Mapping Dogecoin’s road ahead – Why DOGE bulls target $0.20 next

- 7% of DOGE’s supply was concentrated at $0.20, creating a critical resistance zone.

- Low futures interest suggested spot-driven momentum, not speculative hype.

Dogecoin [DOGE] has shown renewed strength recently, but on-chain and derivative data suggest its next move hinges heavily on the $0.20 price level.

With key metrics offering mixed signals, traders and investors closely watch whether DOGE can convert this level from resistance into a launchpad.

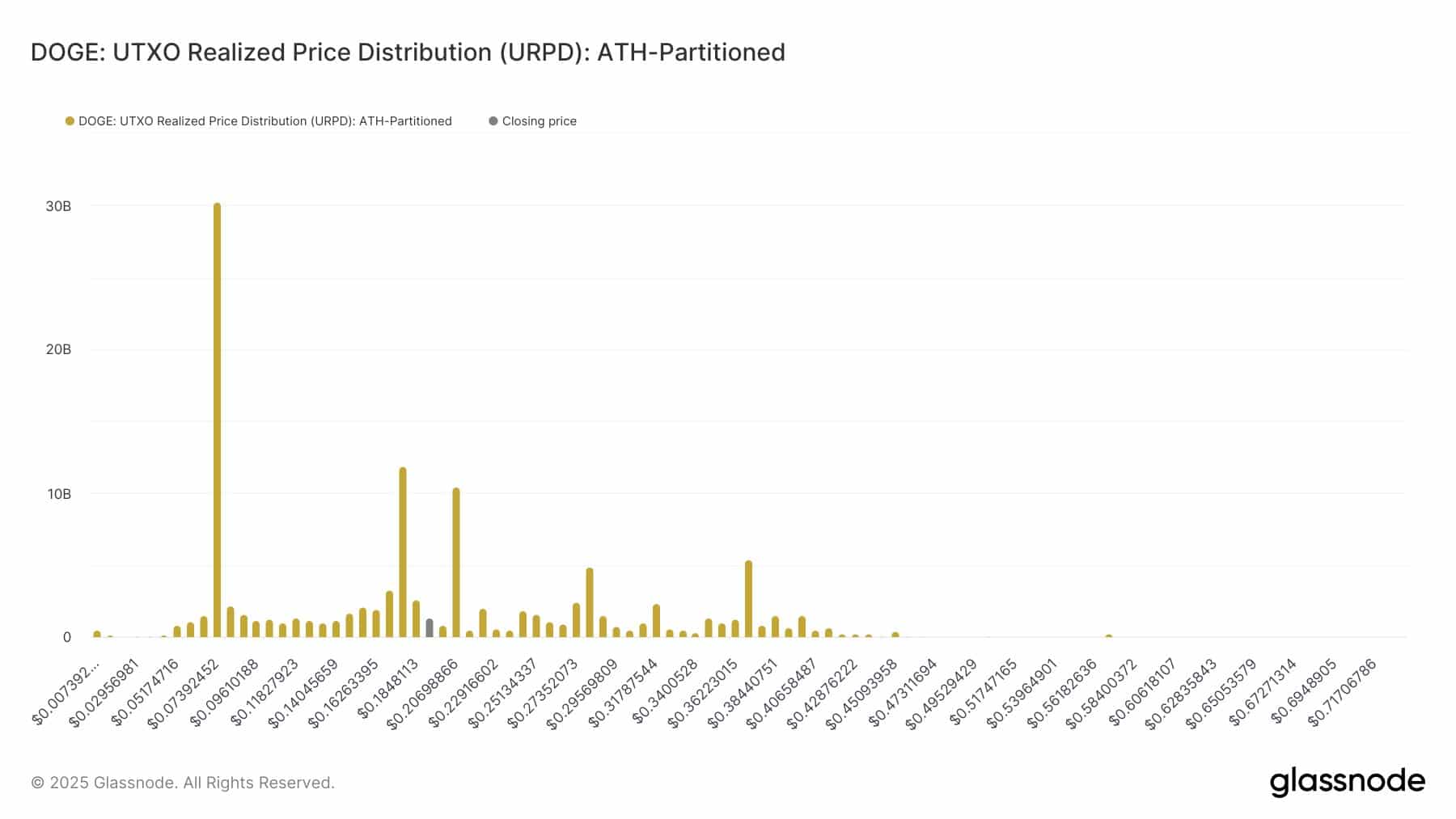

URPD reveals a heavy cluster at $0.20

Glassnode’s UTXO Realized Price Distribution (URPD) shows a significant Dogecoin supply concentration at $0.20, about 7% of the total. This cluster ranks as the third-largest after $0.17 and $0.07.

Notably, inflows at $0.20 started increasing around the 22nd of January, though many wallets likely accumulated earlier and raised their cost basis.

This positioning creates near-term resistance, as many holders may look to exit at break-even.

However, the absence of significant supply between $0.20 and $0.31, the next major cluster, means that a clean break above $0.20 could lead to a sharp rally if volume supports it.

