Mapping Bitcoin’s road to $120K and the odds of hitting that level in Q1

- According to Amberdata, Bitcoin’s journey to $120k could be delayed.

- Slow Fed rate cut expectations and institutional positioning could negatively impact BTC

Options traders have been eyeing a $120k price target for Bitcoin [BTC] by March. However, the latest institutional market positioning and macroeconomic headwinds could delay the projection.

In its weekly update, Crypto Options analytics firm Amberdata cited sticky U.S inflation as a short-term risk for BTC and the overall market. Part of the report read,

“This upcoming week, we’ll get more color on inflation with Tuesday’s PPI and Wednesday’s CPI release. A strong economy and inflation pickup would be the bearish scenario for bonds. This would trickle into stocks and risk-assets as a secondary effect.”

Last week’s market correction and BTC’s retest of the range lows were triggered by growing expectations of fewer Fed rate cuts in 2025. In fact, markets were pricing a nearly 98% chance that the next Fed rate decision on 31 January would remain unchanged.

Coinbase analysts recently shared a similarly cautious outlook, driven by macro factors and supply from long-term holders. They claimed that BTC’s upside could be limited in the short term.

Bitcoin’s $120k target

Most expectations of a likely BTC rally above $100k are pegged to President-elect Donald Trump’s positive policy announcements for the space, including a strategic BTC reserve (SBR).

However, Amberdata cautioned that policy updates have most likely been priced in. Besides, the firm noted that institutional traders have been betting on a potential BTC drop to $55k. This could further slow down the $120k target.

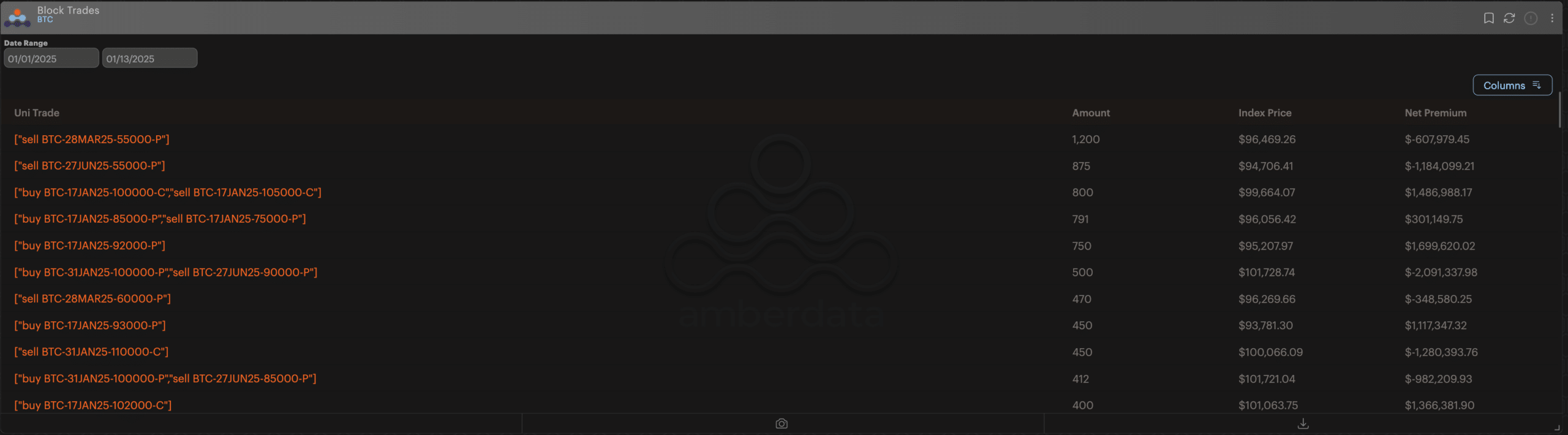

“When looking at top block trades, the institutional traders are also theoretically bullish on Bitcoin prices, but instead of buying calls, they’re selling March $55k Puts and June $55k Puts (shorting volatility rather than buying it).”

Puts options are bearish bets typically associated with large players hedging against downside risk.

Amderdata added that selling puts instead of buying them could reduce implied volatility (future price swings). This alluded to muted price swings (more price stability), which could limit a strong move to $120k.

