Bitcoin

Marathon Digital buys Bitcoin worth $249 mln: What’s next?

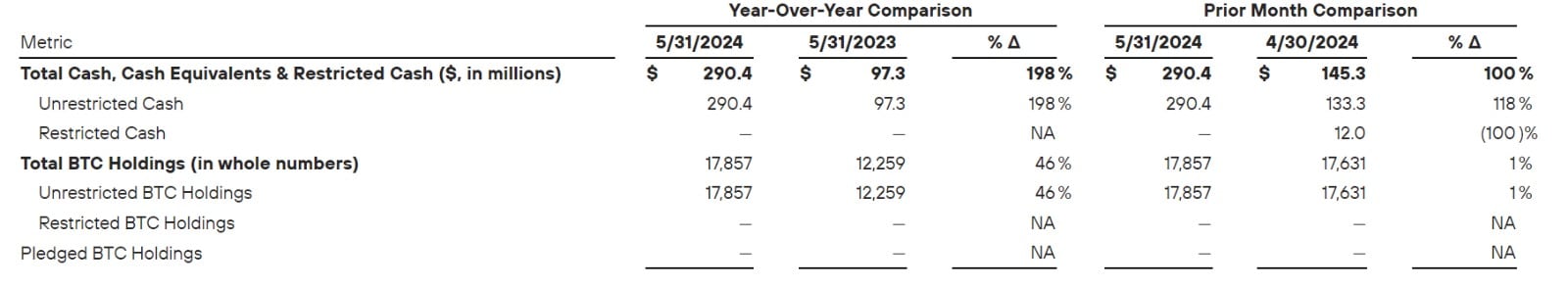

Marathon digital purchases $249 million worth of BTC after earning $300 million from senior note offering.

- Mara purchased BTC worth $249 million.

- Recent purchases of 4144 BTC brought Marathon’s total holding to 25000 BTC.

The crypto market is continually evolving amidst increased acceptability and institutional interest. With increased attention towards crypto by the government, and politicians, crypto miners are re-energized.

Throughout the year, major companies dealing with crypto and Bitcoin [BTC] have been on a buying spree, betting on BTC’s future value.

Notably, the largest BTC miner Marathon is turning to its strategic open market purchase to bolster its bitcoin reserves.

Mara buys $249m worth of BTC

The mining form

announced the purchase through its official page, reporting that,“MARA secures $300M through an oversubscribed offering of convertible senior notes. With proceeds, we purchased 4,144 BTC (valued at approx. $249M), boosting our strategic Bitcoin reserve to over 25,000 BTC. “

The move is significant as the firm attempts to secure its position as a powerful leader in Bitcoin mining.

In the purchase, the company purchased 4,144 BTC at a $59,000 average price, increasing its total holding to 25,000 BTC.

The senior note offering note for the purchase gained investors interest, earning $292.5 million in net income. The note offering is issued with a 2.125% annual interest rate and is due in September 2031.

These sales are essential as it affords the company financial flexibility in operations.

Mara’s HODL strategy

Undoubtedly, the purchase certifies Mara’s strategy for BTC accumulation.

As reported earlier by AMBCrypto, Mara is committed to HODL strategies where it will mine and combine with open market purchases to increase its reserve.

In line with the strategy, MARA purchased $100 million worth of BTC last month. Therefore, the miner bet on BTC’s future value through accumulation without selling.

According to the company, HODL’s strategy reflects its confidence in the long-term value of BTC. Thus, BTC is the best treasury reserve asset which will continually gain value, thus in turn profiting Marathon and investors.

What it means for Marathon Digital and BTC

Before returning to the HODL strategy, MARA has sold a significant amount of BTC since October 2023. Between June and July, the miners sold 1400 BTC has other miners increased sales.

Equally, in May, the company sold 390 BTC.

Despite the sales, the company reduced its outflows to 31% in 2024 compared to 56% in 2023. However, these sales have harmed Marathon Digital.

According to Google Finance, the company stock has declined by 33.97 Year-to-date (YTD). The decline arises from increased BTC volatility while its reserve declines.

Therefore, the continued BTC accumulation after the recent purchase aims to boost the company’s value.

Since BTC is anticipated to increase in value over time, continued accumulation will boost Mara’s stock, revenue, and profitability.

Is your portfolio green? Check out the BTC Profit Calculator

Equally, increased institutional adoption is a win for the King coin as it’s positioned to increase demand, thus driving buying pressure.

Generally, higher demand means higher prices, thus with institutional investment, the demand will skyrocket further driving its value higher.