Mapping Litecoin’s next move this bull cycle as BTC hits $71k

- Even as LTC makes no appearance in a lot of portfolios, data shows that it is more stable than BTC and ETH.

- Both the RSI and MACD are showing clear bull signals.

Litecoin [LTC] is one of the oldest cryptocurrencies in the world and yet, one of the most undervalued. Historically, LTC has never been an investor favorite even as it proves to be relatively more stable than Ethereum [ETH] or even Bitcoin [BTC] in recent years.

It rarely comes up in expert suggestions or analyses, and sometimes even gets mocked. But data shows that Litecoin has some strong potentials in this bull cycle. Let’s break them down.

Examining LTC’s True Potential

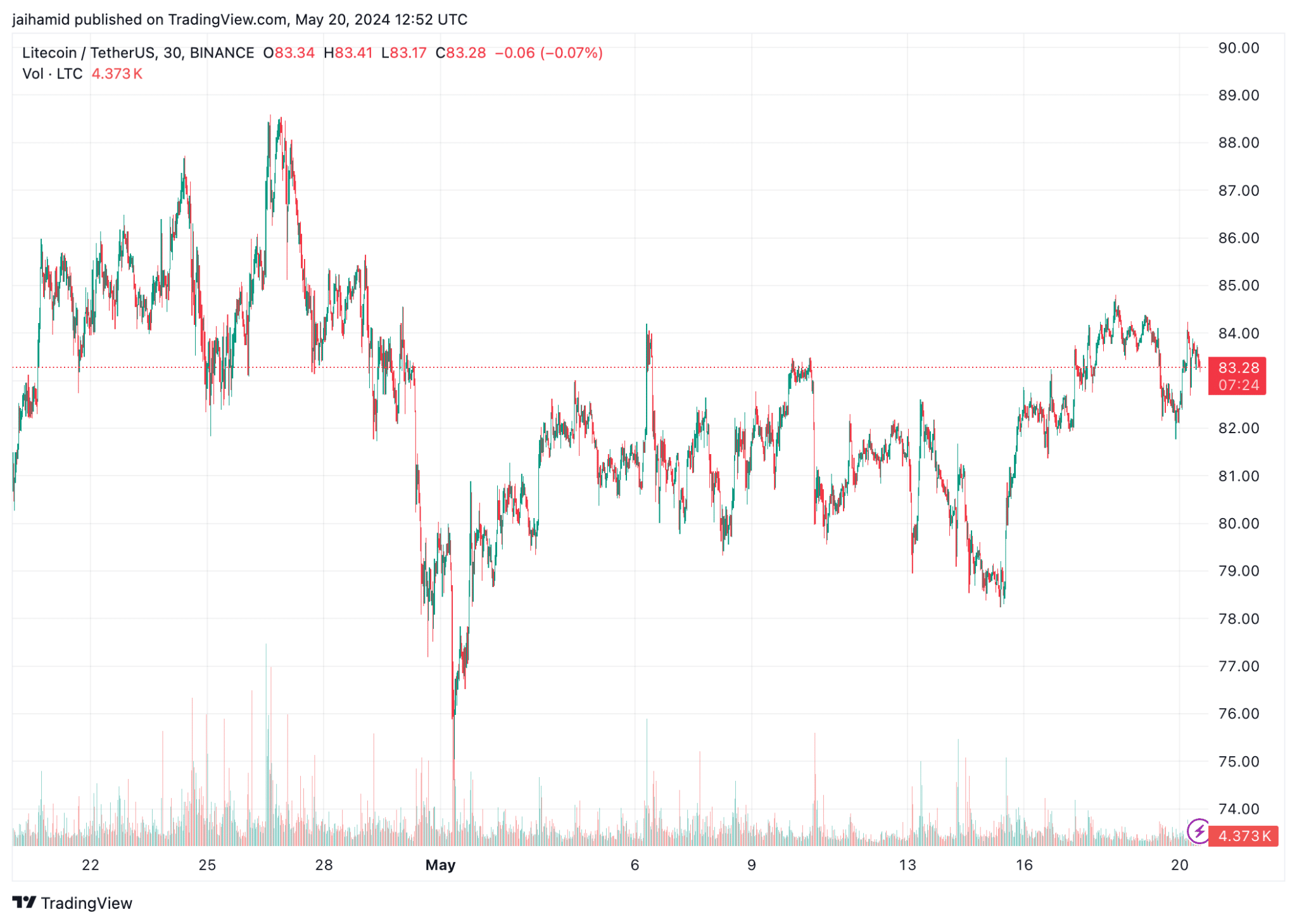

Taking a look at LTC’s trading chart, we see that the RSI is near the lower end, indicating that Litecoin is undervalued. It is the perfect opportunity for investors or traders who believe in its fundamentals and long-term prospects.