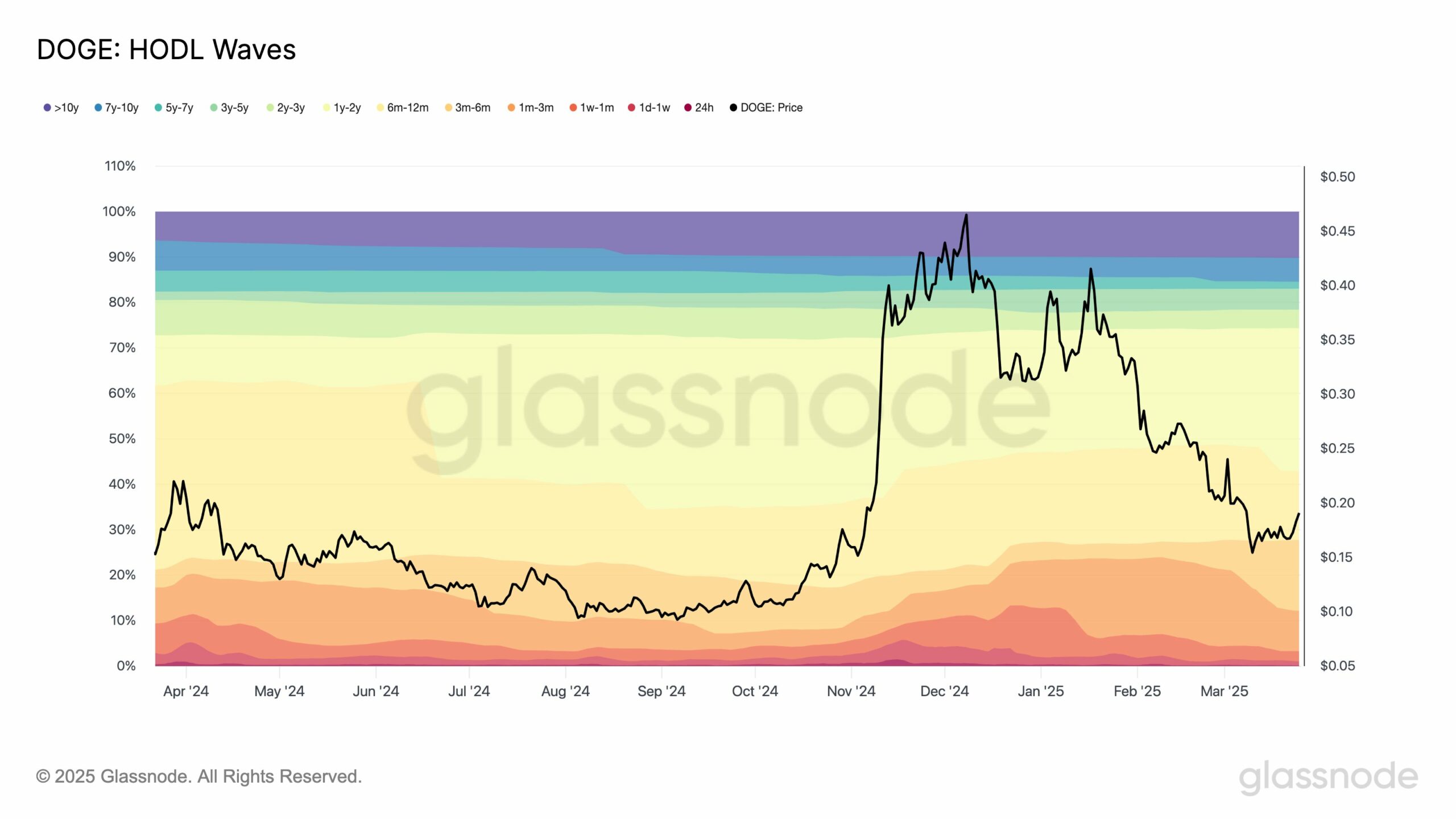

HODL Waves indicate Dogecoin conviction and caution

Glassnode’s HODL Waves chart showed that 15% of the Dogecoin supply was last moved between six and twelve months ago, implying that many holders bought ahead of the Nov/Dec 2024 rally and are still holding, indicating a strong conviction.

More recently, the 3-6 month cohort has grown, suggesting new entrants joined during the January rebound from $0.32 to $0.41.

While this HODLing behavior reflects confidence, it also hints at latent supply. If DOGE revisits those levels, some may sell at break-even, potentially capping upward momentum.

DOGE Futures market: A spot-driven rally

Dogecoin’s Futures volume remains well below previous peaks. At press time, Open Interest (OI) sat around $1 billion, far lower than the $3 billion average seen during the 2024 highs.

The 7-day SMA of Futures volume is gradually rising, but levels are still reminiscent of October 2024. This suggested that leveraged trades are not fueling the ongoing rally.

Also, this is supported by the Futures Funding Rate chart, which shows that rates have fallen to near-neutral levels. The lack of aggressive long positioning means the price uptrend is being driven more by organic spot demand than speculative leverage.

Dogecoin bulls need to conquer $0.20

At the time of writing, DOGE was trading at $0.195, up slightly on the day and still above its 50-day Moving Average of $0.182.

The RSI reading of 63.05 suggested moderate bullish momentum without being overbought. However, the price has paused just shy of the critical $0.20 barrier.

If bulls manage to push past this zone with strong volume, the lack of resistance up to $0.31, as seen in URPD data, could allow for rapid price acceleration. However, failure to break above may lead to consolidation or a minor pullback.

Bottom line

Dogecoin’s breakout attempt depends on surpassing the $0.20 level, which currently acts as a supply ceiling, while there’s a lack of resistance above it. Spot buyers hold control, and long-term holders remain inactive.

DOGE’s short-term direction will rely on volume dynamics and trader confidence. If the $0.20 resistance flips into support, a successful breakout could push DOGE toward $0.31.