Mapping out a recovery route for Bitcoin after Black Friday stint

26 November proved to be the worst day of the month for the crypto market with even Bitcoin charting an acute drop. However, this Black Friday is probably not going to have any long-term implications. That is of course, provided the king coin can maintain its position above certain levels. These indicators will also act as the first sign of a bearish turn.

Bitcoin on Black Friday

Even though the king coin turned red yesterday after an entire week of consolidation, there are chances that Bitcoin could soon recover from its 8.1% drop. However, looking at the short-term bullish case, it is imperative for Bitcoin to make sure that it doesn’t breach certain thresholds.

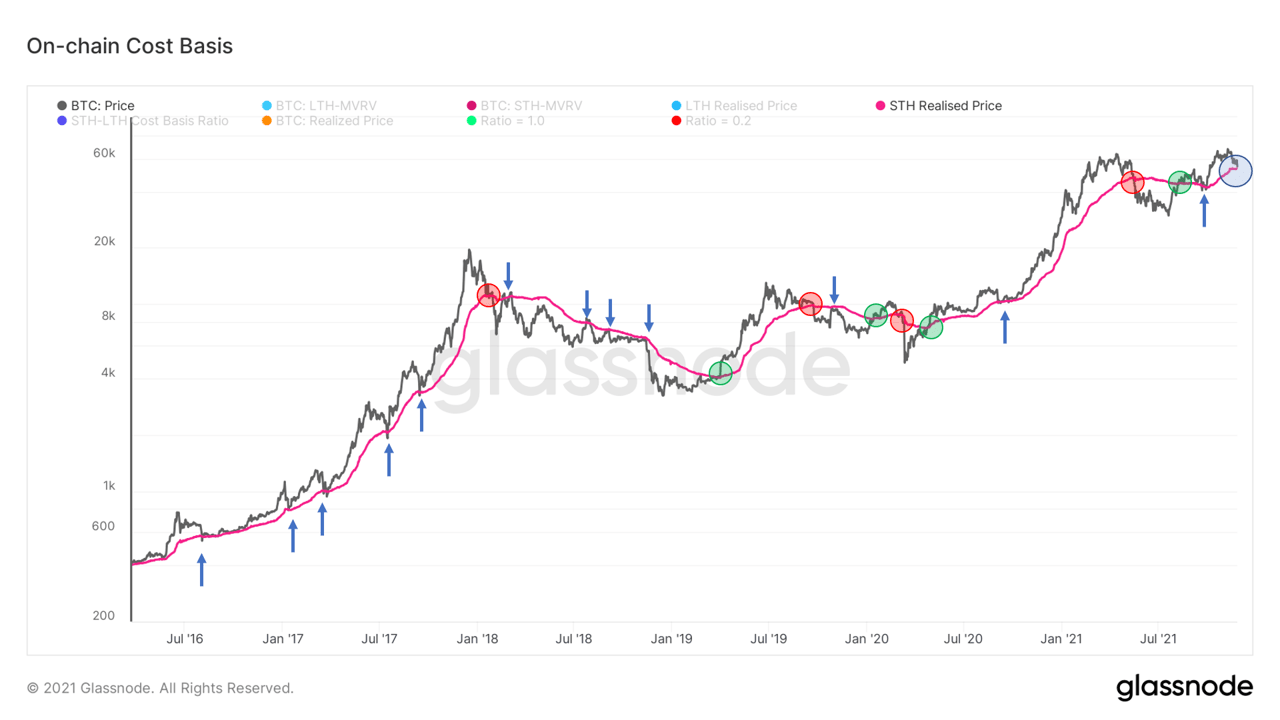

Firstly BTC needs to retest the bull market support band. The short-term holder cost basis chart makes it apparent that with BTC trading at $54k, any retest from the band will only result in pushing BTC back up.

