Mapping Fantom’s [FTM] short-term target of $1.47 and beyond

![Mapping Fantom's [FTM] short-term target of $1.47 and beyond](https://ambcrypto.com/wp-content/uploads/2025/01/FTM-1200x675.webp)

- Altcoin recently broke out of a descending channel, indicating the start of a potential upswing

- Large-volume traders are yet to enter the market, leaving retail investors to drive the price action

In the last 24 hours, FTM’s price gained by 11.68% on the charts, marking a sharp recovery and positioning the asset to potentially erase its monthly losses of 30.87%.

Further price gains could be fueled by greater interest from institutional “whale” investors and sustained buying momentum from retail traders.

FTM’s build-up to $1.47 in progress

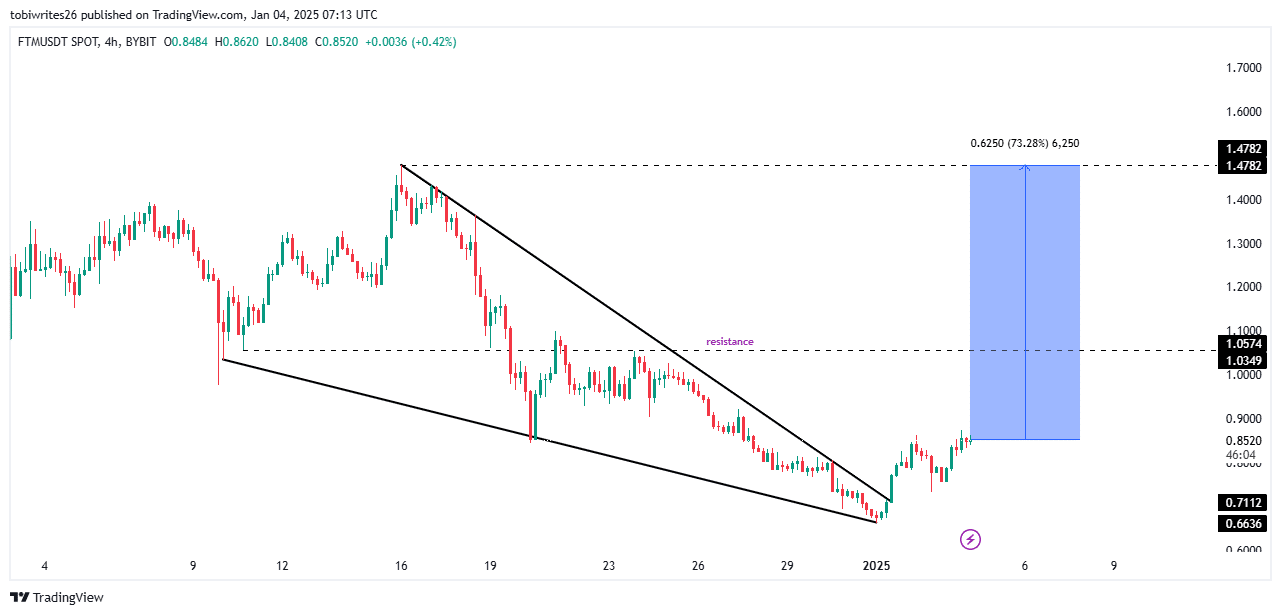

At the time of writing, FTM had broken out of a descending triangle pattern on the 4-hour chart, marked by a shift towards higher prices after an extended period of consolidation within narrow zones.

However, the chart revealed a significant resistance level, one that has previously blocked upward momentum twice – Intensifying the descending triangle’s formation. This resistance could lead to a slight pullback or a delay in further gains, depending on the strength of the ongoing bullish momentum.

If FTM can sustain its upward drive from the press time price of $0.85, the asset could rally to $1.47—A potential 73.28% hike.

To evaluate whether there is sufficient momentum to fuel this rally, AMBCrypto conducted an analysis of key on-chain variables.

Retail investors drive FTM’s rally as whales hold back

FTM’s recent gains in both weekly and daily trading periods appear to be primarily driven by retail investors, who account for a smaller portion of the market.

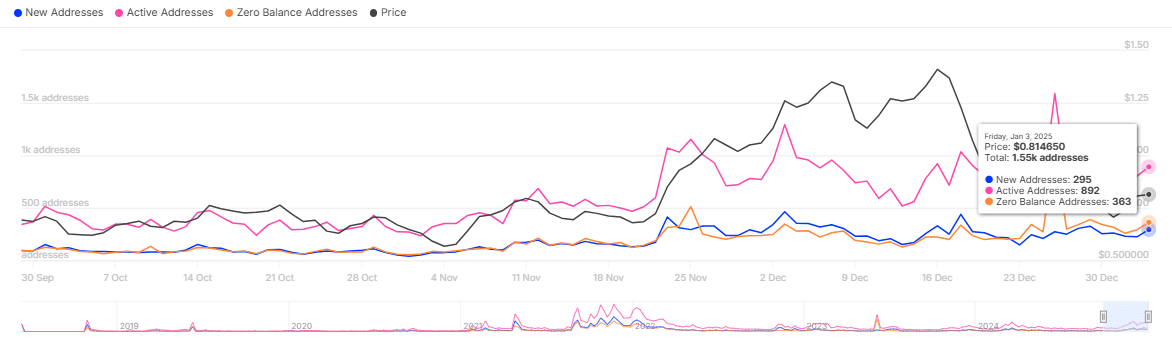

This trend seemed to be supported by a 17.86% spike in the number of Active Addresses, indicating a hike in trader participation. Here, Active Addresses refer to wallet addresses involved in at least one transaction—sending or receiving—within a specific timeframe.

