MATIC: Bulls out to defend $0.8355 support – will they prevail?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bulls have fiercely defended $0.8355 support level.

- Funding rates on the rise.

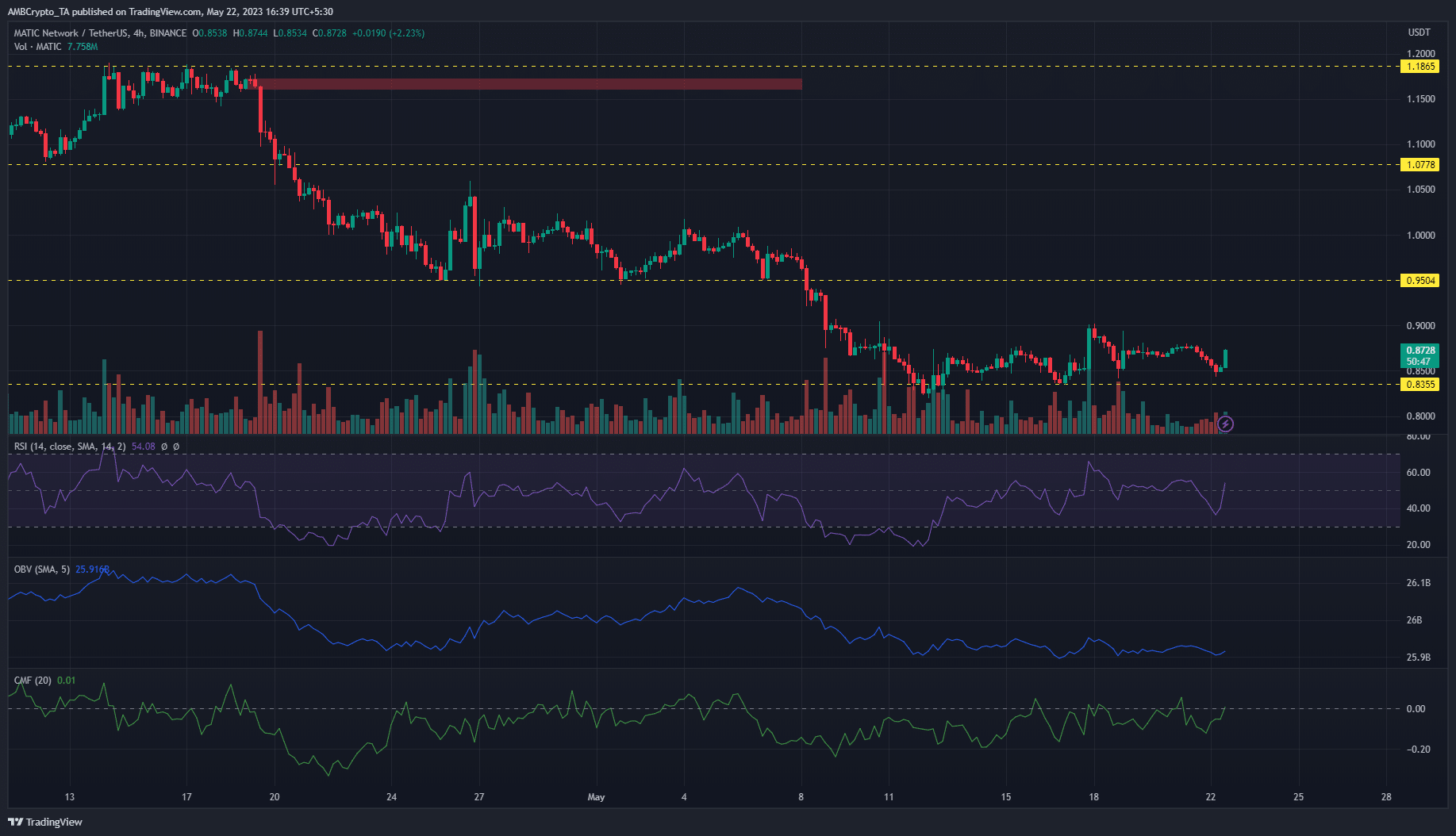

Polygon’s [MATIC] price decline over the past month has seen the altcoin lose over 27% of its value. This has seen the coin dip from $1.1865 to trade at $0.8728, as of press time. Bitcoin’s [BTC] dip back into the $26k zone over the past 24 hours could play a significant role in MATIC’s price movement.

Read Polygon’s [MATIC] Price Prediction 2023-24

With MATIC hovering on a key support level of $0.8355, it remains to be seen if this support level will act as a strong base for bulls.

Can bulls maintain hold of the $0.8355 support level?

The selling pressure on MATIC has seen bears smash key support levels at $1.0778 and $0.9504. However, bulls have been able to briefly stem the bearish tide at the $0.8355 support level. The support level has held strong over the past seven days.

Recent price action over the past 24 hours revealed that the $0.8355 support level might be key to a bullish reversal. The support level has already been tested three times with the level holding firm so far.