Bitcoin STH cost basis | Source: Glassnode

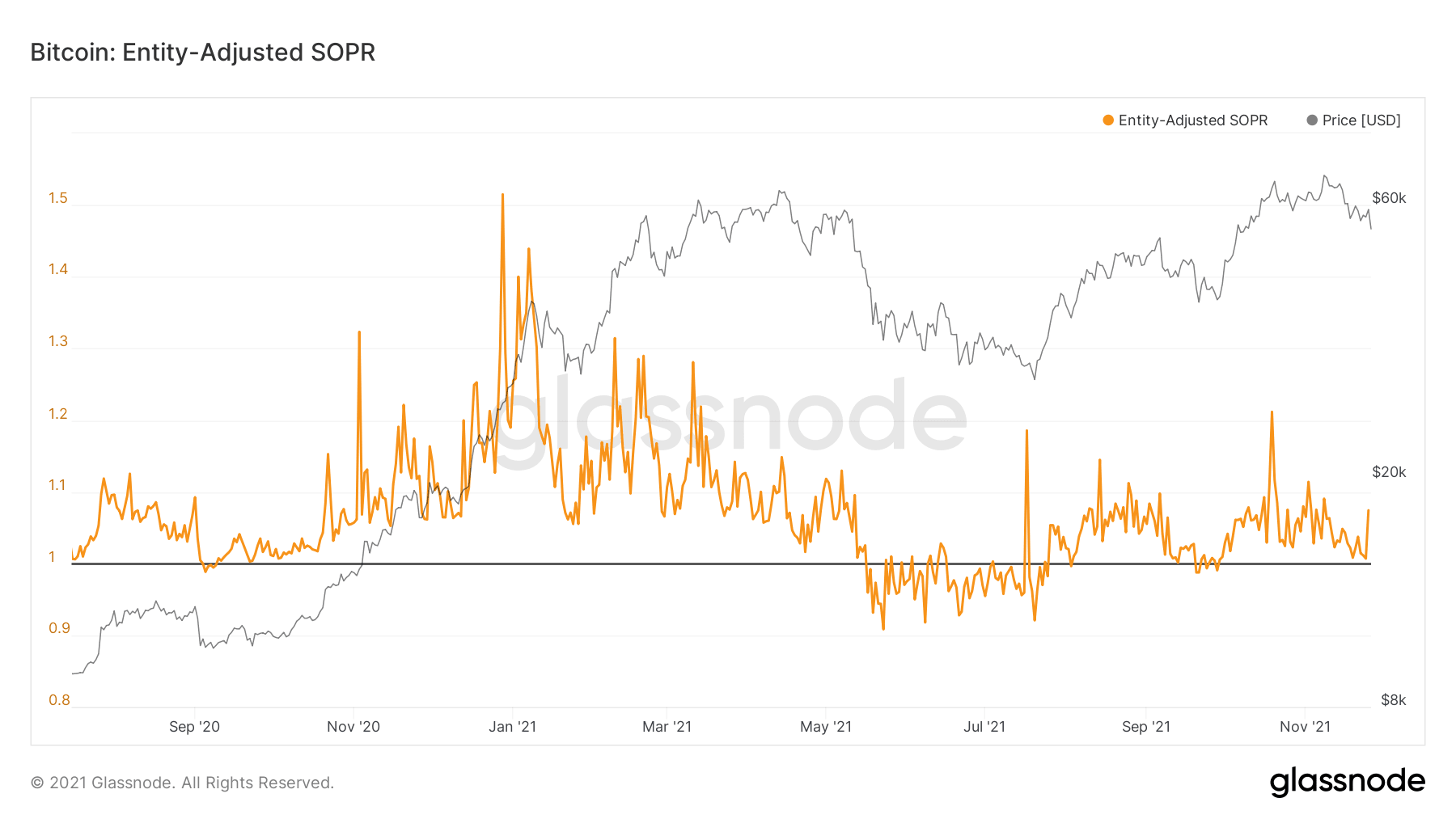

Secondly, the Spent Output Profit Ratio line just bounced off the 1.0 neutral line and this shows that investors are refraining from selling into losses. This retest was much awaited since in a bull market, SOPR’s retest of the neutral line is an indication of relatively secure performance.

Similarly, if 1.0 is tested as resistance during a bear market, it means that the market is not at a loss anymore. Thus in this case keeping above 1.0 is necessary for now.

Bitcoin SOPR | Source: Glassnode

And third, the supply shock ratio is currently displaying a bullish divergence which was also observed, back in August and September. The reason behind this is that illiquid entities with little to no history of selling are taking over the supply from liquid and highly liquid entities.

Bitcoin this time has survived despite falling and almost creating a bearish divergence. However, if the price movement moves under the illiquid supply shock ratio indicator, then will we see a bearish divergence, which shouldn’t happen if the incline remains steady.

Bitcoin supply shock ratio | Source: Glassnode

So if you are looking for a short-term bull market, then keeping an eye on the aforementioned signals are necessary. As long as the Bitcoin market is safe from a bearish divergence and/or SOPR falling under 1, investors can hope for a quick recovery.