The rise in active addresses, coupled with FTM’s price surge, pointed to growing retail interest in the crypto asset.

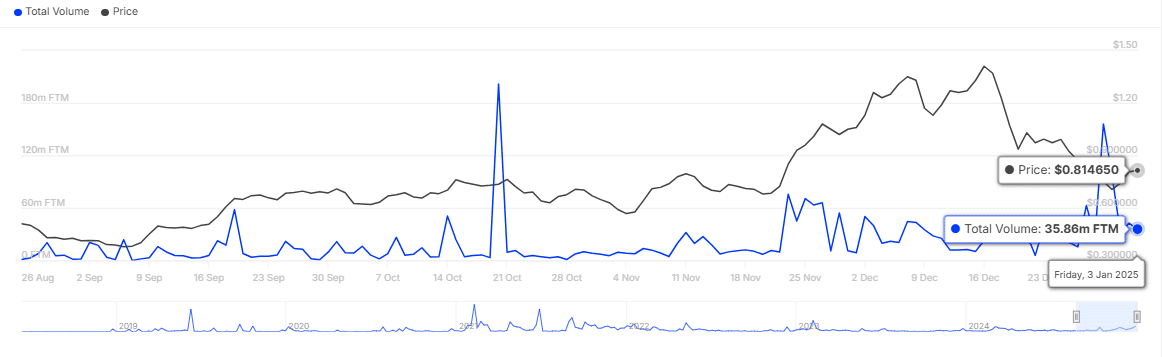

Conversely, whale activity seemed to have slowed down. At the time of writing, large transactions totalled 35.86 million FTM, worth $29.22 million – Marking a significant decline in volume. A drop in transaction volume during a price rally is a sign of limited trading activity by large holders.

Should whale investors re-enter the market and raise their purchases, FTM could see a strong momentum surge. As large-volume transactions begin to rise, the influx of institutional buying pressure could drive the asset higher, reinforcing its upward trajectory.

FTM’s full rally on the horizon

At the time of writing, FTM looked to be on the cusp of a full-fledged rally. Especially as the technical indicators suggested the formation of a Golden Cross pattern—A signal that a rally could be imminent.

A Golden Cross occurs on the Moving Average Convergence Divergence (MACD) indicator when the blue MACD line crosses above the orange Signal line. This crossover typically means a hike in buying momentum and a subsequent price surge.

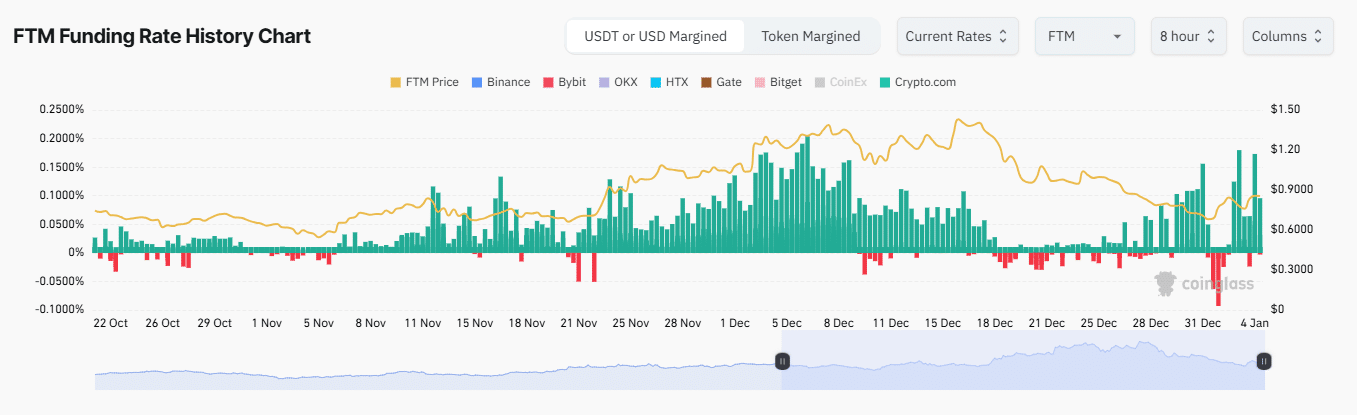

Supporting this potential rally are additional metrics such as the funding rate and the long-to-short ratio, both of which pointed to bullish market sentiment.

Finally, the funding rate reflects whether bulls or bears dominate the market over a specific period by identifying which side pays the premium to maintain price equilibrium between Spot and Futures markets. Currently, bulls are in control, with the funding rate surging to 0.0330%.

Similarly, the long-to-short ratio climbed above 1, sitting at 1.0317 for FTM. This indicated that there are more long contracts (buy positions) than short contracts, further confirming bullish momentum in the market.