low with no excitement around the network, and hence investors’ sentiment.

What did I do?

Well, the protocol itself didn’t do anything much to register a recovery. Moreover, MakerDAO voted to cut off lending platform Aave’s ability to generate DAI for its lending pool without collateral. The risks of Celsius’s liquidity crisis loom large over the entire crypto ecosystem to make things worse.

The Maker Governance has voted to temporarily disable the @AaveAave DAI Direct Deposit Module (D3M).

This change is available for execution on June 17 2022 21:03 UTC.

— Maker (@MakerDAO) June 15, 2022

Disabling the module would mean that Aave could no longer generate DAI at will, allowing it only to pay off existing debts. The change will be available for execution on 17 June. Moreover, the proposal censured Aave to additional risks due to its deployments on multiple chains.