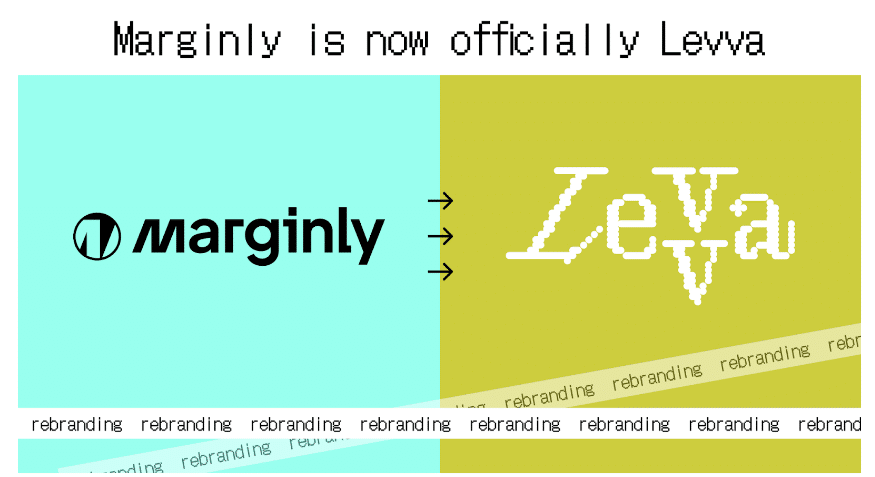

Marginly Evolves: Meet Levva, the Future of Effortless DeFi Capital Management

Today marks the evolution of Marginly into the Levva protocol, built on Marginly’s powerful foundation to make capital management effortless. Levva introduces automated smart vaults that simplify yield generation and solve the challenges of fragmented liquidity, bringing accessible, efficient, and rewarding DeFi opportunities to all.

Smart Vaults: Set It and Forget It

Levva’s smart vaults automate yield generation across DeFi protocols. Users simply deposit assets, and the vaults take care of the rest – from rebalancing to yield optimization. This automation removes the need for constant monitoring and adjusting positions across various platforms.

“We built Levva to make DeFi work for everyone,” said Marcel Thiess, General Manager at Levva. “The smart vaults handle the complex work of managing capital, so users can focus on what matters – earning optimal yields.”

How Levva Works?

Levva is a permissionless DeFi protocol that simplifies capital management through automated smart vaults. The protocol’s core functionality centers on two user groups: liquidity providers who earn passive income through automated capital allocation, and users seeking optimized yield farming opportunities. Smart vaults serve as the foundation of the platform, automatically managing risk and distributing liquidity across major protocols including Uniswap, Curve, and Pendle.

The protocol stands out through its key features:

- Supercharged Farming For Farmers: Boost your farming with Levva. Borrow assets to boost your farming of yield and points. Levva’s automated strategies help you earn up to 20x higher rewards from your favorite DeFi platforms

- Automated Smart Vaults: Intelligent systems handle yield optimization and risk management without requiring user intervention

- Simplified User Experience: A single interface provides access to multiple DeFi opportunities, eliminating the complexity of managing separate positions

- Seamless Integration: Direct connections to leading DeFi protocols maximize earning potential while maintaining security

- Cross-Chain Compatibility: Users can access opportunities across multiple blockchains without managing separate wallets or bridges

Through automation and intelligent design, Levva transforms complex DeFi operations into a streamlined experience, making sophisticated yield strategies accessible to everyone.

Future Developments

The protocol’s roadmap emphasizes expanding yield opportunities while maintaining simplicity at its core. The smart vault infrastructure will support cross-chain operations, enabling users to access yield opportunities across multiple blockchains through a single interface.

Additional automated strategies will capture emerging DeFi opportunities, while deeper integration with leading protocols will expand earning potential. Each development maintains Levva’s commitment to security and ease of use. Furthermore, Levva is committed to advancing toward a fully decentralized and trustless architecture.

“With our upcoming cross-chain capabilities and evolving smart vaults, users will access top-tier yield across multiple networks without complexity. Levva is designed to adapt and grow with the DeFi landscape, always prioritizing simplicity and security,” says Peter Sergeev, CPO and Co-founder of Levva.

Levva will host a public token sale on Fjord at the end of November, to stay updated head to Levva’s website at https://levva.fi/.

Partners

We’re proud to partner with Cicada Market Making, a leader in holistic liquidity solutions for crypto projects. Cicada not only ensures market stability but also aligns market-making efforts with tailored marketing strategies. By integrating social impact analysis, Cicada provides projects with a unique foundation for sustainable growth and long-term market stability.

We’re excited to welcome Hardcore Labs (HCL), DeFi pioneers who capitalize on market inefficiencies using advanced analytics and deep market expertise. With a strong foundation in traditional finance and asset management, HCL’s innovative, market-neutral strategies make them a valuable addition to our network.

We’re also grateful for the continued collaboration with key partners like Pendle Finance and Ether.fi, along with our points integration and pool partners: Mellow Protocol, Turtle Clubhouse, Symbiotic Finance, KelpDAO, Puffer Finance, Amphor.io, Lombard Finance, and Bedrock.

About Levva

Levva offers effortless capital management through automated smart vaults. By connecting highly optimized lending pools to major DeFi platforms like Uniswap, Curve, and Pendle, Levva provides seamless access to top-tier yield opportunities. The protocol makes sophisticated yield strategies accessible to everyone – from active farmers to institutional users.

Disclaimer: This is a paid post and should not be treated as news/advice.