MATIC and LINK: How does this combination help traders’ portfolios?

While several combinations of altcoins exist that help lower market risk to some extent. One such combination is MATIC and LINK. The two altcoins have opposite correlations with Bitcoins during its peak and corrections. LINK rallies following BTC dips historically, while MATIC rallies alongside BTC. This is based on their price trend and observations year till date.

Both these altcoins rank in the top 20 based on market capitalization on coinmarketcap.com and the parallels drawn between the two make them ideal to add to a portfolio.

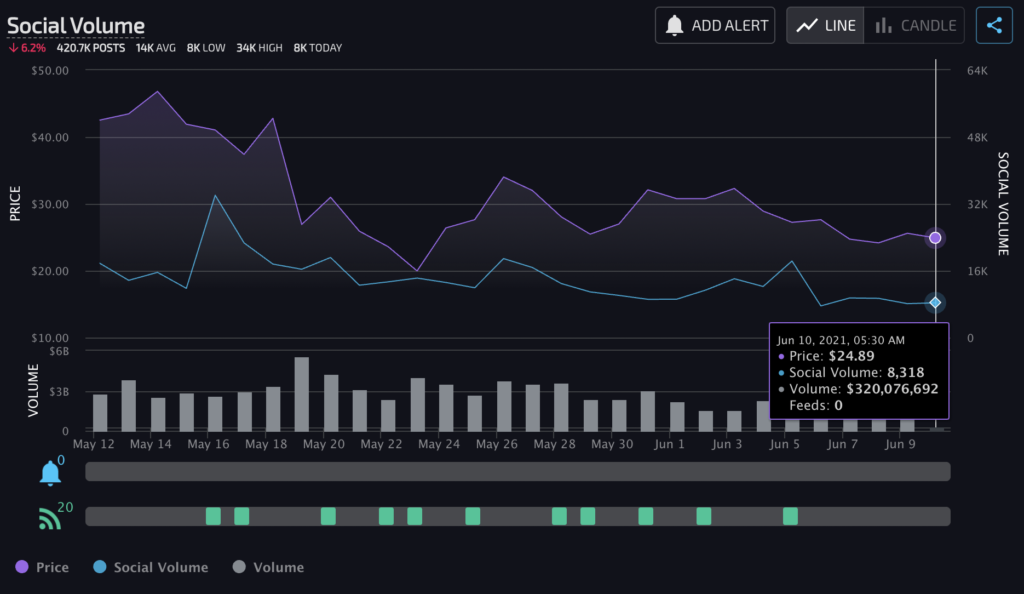

LINK was trading 52% away from its ATH, however, at this price level, the market capitalization was $24.7 Billion. The altcoin is currently trading at the $24.71 level. The social volume has taken a hit, based on a chart from lunarcrush.com and this is a sign that the altcoin is currently undervalued. LINK has remained rangebound below the $32 level for over two weeks now, the price is likely to break past $40 if the rally continues.

LINK Social Volume | Source: Lunarcrush

In the case of MATIC, following the drop to the $0.8 level, the altcoin has recovered and was trading at the $1.45 level. The recovery was quick owing to the liquidity and the volatility across exchanges. The 24-hour trade volume on top markets across exchanges is relatively high for MATIC making recovery quicker than anticipated.

The price was 45% away from its ATH and MATIC’s growth is more organic than ever. Starting out as an L2 scaling solution, MATIC has come a long way in terms of partnerships, community building and social media mentions. The long-term sentiment among traders is bullish and when choosing altcoins to add to a portfolio, LINK and MATIC are both competitors. The possibility of booking profits on the overall portfolio through the bloodbath and flash crashes makes it lucrative for traders to add both these altcoins in similar volume to their portfolio.

Institutional investors have shown interest in both and accumulated LINK and MATIC through the May 19 flash crash. Further accumulation is expected in the short term if there is a bloodbath triggered in the following weeks of June. However, until then, these two altcoins complement each other in terms of metrics, HODLer composition and price trend.