MATIC loses to ‘optimist’ demand, but are whales planning a comeback

- Arbitrum and Optimism registered better numbers in transaction fees than Polygon

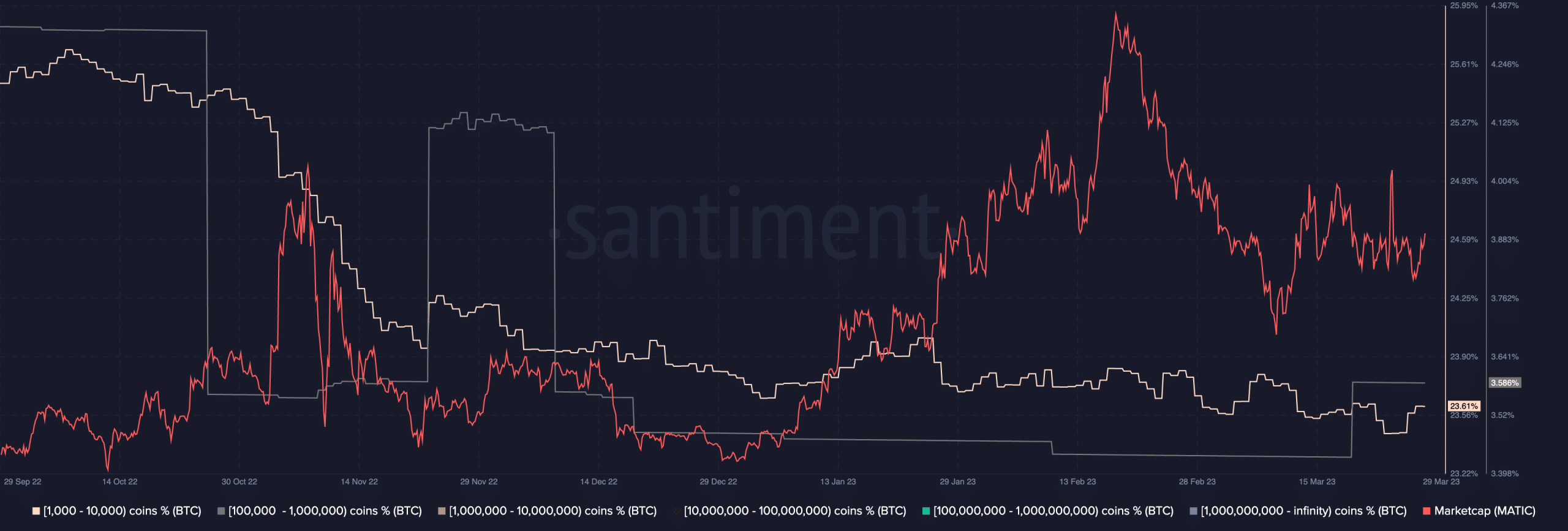

- MATIC whales have been accumulating since the web3 project’s official launch of its zero-knowledge network

The launch of the Polygon [MATIC] zkEVM Mainnet could set in motion a combat among projects in the layer two (L2) ecosystem. Surely, all, including Arbitrum [ARB] and Optimism [OP], have their strengths. However, Polygon noted that zkEVM would improve on the scaling effect and improve its current numbers.

Realistic or not, here’s MATIC’s market cap in OP’s terms

The rollup race is in full-fledged mode

But before the Polygon event, these optimistic rollup-based protocols made more transaction fees than the eighth-largest blockchain. As shared by The Rollup, using Token Terminal’s data, both Arbitrum and Optimsm outperformed Polygon in the last 30 days.

This data chart from @tokenterminal reveals that @0xPolygon has lost some ground to layer-2 scaling solutions like @arbitrum and @optimismFND in terms of transaction fees collected over the last 30 days. pic.twitter.com/Sq8V0gtdHk

— The Rollup (Formerly DeFi Slate) (@therollupco) March 28, 2023

This data implies that the number of addresses registering on the optimistic rollup network was higher. The same goes for the transactions made. And, in retrospect, Polygon’s revenue decreased For Arbtirum, this could be connected to the recently distributed AirDrop, which caused FOMO and FUD. Many also seem to view the Arbitrum ecosystem as a potential long-term favorite; hence, the rapid growth in the number of users.

The reason for Optimism’s growth was unclear even though it was the L2 star of Q3 2022. However, it was possible that the action of MATIC whales could make way for the Polygon’s resurgence. This was because the number of addresses holding 1,000 to 100,000 worth of the token had increased their holdings since the zkEVM pronouncement.

Usually, this gesture confirms investor sentiment towards bullishness and price action. However, an increase in transactions, if sustained, could also drive a hike in fees generated. Also, Polygon also confirmed that several projects would be building on top of the zero-knowledge (ZK) technology.

Increasing activity on the Polygon network

In the process, this could positively affect the project’s revenue. However, there was still a dark cloud over when active building would begin. Therefore, it is uncertain when Polygon will upturn Arbitrum and Optimism’s dominance.

Read Polygon’s [MATIC] Price Prediction 2023-2024

Meanwhile, whales were not the only contributors to the Polygon bid. According to Santiment, active addresses on the Polygon network have taken a good turn in the last seven days. The rise of the metric to 24,800 at press time meant that the level of crowd interaction with the network had significantly increased.

On the other hand, the volume, which increased prior to the Mainnet public availability, had reduced to 345.53 million in the last 24 hours. This meant that the number of MATIC transactions has been reduced. Thus, time will tell if Q2 2022 will be Polygon’s season, since Optimism has had its time, and Arbitrum was enjoying a wave of attention at press time.

![Polygon [MATIC] active addresses and volume](https://ambcrypto.com/wp-content/uploads/2023/03/Bitcoin-BTC-07.17.04-29-Mar-2023.png)