Maker’s short-term pullback persists — Can MKR sellers benefit?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- MKR cracked below $1.40 at press time as the retracement extended.

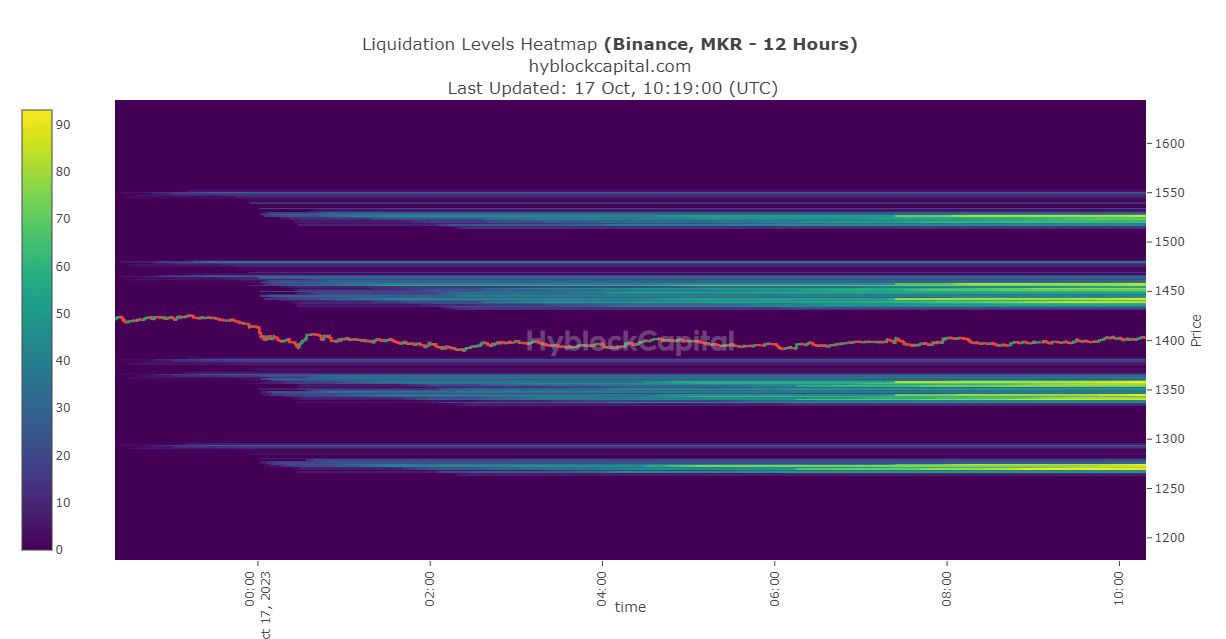

- High liquidation levels existed at $1350 and $1450 and could see strong price reaction.

