Mapping Bitcoin Cash’s rally past $600 amid THESE bullish signs

- Bitcoin Cash has rallied by 71% in 30 days, with its market capitalization increasing nearly two-fold to $11.3 billion.

- BCH’s Open Interest has also reached its highest level in over seven months, suggesting high demand for BCH futures.

Bitcoin Cash [BCH] has gained by 71% in one month, to trade at a multi-month high of $574, at press time. Its market capitalization has also risen from $6.6 billion to $11.3 billion, with the rally mirroring broader gains across the altcoin market.

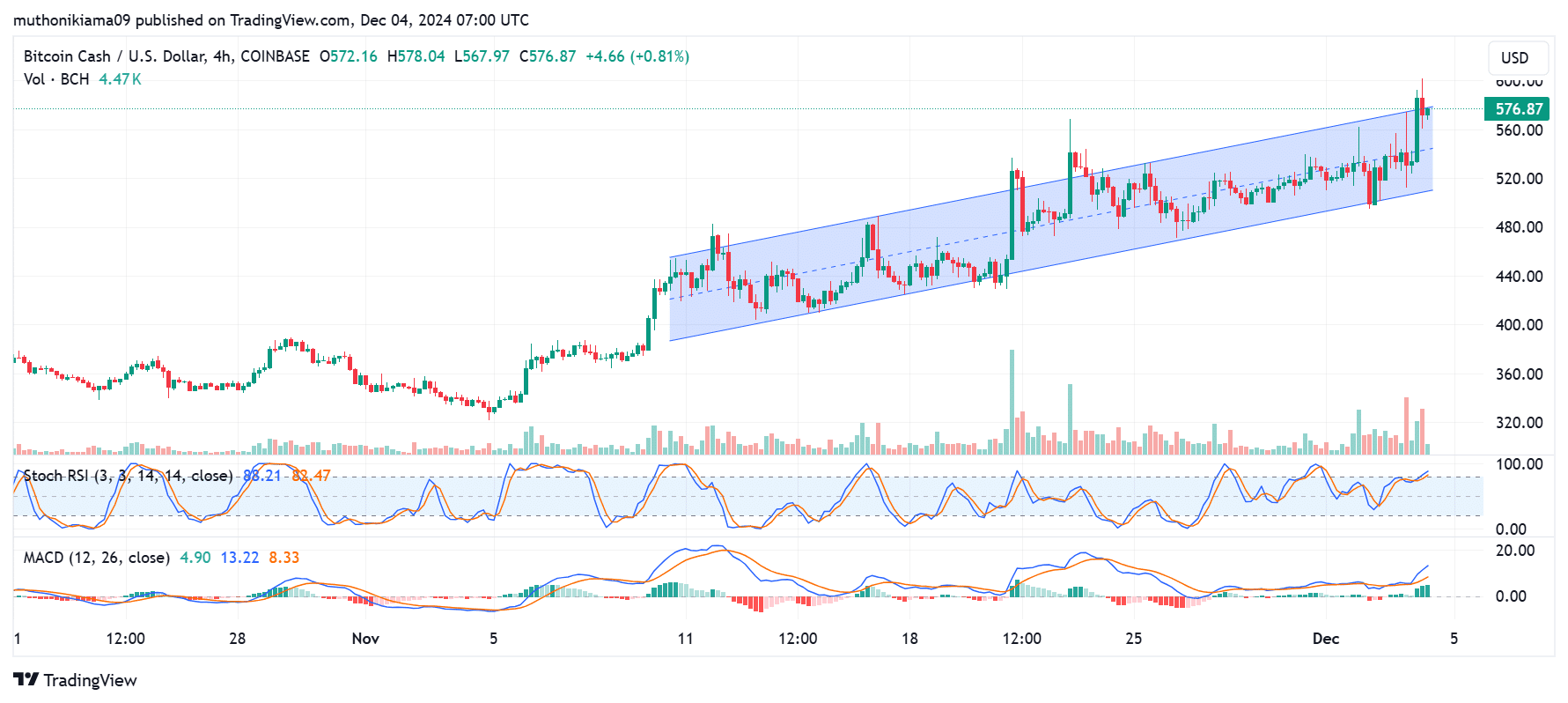

Bitcoin Cash’s rally is gaining momentum as the token moves within an ascending parallel channel, indicating a continuation of the bullish trend.

At press time, BCH is testing resistance at the upper boundary of the channel. However, trading volumes remain low, as shown by the volume histogram bars, raising concerns about a breakout.

