MakerDAO’s DSR surge could steer the protocol’s growth in this direction

- MakerDAO’s DAI experiences substantial growth and adoption through strategic DSR adjustment.

- Spark Protocol emerges as a transformative force, driving MakerDAO’s DeFi ecosystem to new heights.

In the realm of decentralized finance (DeFi), MakerDAO’s [MKR] DAI has established its dominance, showcasing remarkable growth over recent months. A pivotal catalyst behind this surge is the MakerDAO community’s decision to amplify the Dai Savings Rate (DSR) to an enticing 8%, ushering in a host of positive effects for the protocol.

Realistic or not, here’s MKR’s market cap in BTC’s terms

DSR brings all the users to the yard

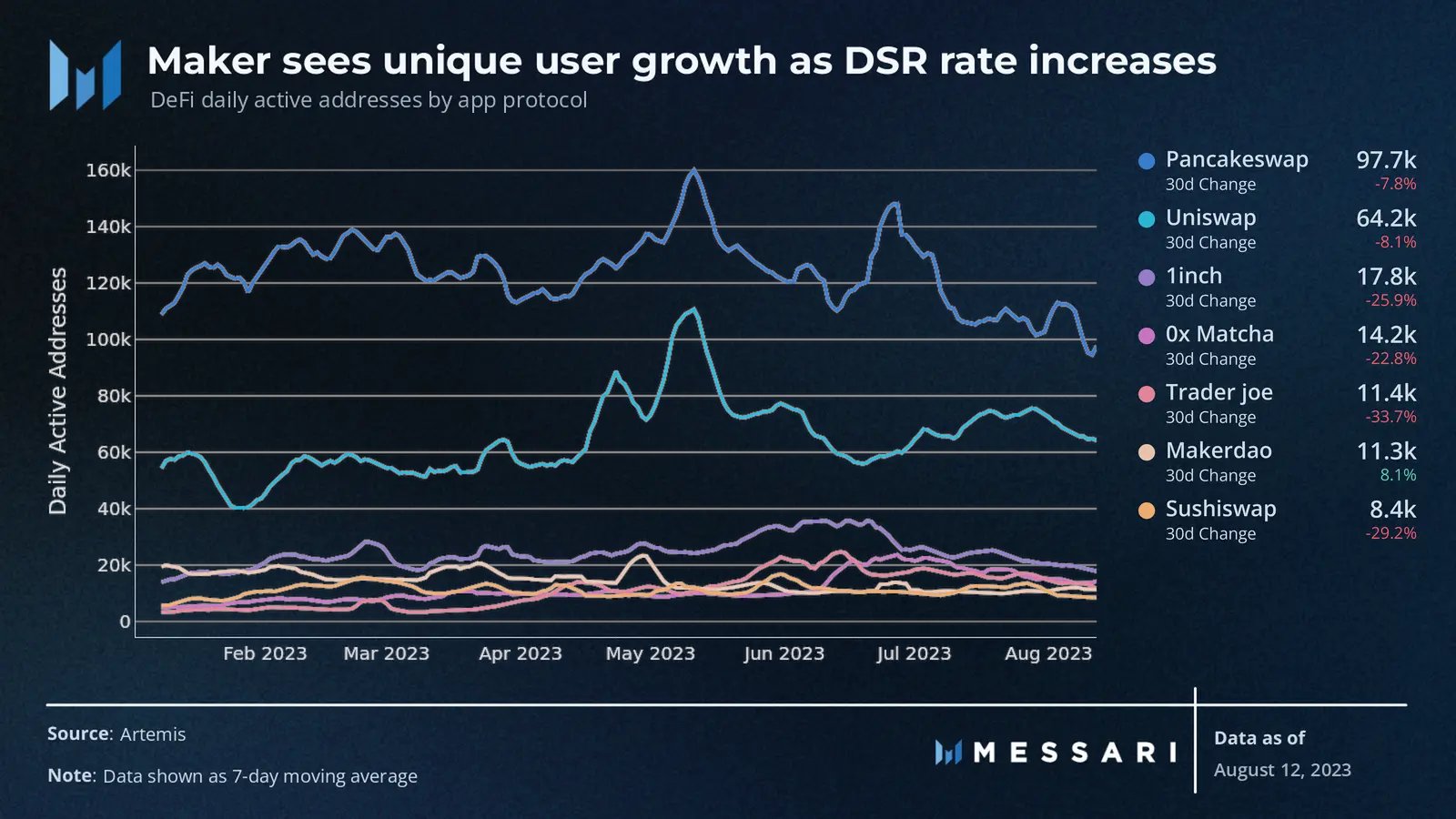