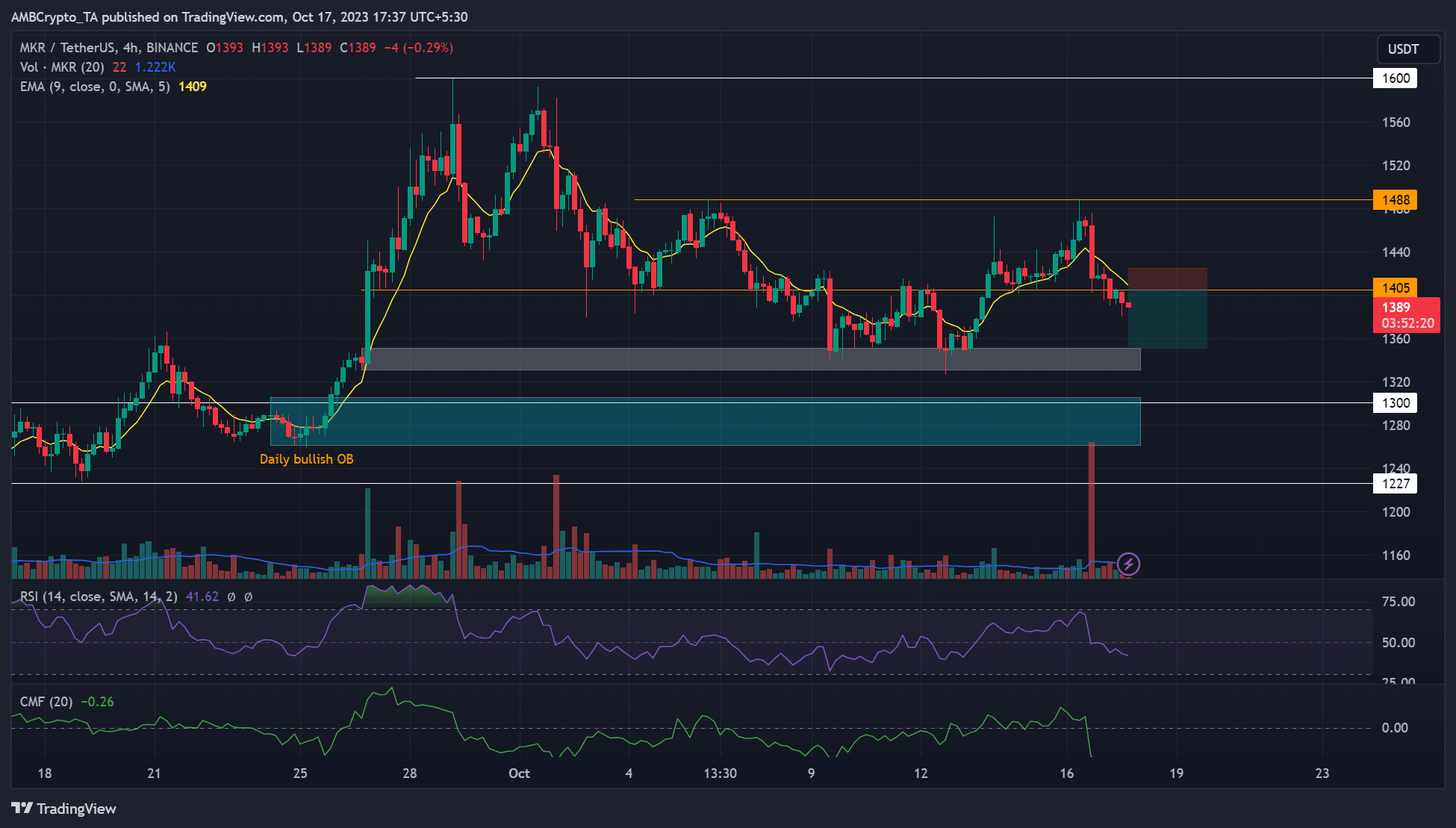

Maker [MKR] oscillated between $1488 and $1350 in the first half of October, allowing traders to exploit extreme levels. At price time, sellers grabbed a shorting opportunity after MKR faltered at the overhead resistance at $1488.

Is your portfolio green? Check out the MKR Profit Calculator.

Short-sellers saw +5.6% shorting gains after MKR dropped below $1405 at the time of writing. A prior MKR’s price analysis correctly projected a rebound at $1350. After faltering at $1,488, will the pullback extend to the short-term support?

Will Maker sellers extend shorting gains?

The $1405 was a key price reaction level since late September. A crack below it, as seen at the time of writing, could encourage sellers to extend gains.

Besides, MKR’s short-term price trend flipped negative, as shown by price action below the 50-Exponential Moving Average (EMA). Other key price indicators were also negative, as the downsloping Relative Strength Index (RSI) and Chaikin Money Flow (CMF) demonstrated. It underscored a bearish scenario amidst a spike in selling pressure and capital outflow.

So, sellers could drag MKR to short-term demand and H4 bullish order block (OB) at $1350 (white). An extended drop to the support will offer an extra 3.8%, shorting gains from $1405.

Key liquidation levels existed at $1350 and $1450

Liquidation data from Hyblock Capital marked out $1350 and $1450 as the immediate high liquidation levels (orange). For inference, high liquidation zones act as support or resistance zones and could also see strong price reactions.

How much are 1,10,100 MKRs worth today?

Ergo, the $1350 was a demand zone and crucial high liquidation levels. So, the MKR prices could be dragged to the bearish target of $1350 due to liquidity hunting.

However, traders should track BTC price action for optimized trade set-ups.