MATIC reclaims $1 – Could this bullish signal mean more gains?

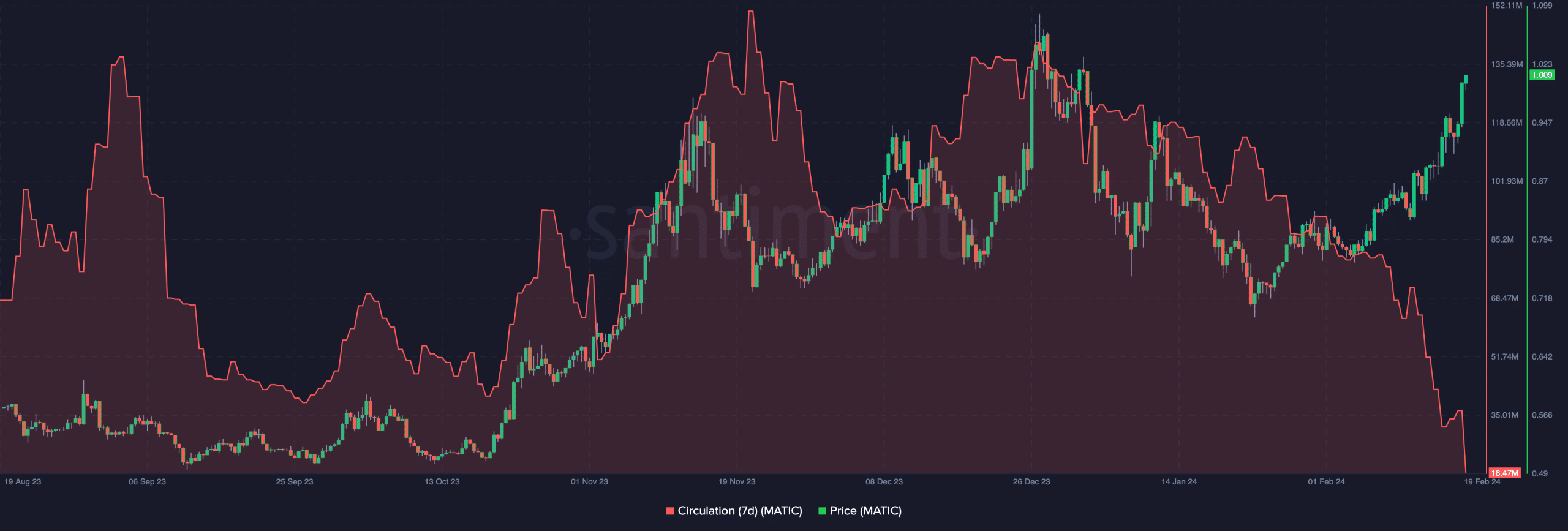

- Circulation decreased, indicating a further upside for the token.

- High-leverage short positions could be liquidated between $0.89 and $0.96.

After a 20% increase in the last seven days, AMBCrypto noticed that Polygon [MATIC] climbed back above $1. At press time, MATIC changed hands at $1.005.

However, the recent milestone might not be the end for the token, as some on-chain metrics hinted at a further upside.

One of these metrics was the circulation. Circulation measures the number of tokens engaged in transactions within a specific period.

But when it comes to the price, the metric shows something else. In most cases, an increase in circulation depicts likely selling pressure, which could draw down the price of a cryptocurrency.

On the contrary, a decrease in circulation could foreshadow price stability or a significant upside.

According to AMBCrypto’s analysis of Santiment, the seven-day circulation has been decreasing since the 27th of December.

MATIC to $1.20 is an option

If this decrease continues, then MATIC’s price might aim at another 20% increase. Should this be the case, the Polygon native token might hit $1.20 within the next few weeks.