The Stochastic Relative Strength Index (RSI) was at 85, indicating that BCH is overbought. Despite this, its continued trend above the signal line shows that the momentum remains bullish.

Historically, an overbought Stoch RSI hasn’t always led to a price correction, suggesting that the rally could continue.

The Moving Average Convergence Divergence (MACD) also reflected bullish momentum after rising and widening the gap with the signal line.

These bullish signs point towards a sustained uptrend for Bitcoin Cash, but for the price to break the boundary of the ascending channel and rally past $600, an increase in buying activity is needed.

Are Bitcoin Cash whales buying into the rally?

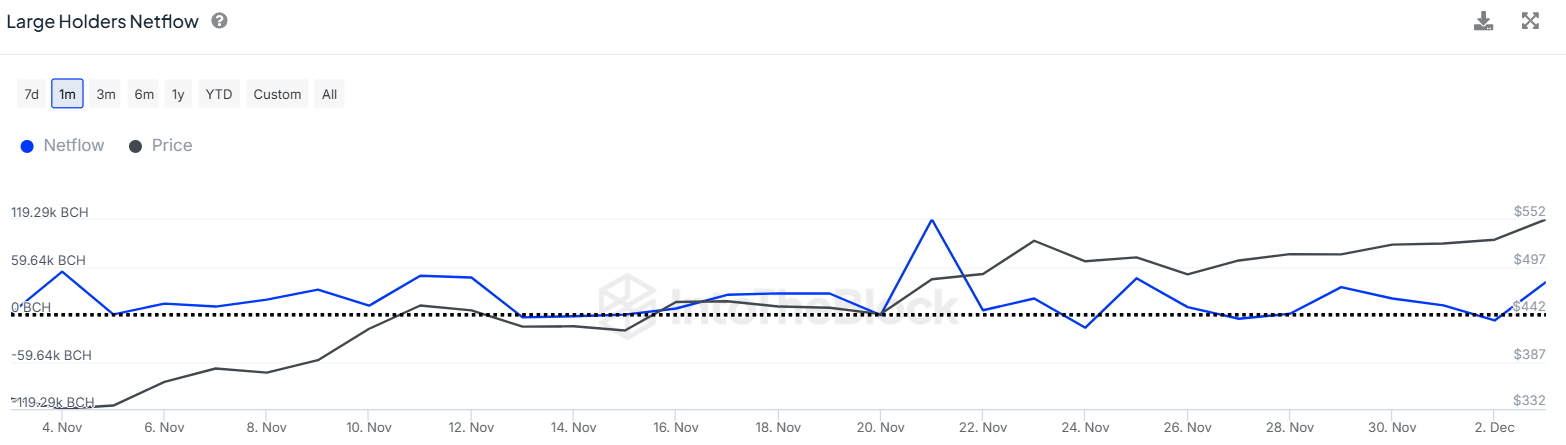

Data from IntoTheBlock shows a spike in BCH’s whale activity after large transactions increased from 506,210 BCH to 1.25M BCH.

These whales, who make up 16.71% of Bitcoin Cash’s supply, are likely buying as depicted in the large holders’ netflow that has flipped positive. This points towards high buying activity from this cohort.

Accumulation by these whale addresses could strengthen Bitcoin Cash’s bullish momentum, and pave the way for further gains.

