MANTRA [OM] price prediction – New highs after breaching July’s levels?

![MANTRA [OM] price prediction - New highs after breaching July's levels?](https://ambcrypto.com/wp-content/uploads/2024/10/OM-Featured.webp)

- MANTRA token has a strongly bullish outlook for the coming weeks

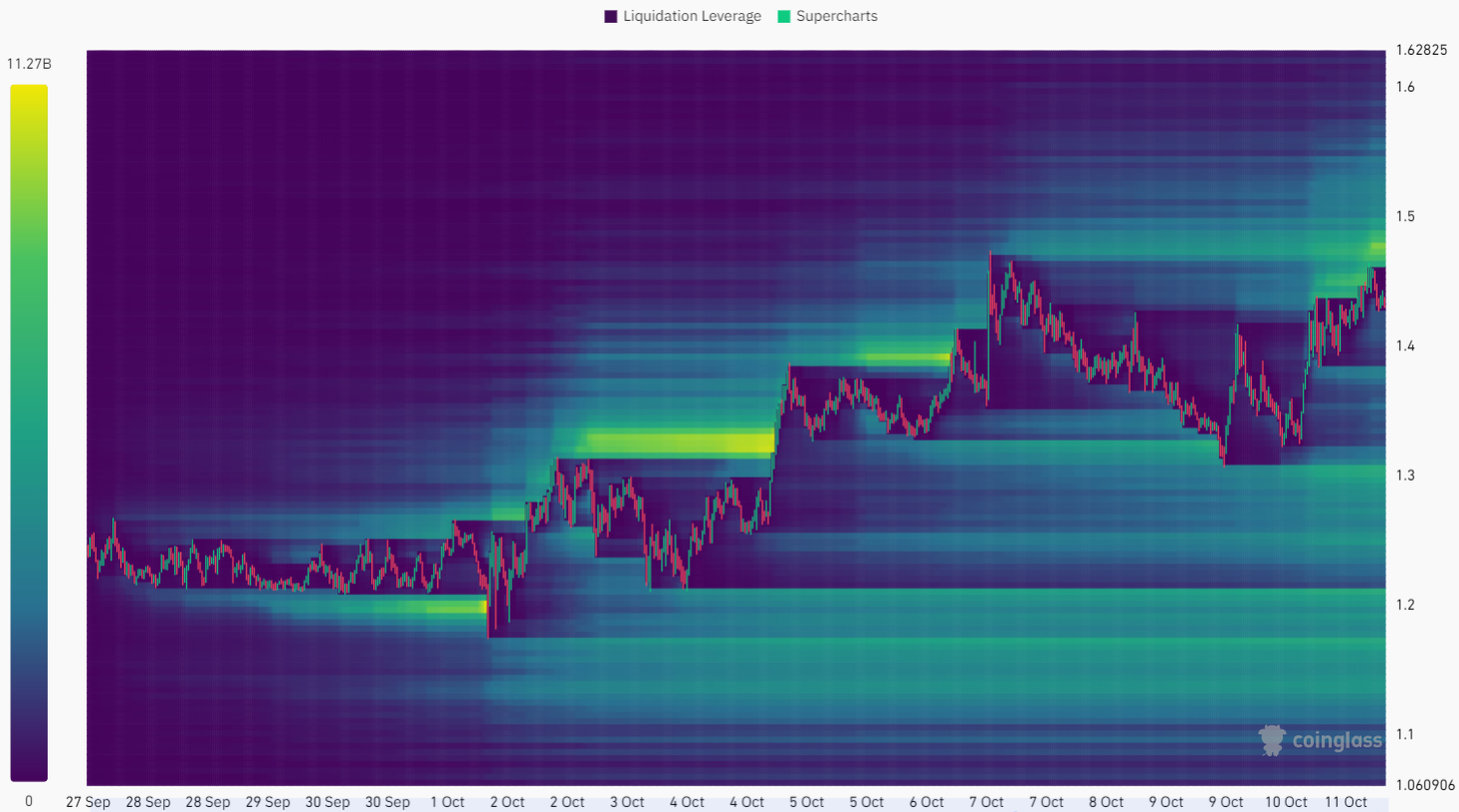

- Liquidation heatmap noted a magnetic zone at $1.5 that could stall the trend

MANTRA [OM], at press time, had broken past its July highs after recording a 69% rally since 8 September. The selling pressure on Bitcoin [BTC] that forced it from $66.5k to $59k in October hardly dented OM’s bullishness.

The breakout past its recent highs, combined with the steady buying pressure, meant that bulls could target greater gains. Such a move could take a while to materialize if the price is attracted to the $1.3 liquidity pocket next.

Chances of sustained price gains for OM

As things stand, the evidence pointed towards the continuation of an uptrend. The market structure on the daily chart has been bullish since the first week of September. The CMF has been above +0.05 for the majority of the past two weeks.

This showed significant buying pressure behind OM. The moving averages formed a bullish crossover and indicated upward momentum on the daily chart.

In case of a price retracement, the $1.25 and $1.1 levels can be expected to serve as support. It is more likely that the $1.41 level is flipped to support in the coming days and the overhead Fibonacci extension levels at $1.6 and $1.9 are targeted.

Liquidation levels showed a minor price dip could be looming

Source: Coinglass

The 2-week lookback period revealed that the $1.48 zone has a noticeable cluster of liquidation levels. It is possible that the price is attracted to this zone, before being forced lower.

Is your portfolio green? Check the MANTRA Profit Calculator

And yet, it is also possible that the strong bullishness forces the price well beyond the cluster of liquidity overhead, as it did on 4 October. Overall, though OM might see a minor dip towards $1.3-$1.35, it is expected to trend higher in the coming days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion