Mapping MATIC’s path to $1.20 and how you can take advantage of it

- On-chain analysis spotted a buy signal that participants might find useful

- MATIC’s price might hike towards $1.20 in the short term

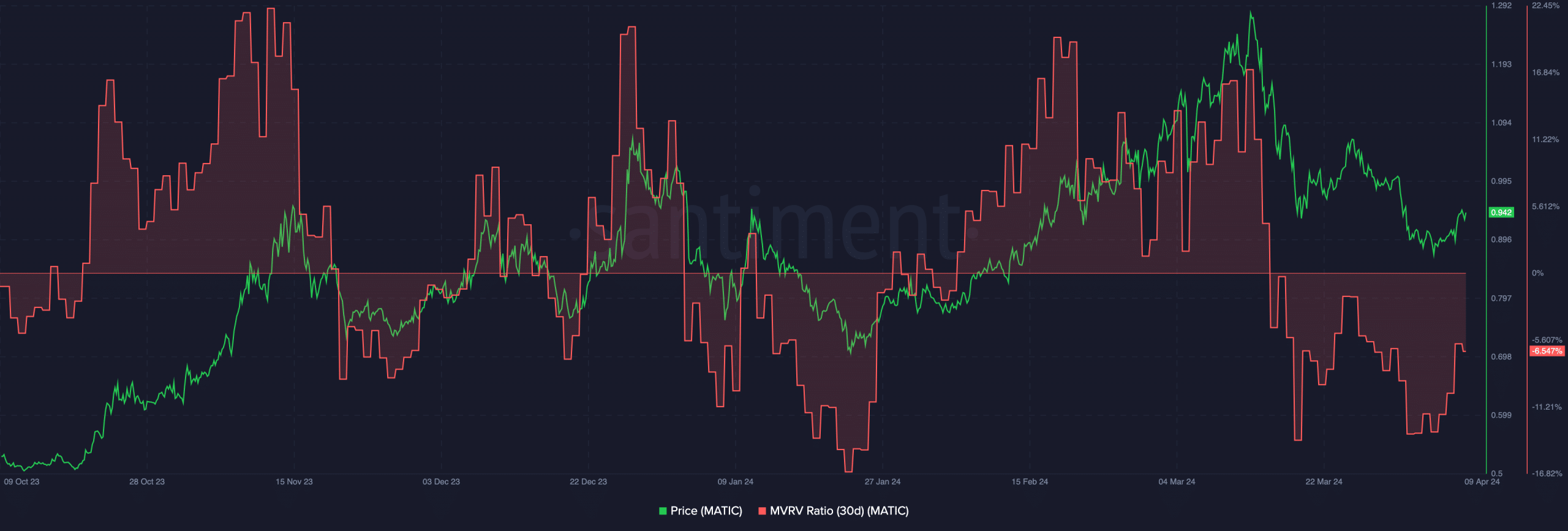

MATIC’s 23.64% decline over the last 30 days might be a golden opportunity, according to AMBCrypto’s analysis. The Market Value to Realized Value (MVRV) ratio is a major reason for this conclusion. At press time, the altcoin’s 30-day MVRV ratio had a reading of -6.54%.

This ratio shows the level of holders’ profitability or loss. Simply put, the press time reading seemed to suggest that if all MATIC holders sell their tokens, they’d make an average loss of 6.54%. However, this figure also pointed to an accumulation chance before the price potentially rallies. While this could be just hearsay, it can be traced back to MATIC’s historical performance.

MATIC looks set for the good old days

For example, on 30 November 2023, the MVRV ratio was -5.06%. MATIC’s price at that time was $0.75. Days later, the value of the token jumped to $0.92. A similar occurrence happened in January when the price was $0.70. Within a few weeks, the token climbed past $1. Therefore, it is possible that the value could climb like it did in the past.

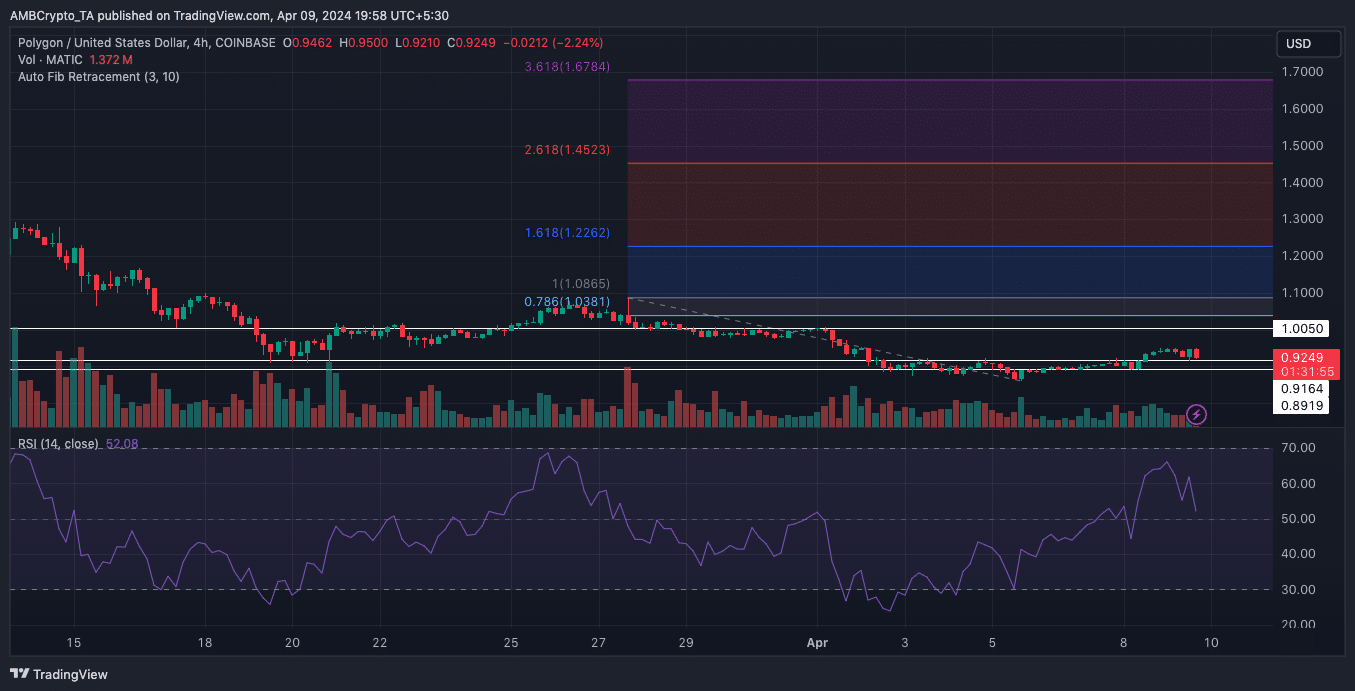

However, it is also necessary to check the prospect from a technical perspective which AMBCrypto did. On the 4-hour charts, the bulls were camped around the $0.89-support on 8 April.

Thereafter, the token was able to clear the $0.91-resistance level. At press time, MATIC was valued at $0.93, with market bulls eyeing a move to $1.

Furthermore, the Relative Strength Index (RSI) turned south, indicating that bullish momentum was waning. In light of the recent trend, MATIC might find it challenging to appreciate on the charts over the next few days.

On the contrary, if buying pressure rises, the cryptocurrency might break through the resistance level. If this is the case, the Fibonacci indicator predicted that MATIC could rise to $1.67.

Will the revival be easy?

However, this prediction depends on the bulls’ intensity. Also, further bearish dominance might invalidate the upwardly mobile forecast.

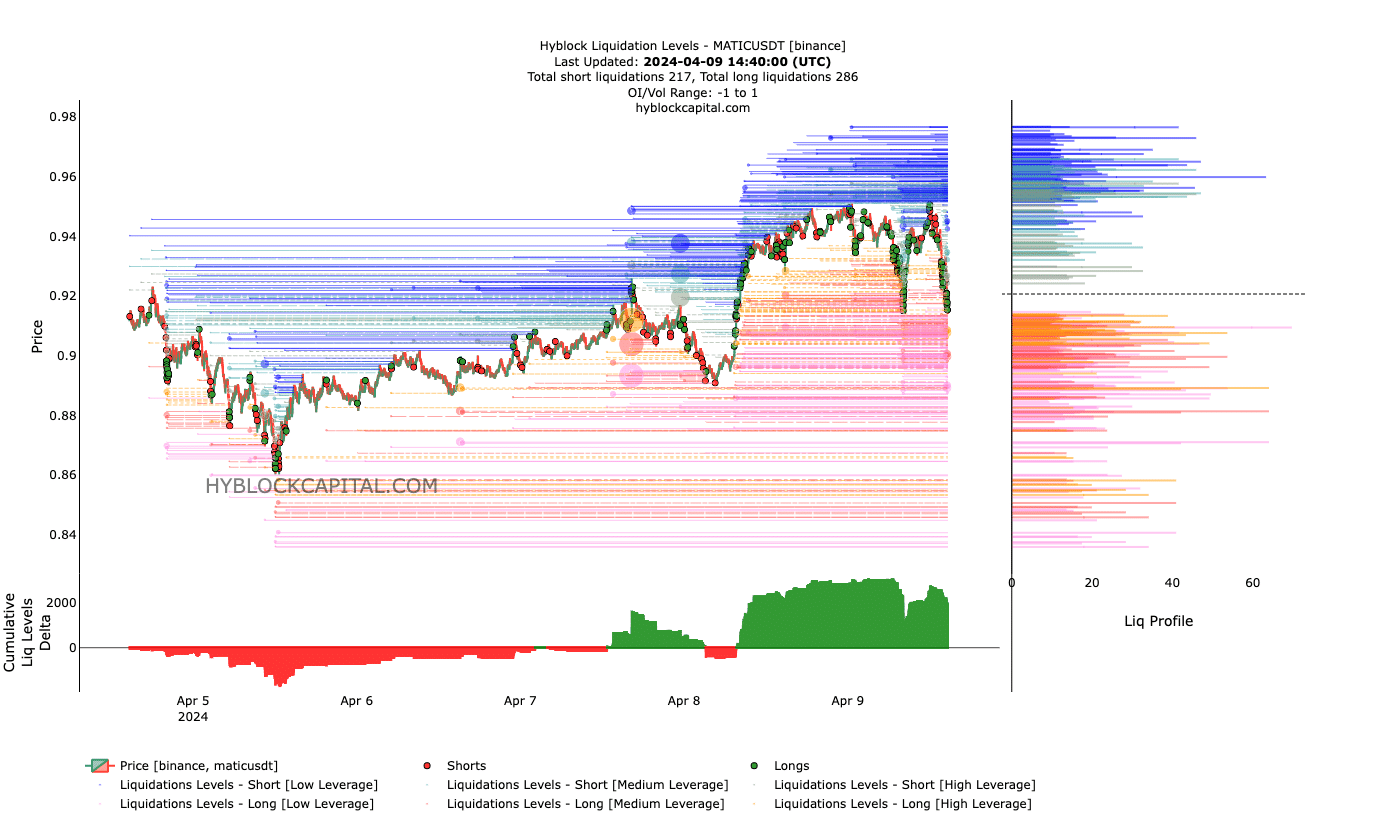

Another indicator we looked at was the Cumulative Liquidation Levels Delta (CLLD). From AMBCrypto’s assessment, the high liquidity between $0.95 and $0.98 meant that MATIC might rise in that direction.

Should that be the case, shorts with high-leveraged positions could be wiped out. At the same time, those with medium leverages might also be affected by the plunge.

Meanwhile, the CLLD was positive, indicating a high risk-to-reward circumstance. With this reading of the CLLD, a bearish bias might transpire in the short term – Spurring a MATIC retracement.

Read Polygon’s [MATIC] Price Prediction 2024-2025

However, when this decline ends, a significant recovery might be on the cards. In a situation like this, the price of the cryptocurrency might attempt to hit $1.20.