Increased participation from the derivatives market signals…

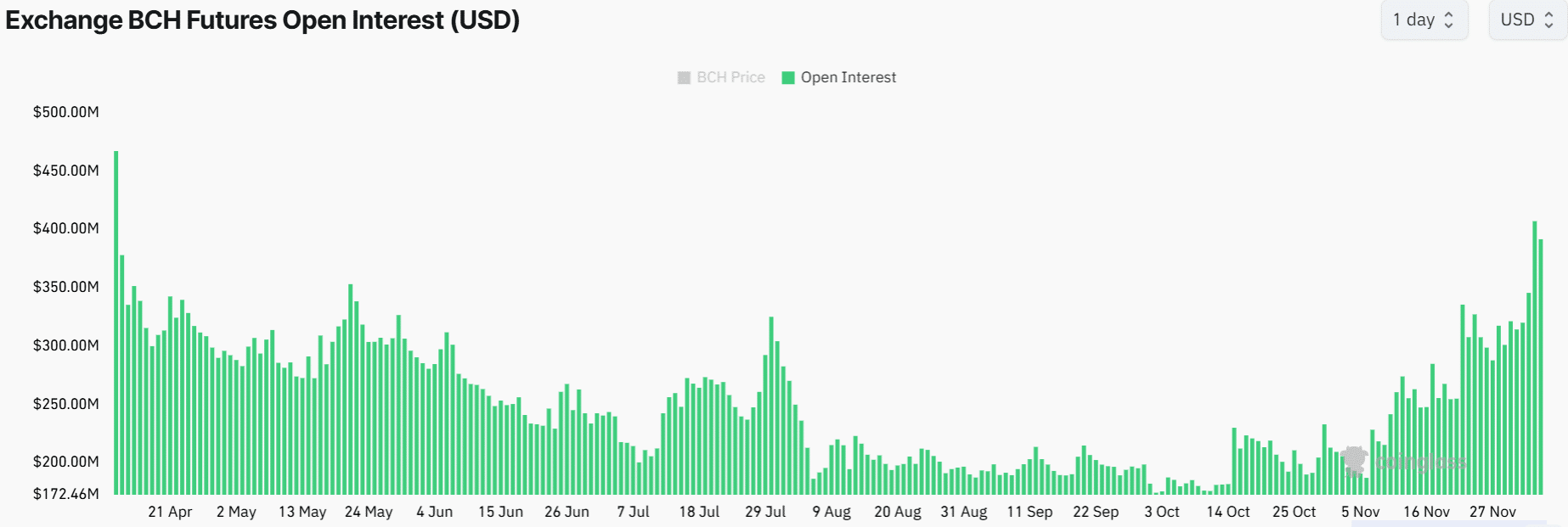

Besides the rising demand from whales, the derivatives market also shows a bullish outlook due to high demand for BCH futures.

On the 4th of December, BCH’s Open Interest surged to $407M, its highest level in more than seven months.

Bitcoin Cash’s Open Interest growth is noteworthy, as it is nearly at the same level as Tron [TRX], which stood at $438M at press time, despite TRX having a market cap three times larger than BCH.

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

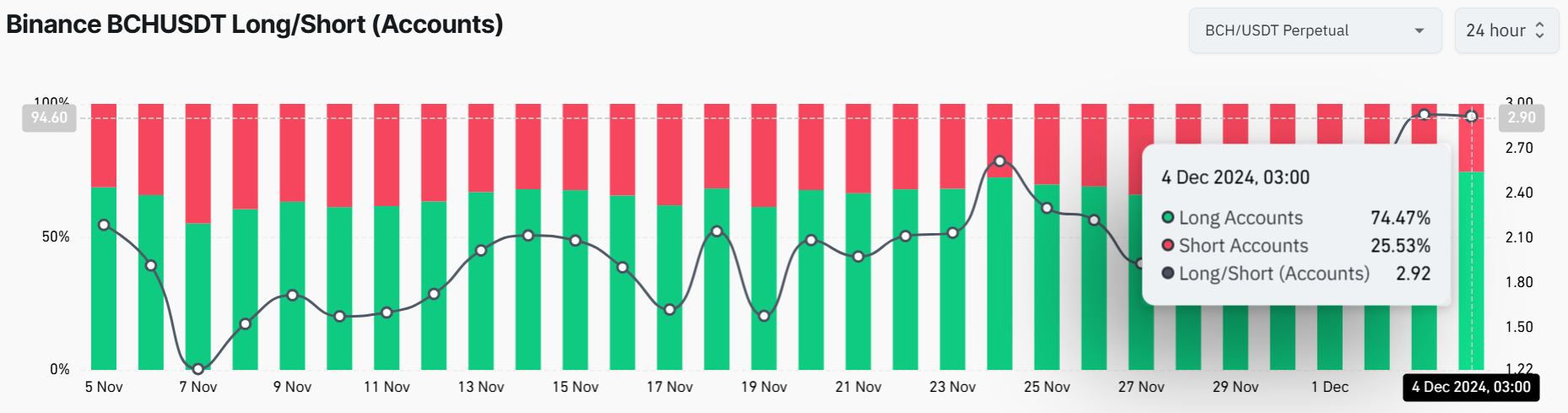

The increased market participation could be beneficial for Bitcoin Cash, as the Long/Short Ratio shows that most traders are opening long positions.

On Binance, 74% of traders with open futures positions on BCH are going long, indicating a bullish bias. Additionally, the Long/Short Ratio for BCH on Binance has reached a monthly high of 2.92.