Moreover, the MACD shows convergence (shorter-term moving average crosses above the longer-term average), increasing bullish momentum, supporting the case for a potential upswing for the underestimated altcoin.

At press time, LTC was worth $87. We see that over the past month, $77 has acted as a major support level, where price rebounds have occurred multiple times throughout the month.

It is both a strong psychological and a technical support zone. But Litecoin did not fall below the support since February, showcasing its resilience even as Bitcoin and Ether were plunging.

$81.00 to $85.00 seems to be where Litecoin has spent a considerable amount of time oscillating within the month. The breakout to $87 will see LTC aiming for $90 in the short-term.

Are investors waking up?

Interestingly, the whales seem to finally be waking up. Recent data from IntoTheBlock reveals that on 10th May, whales accumulated nearly three million LTC coins, worth over $900k at press time.

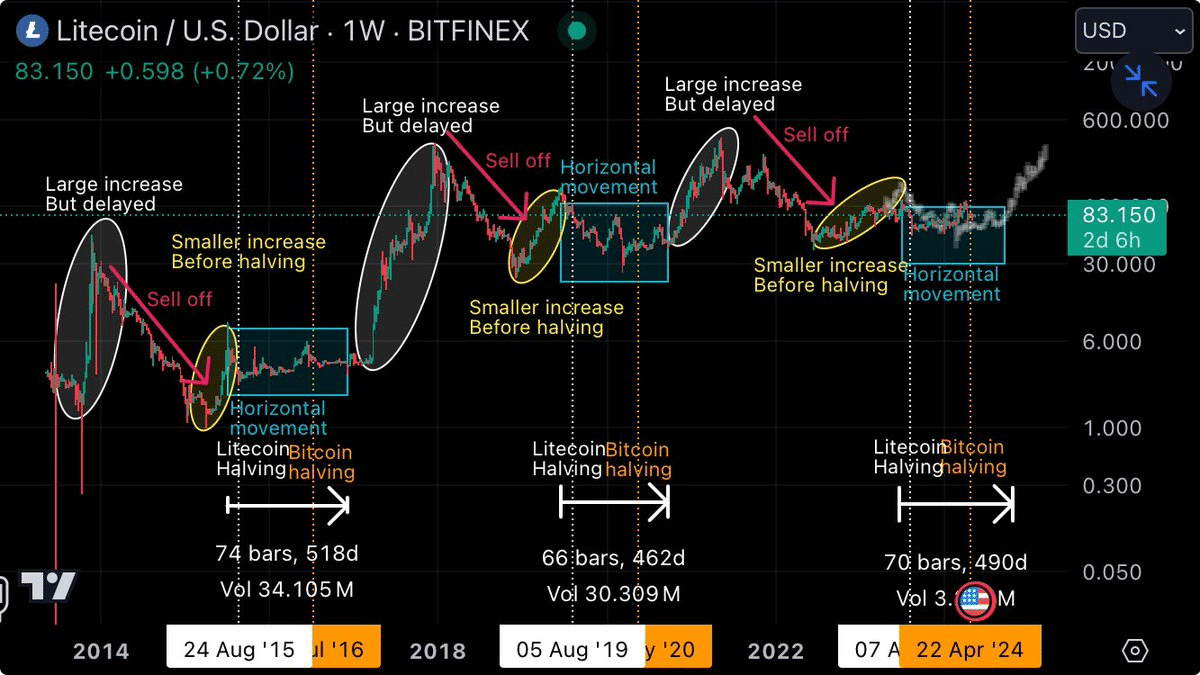

Historically, LTC follows a clear pattern in each cycle. Prices stay stable during the halvings until about 4-5 months after the Bitcoin halving. After that, the price usually shoots up. If this pattern holds, we can expect the price to rise towards the end of Q3 this year.

Is your portfolio green? Check out the LTC Profit Calculator

The whale purchases have reignited talks of LTC on crypto Twitter, albeit only slightly.

But data says more than social sentiment, and the verdict from examining historical patterns is that LTC could skyrocket starting around August or September.