MATIC extends a buying opportunity – Should you take it?

- MATIC has a firmly bullish bias, and a retest of $0.95 is likely to see the coin rally higher once more.

- Some of the on-chain metrics pointed toward the likelihood of rising sell pressure on the token.

Polygon [MATIC] breached the critically important $1 resistance level on 26th December. It ascended as high as $1.09 and was going through a pullback at press time. This was good news for MATIC bulls.

AMBCrypto recently reported that zkEVM’s network activity dropped despite the rising TVL. The futures market reflected robust bullish sentiment in recent days, and that trend could continue should MATIC defend the $0.95-$1 support zone.

The MATIC market structure showed large gains could be imminent

The one-day chart has formed higher lows and higher highs after 23rd December. The token traded within a range (purple) that extended from $0.934 to $0.722 since mid-November. Hence, the recent breakout spelled bullish intent.

The OBV was in an uptrend and the RSI was above neutral 50. Together, they showed that the buyers were in control. The Fibonacci retracement levels at $0.9218 and $0.8813 are close to the range high and the former bearish order block.

This zone is now a bullish breaker, a demand zone on the 1-day timeframe.

It was also where a fair value gap (white) lay, marking the $0.93-$0.98 region as an area of interest for swing traders. The confluence of multiple factors outlined a strong buying opportunity targeting $1.17 and $1.3, the Fib extension levels northward.

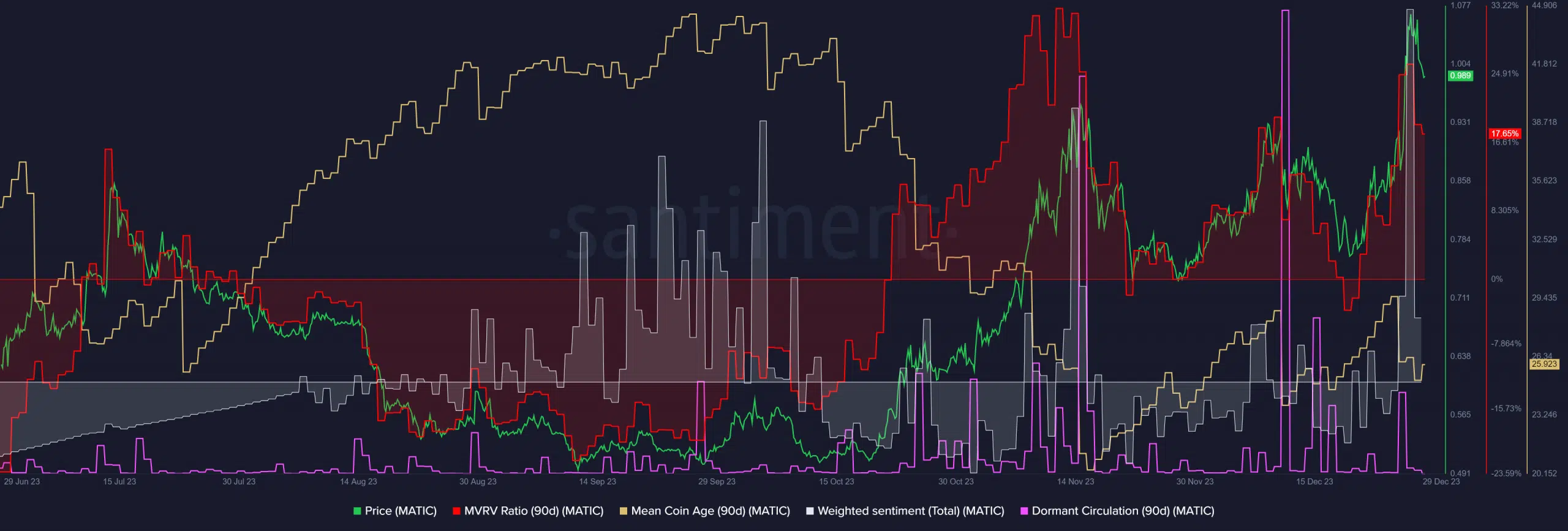

The weighted sentiment shot skyward alongside the prices

Source: Santiment

AMBCrypto noted that despite the strong rally since October, the mean coin age has not trended upward consistently. This suggested that holders were more keen on securing profits than riding the wave higher.

However, the weighted sentiment on social media has been highly positive in recent days, likely due to the price action.

Is your portfolio green? Check the MATIC Profit Calculator

The dormant circulation saw a major spike on 11 December, which was a sign of selling pressure. This was followed by a retracement.

Another surge in this metric is something traders can watch out for. The MVRV ratio was also near the October high, which meant MATIC was an overvalued asset that holders could look to book profits on.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.