According to data from Messari, DAI’s supply witnessed an impressive $1 billion surge, harmonizing seamlessly with a concurrent rise in active MakerDAO users. Furthermore, the decision to fortify the DSR aimed to stoke demand for DAI, resulting in a swift amplification of its market cap.

This strategic maneuver swiftly positioned DAI as the preeminent high-yield stablecoin, thus outshining the yield potential of U.S. Treasuries. The once $4.4 billion DAI supply surged to an impressive $5.3 billion, fueled by the surge of DSR-locked DAI from $340 million to a substantial $1.2 billion.

In a symbiotic process, holders of ETH and stETH capitalized on this opportunity, minting DAI and bolstering the protocol’s reserves.

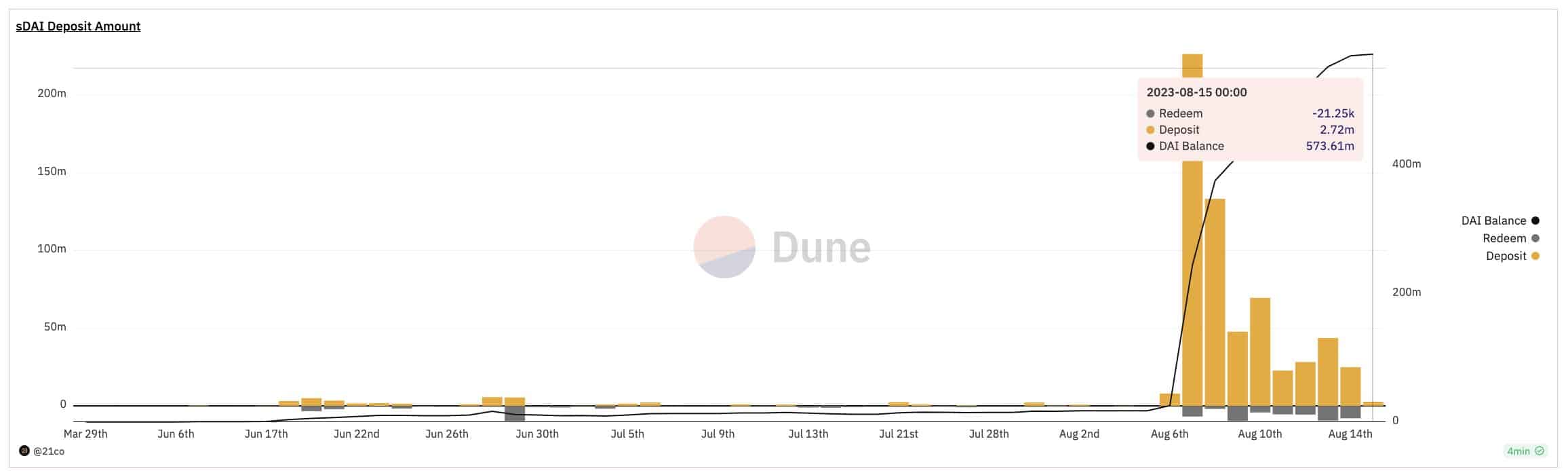

The ripples of these events resonated through the ecosystem, effectively boosting the circulating supply of sDAI by an impressive 54% within a mere week.

