Markets called ‘delusional’ – Will Trump’s 2025 inauguration crash BTC?

- Analysts warn of a potential BTC crash around Trump’s inauguration day

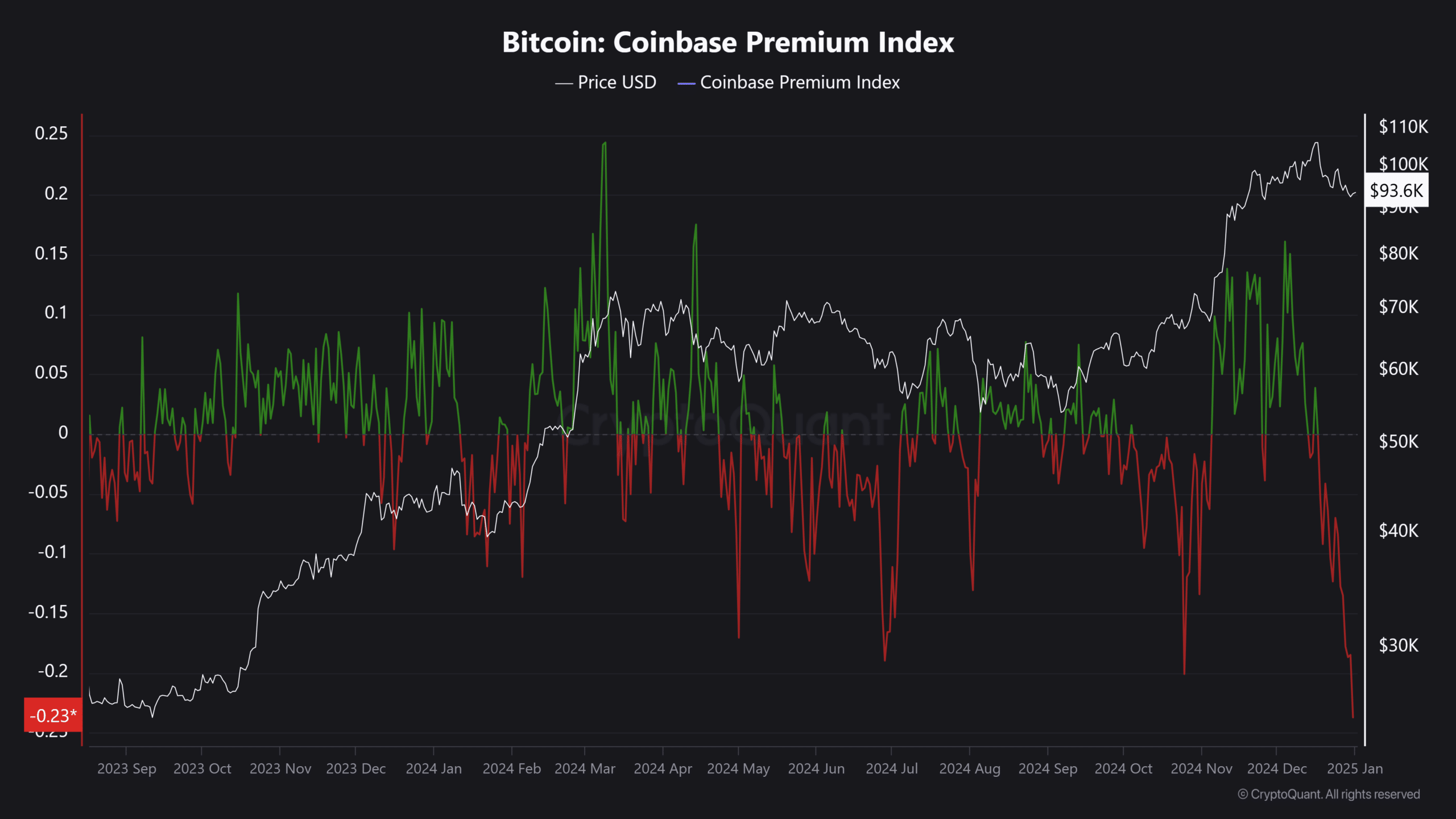

- Coinbase Premium Index has dropped to record yearly lows, underscoring weak demand in the market

The upcoming inauguration of Donald Trump as U.S president on 20 January has elicited a mixed outlook for Bitcoin [BTC] from analysts.

In fact, a recent Forbes report even claimed the event could crash BTC because the market is ‘delusional’ and overpriced the asset on pro-crypto policies that might as well fail to materialize.

The report cited K33 Research’s December market outlook which read,

“It’s highly likely that the market has delusional expectations for the pace of policy changes and will overprice the impact running into the inauguration.”

Trump’s inauguration to crash BTC?

This cautious position was also shared by the Co-founder of BitMEX and crypto investor Arthur Hayes. In his December newsletter, Hayes warned that the inauguration could be marked by a massive sell-off. He said,

“I believe the crypto markets will experience a harrowing dump around Trump’s January 20 2025, inauguration day.”

Additionally, based on seasonality trends, January isn’t one of the best months for BTC. Should history rhyme, BTC could face a potential risk in the short term.

However, part of the community still expects key policy changes, including the creation of the BTC strategic reserve. In fact, the BTC reserve could be the primary catalyst for BTC’s price action in 2025.

That being said, the Coinbase Premium Index indicated that December’s sell pressure for the cryptocurrency has extended to early 2025.

Read Bitcoin [BTC] Price Prediction 2025-2026

In most cases, BTC’s rebound coincides with strong demand from Coinbase (U.S investors). So, the low demand suggested that a BTC rebound was still not on the cards, at least not at press time.