Mapping XLM crypto’s road to $0.50 after 34% weekly surge

- XLM crypto’s golden cross sparked a 34% weekly surge, outperforming major altcoins like SHIB.

- Indicators like CMF and DMI revealed weakening momentum, signaling possible price consolidation ahead.

Stellar [XLM] has been on an impressive rally, with its price surging 34% over the past week. The catalyst for this surge seems to be the formation of a golden cross, a technical pattern that signals the potential for sustained upward movement.

However, while the price action appears bullish on the surface, several key indicators point to a potential loss of momentum.

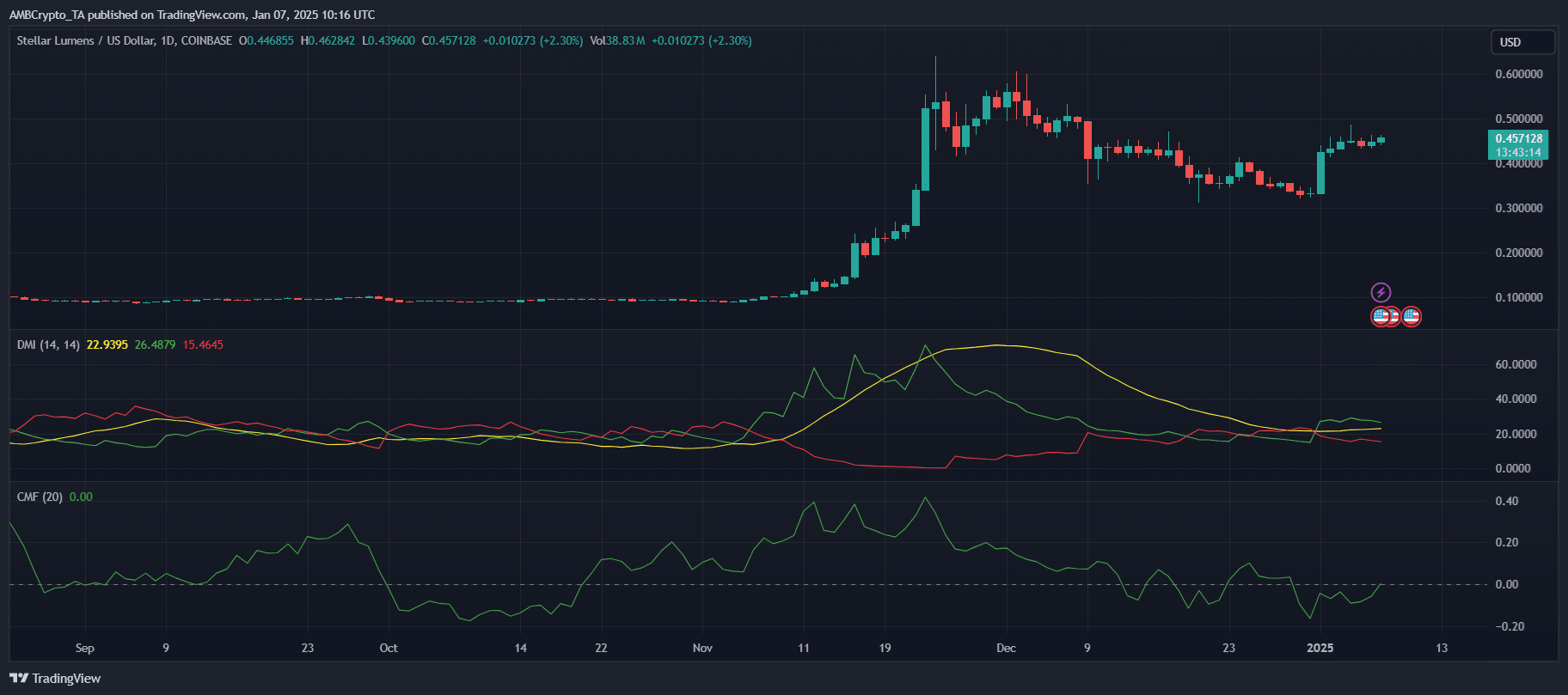

XLM Crypto: DMI reveals waning buyer strength

The DMI for Stellar shows early signs of shifting momentum. The +DI has declined to 25 from a previous high of 40.3, indicating that bullish dominance is weakening.

Meanwhile, the -DI has risen from 7.9 to 14.6, suggesting that sellers are gradually gaining ground. Despite this, the ADX still sits above 25, confirming that XLM remains in an uptrend.

However, the drop in the ADX from 52.6 to 40.1 over the past two days signals diminishing trend strength. If selling pressure continues to rise while buyers retreat, the current bullish trajectory may falter, leading to potential price consolidation or reversal.

CMF signals increasing outflows

The CMF for Stellar shows a concerning shift in market sentiment. At press time, CMF has declined sharply from its yearly high of 0.41 recorded on the 1st of January.

This plunge into negative territory highlights a transition from strong inflows to net outflows, pointing to heightened selling pressure.

Just two days ago, the CMF stood at 0.17, reflecting a rapid loss of investor confidence. A sustained negative CMF could exacerbate downward pressure on XLM’s price, challenging its recent bullish momentum.

Conversely, a recovery into positive territory might indicate renewed interest and provide the support needed for the price to stabilize or rally once more.

Stellar’s rise: Can XLM flip Shiba Inu in market cap?

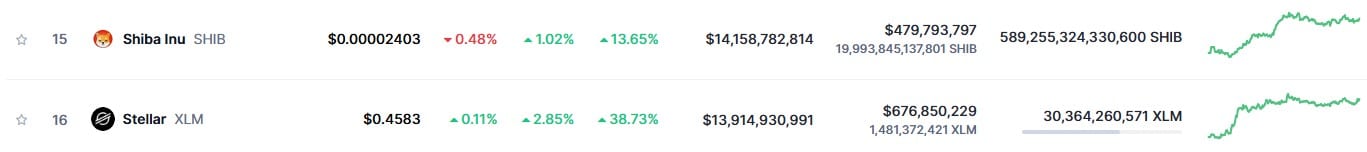

Stellar (XLM) is closing in on Shiba Inu (SHIB), with only about a $243 million gap in market capitalization left to catch up.

While SHIB maintains a larger circulating supply and a strong community-driven narrative, its market momentum has slowed, showing a modest 13.65% monthly gain compared to XLM’s 38.73% surge.

The memecoin’s utility limitations might also hinder sustained growth, giving XLM an edge with its practical use cases in cross-border payments and blockchain innovation.

Read Stellar’s [XLM] Price Prediction 2025–2026

Price charts show XLM consolidating above $0.45 after a significant rally, with support at $0.44 and resistance near $0.47. If bullish sentiment continues, XLM could target $0.50 and beyond, potentially overtaking SHIB.

However, a bearish correction may test support near $0.42.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)