Furthermore, an influx of over 573 million DAI found its sanctuary within the sDAI contract. Along with that, 556 million sDAI emerged from the minting process.

Responding to this dynamic surge, Maker’s founder, Rune Christensen, proposed to reduce the DSR to 5%.

Not losing its Spark

Spark Protocol’s growth could also impact DAI positively. It is an entity that holds promising potential for the MakerDAO ecosystem. Emerging onto the DeFi scene in May, Spark Protocol rapidly catapulted itself into the echelons of the top 30 DeFi protocols. It established its foothold with a TVL that increased massively in just three months.

The ignition of Spark’s lending operations, commencing with 5 million DAI sourced from Maker’s D3M, kindled a rapid ascent, with borrowed DAI skyrocketing to an impressive 198 million. Recognizing the protocol’s immense potential, Maker Governance swiftly extended a 20 million DAI credit to fuel Spark’s continued growth.

Is your portfolio green? Check out the MakerDAO Profit Calculator

A testimony to Spark Protocol’s traction emerged as users promptly consumed this expanded credit line within weeks. Additionally, in a resounding affirmation, Maker Governance granted approval for an escalated borrowing limit of 200 million DAI.

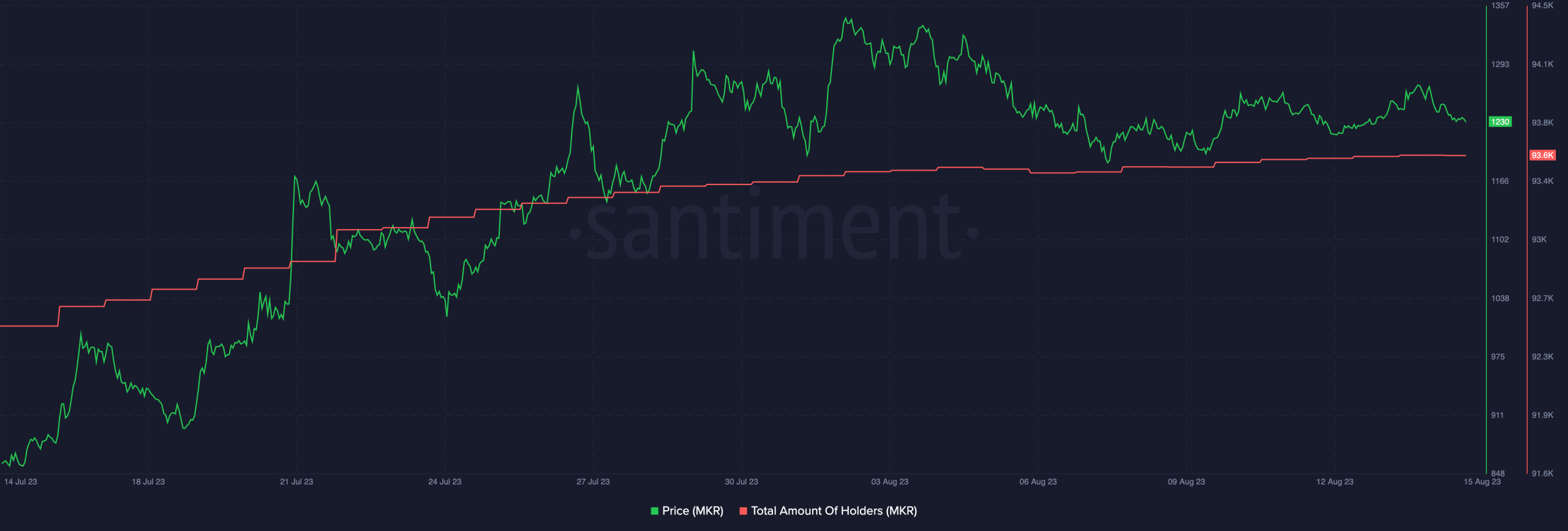

Furthermore, the price of MKR remained stable at $1230. The number of addresses holding the MKR token continued to increase.