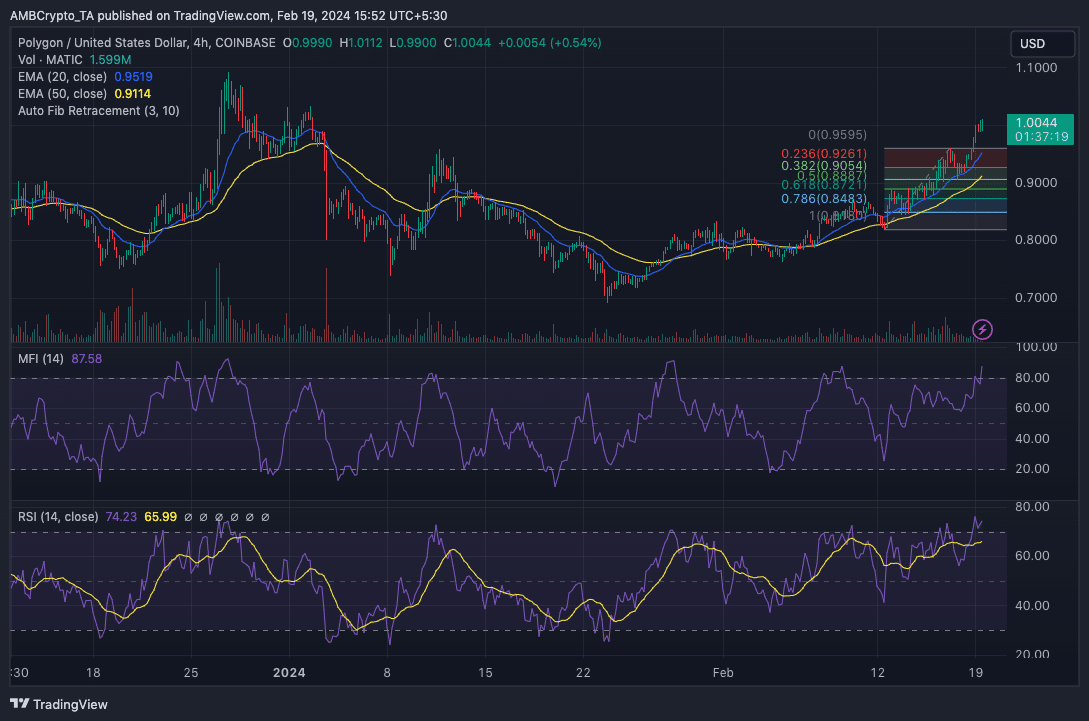

When AMBCrypto looked at Polygon from a technical point of view, we observed that capital has been increasingly flowing. At press time, the Money Flow Index (MFI) was 87.58.

However, this reading implied that MATIC was overbought, since the MFI reading was above 80.00.

This condition puts MATIC at risk of a decline. Should the price retrace, the next targets could be around $0.88 and $0.92 where the 0.618 and 0.236 Fibonacci retracement were positioned.

Furthermore, the Relative Strength Index (RSI) aligned with the MFI, as it indicated that the token was oversold.

But the 20 EMA (blue) was above the 50 EMA (yellow), suggesting a bullish thesis. In a highly bullish scenario, the price of MATIC could hit $1.20.

Alternatively, if bearish forces dominate the market, the value could drop below $0.90. But that seemed unlikely in the short term.