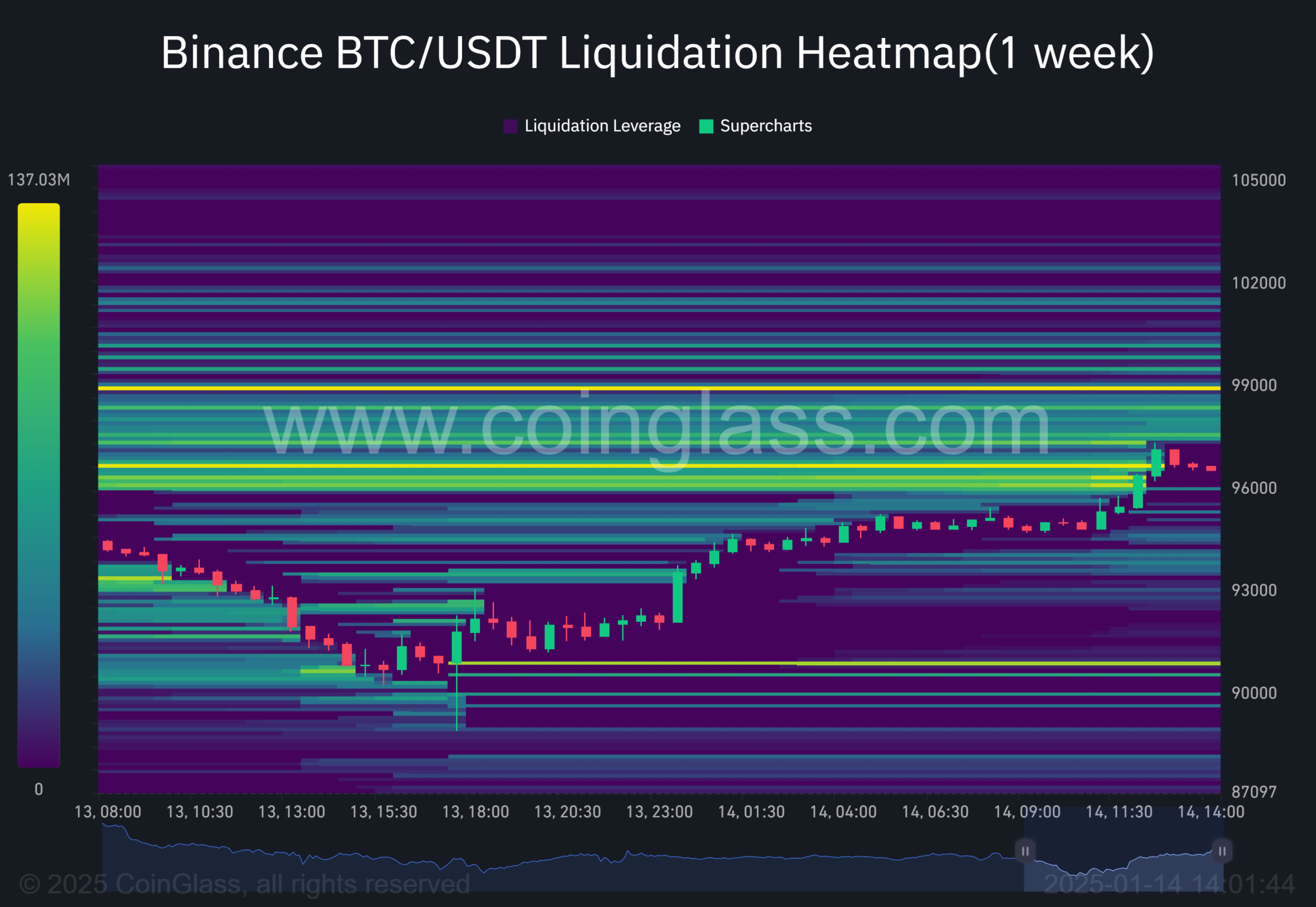

At press time, BTC had soared past $95k, driven by a liquidity sweep at $96k (bright yellow area). Extra pockets of liquidity were located at $99k and $90k, which could further influence price action.