A look at on-chart indicators showed that buyers might be growing in strength. The RSI showed a reading of 54 to denote increasing buy pressure. The OBV also showed a slight uptick to hint at increasing volume. The CMF rose sharply to the zero mark, signaling more inflows for MATIC.

Bulls will be aiming to push on to test the resistance level at $0.9504. On the flip side, a break of the bullish defense at the $0.8355 support level could see bears aim for the January low of $0.7414.

Funding rates on the rise

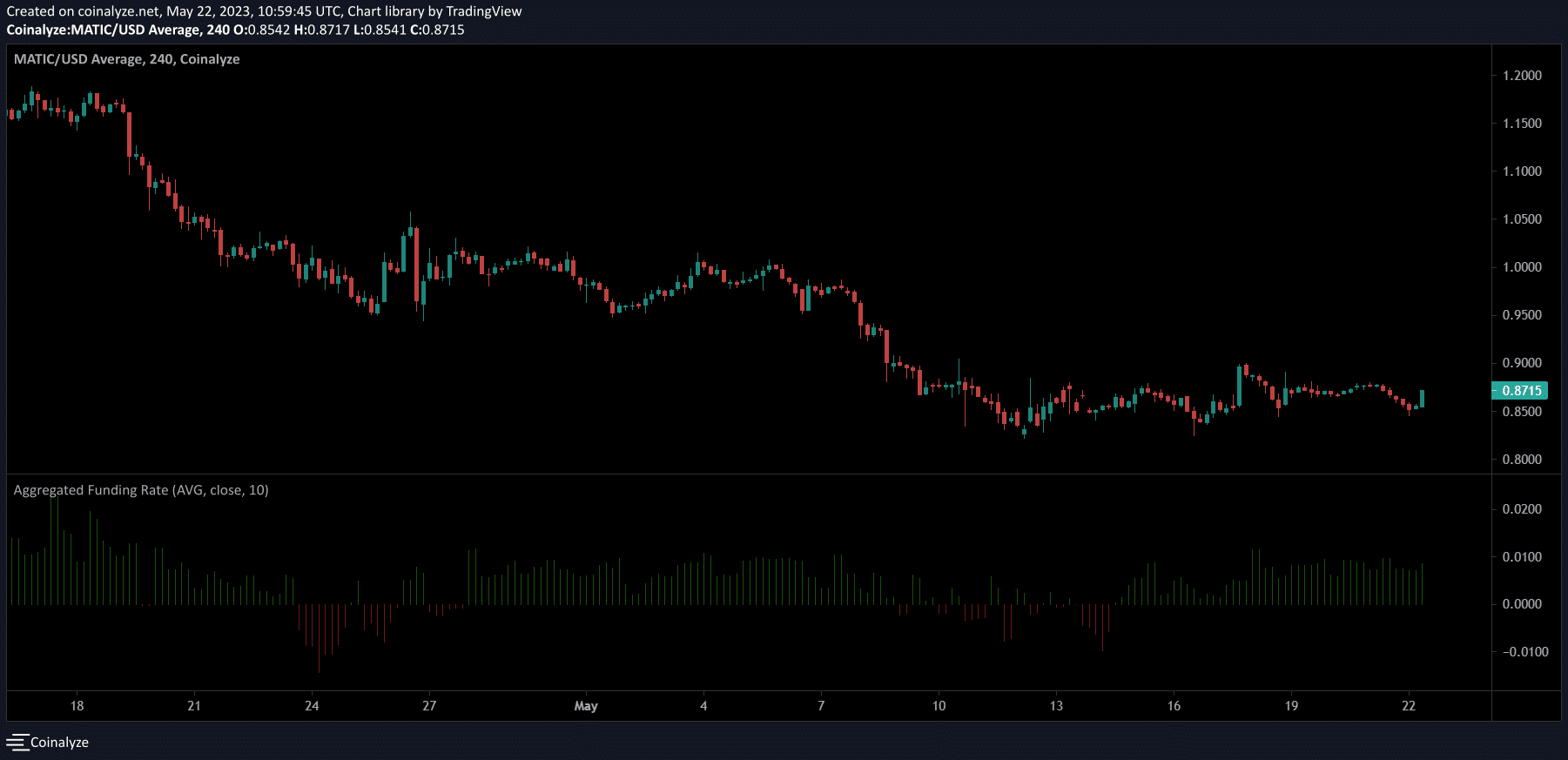

On-chain metrics revealed that bulls are actively preparing to rally from the press time support level. A look at data from Coinalyze showed that the funding rates over the past seven days have been on the rise.

How much are 1,10,100 MATICs worth today?

Buyers also held the upper hand in the long/short ratio with a 56.08% advantage on the four-hour timeframe. This suggested that a bullish reversal on the lower timeframes could kickstart a recovery for MATIC.

Source: Coinglass