Longs have a clear path

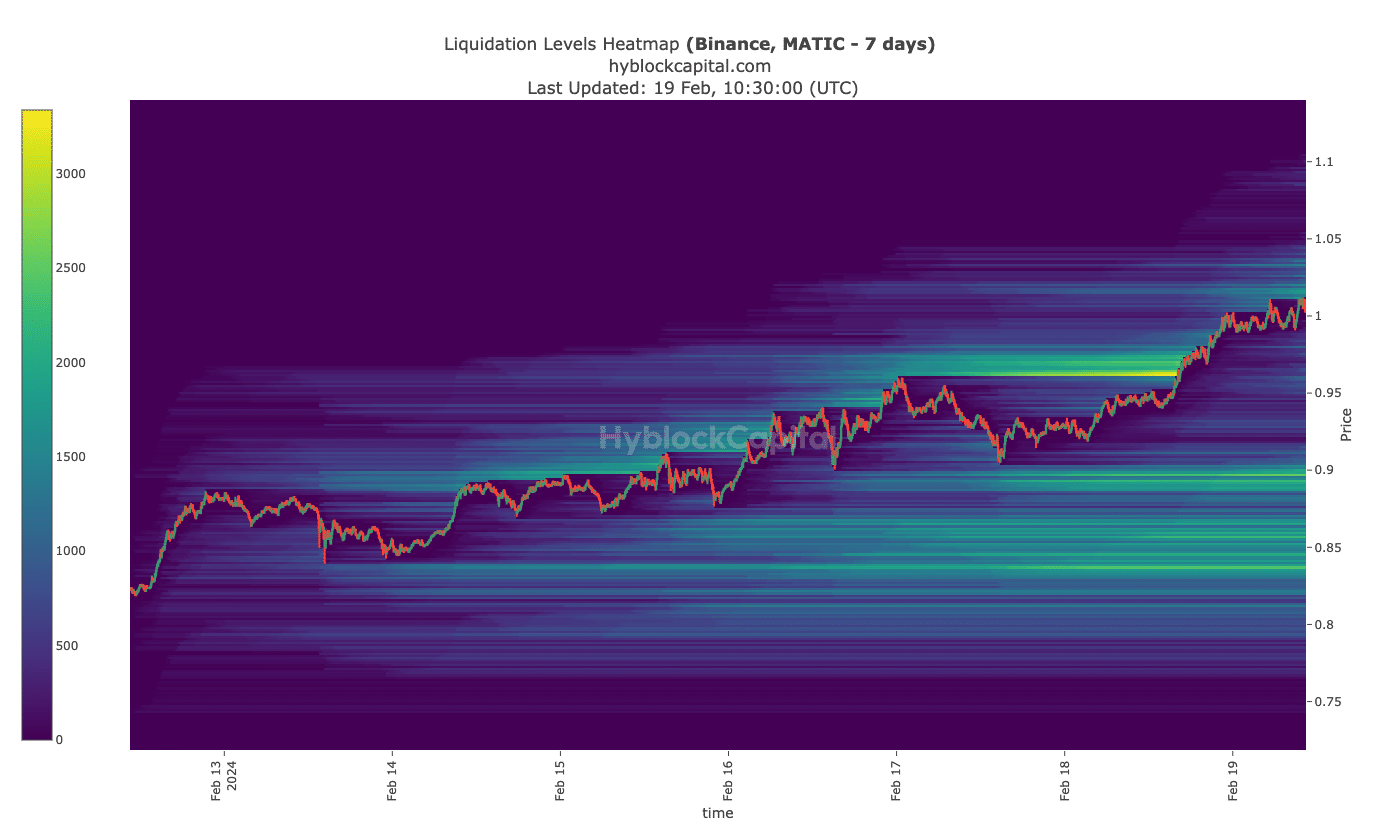

In addition, AMBCrypto analyzed the Liquidation Heatmap. For the unfamiliar, Liquidation Heatmap shows price zones where over-leveraged traders could lose money.

At press time, HyblockCapital’s data showed that high-leverage positions could face liquidation between $0.89 and $0.96.

But when we looked northward, it was an entirely different story. Above $1.05, the Liquidation Heatmap showed that longs could still profit from targeting higher prices.

At the same time, it could be better to avoid using high leverage, especially as the market condition could change from bullish to bearish at any point.

Is your portfolio green? Check out the MATIC Profit Calculator

Going forward, it might not be a good idea to open short MATIC positions. Despite the prediction, the Polygon native token might pull back before it continues climbing.

Therefore, longs, like shorts, need to be cautious about placing big bets.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)