MATIC sits atop a crucial support but is another 8% drop around the corner

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice

- Market structure flipped bearish for MATIC and volatility was high

- Despite the large volatility, and against the market trend, a high-risk high-reward buying opportunity could soon arise

MATIC rallied from $0.88 to $1.26 within a week in early November, which represented gains amounting to nearly 50%. Four days after the peak of this rally MATIC sunk to $0.76, a decline of 41%. Can higher timeframe traders profitably trade this kind of volatility?

Read Polygon’s [MATIC] Price Prediction 2023-24

Lower timeframe traders will likely be joyous due to the recent sharp price movements. With Bitcoin falling below the $16.2k support, it appeared that the entire market could see another leg downward. In this background, MATIC offered a buying opportunity. Can the buyers hold their ground in the coming weeks?

Range low and bullish order block once more as bulls and bears skirmish near $0.79

MATIC traded within a range (yellow) from $1.03 to $0.72 since mid-July. The sharp breakout in early has rapidly reversed two weeks ago. At that time, the technical indicators leaned in favor of the bulls. The Relative Strength Index (RSI) shot into overbought territory while the Chaikin Money Flow (CMF) and Accumulation/Distribution (A/D) indicator also saw a decent uptick. However, all of this took a bearish shift in the past few days. The CMF and A/D declined, while the RSI retested neutral 50 as resistance to show downward momentum.

On 21 September, the daily trading session formed a bullish order. It was near a significant level at $0.74, and the price action in late September showed a bullish market structure development. This order block was highlighted in cyan, and it has been tested twice since then. Both times saw a strong bullish reaction. Can the bulls deliver another performance like that, or will they finally succumb?

A revisit to the $0.74-$0.76 region will likely offer a buying opportunity. Invalidation would be a daily session close beneath $0.68, with targets being $0.88 and $1.03 to take profit at. However, the Bollinger Bands were wide. Even though a visit to the lower band at $0.69 can be bought in the hopes of a mean reversion, buyers would need to be cautious, especially given Bitcoin’s weakness on the charts.

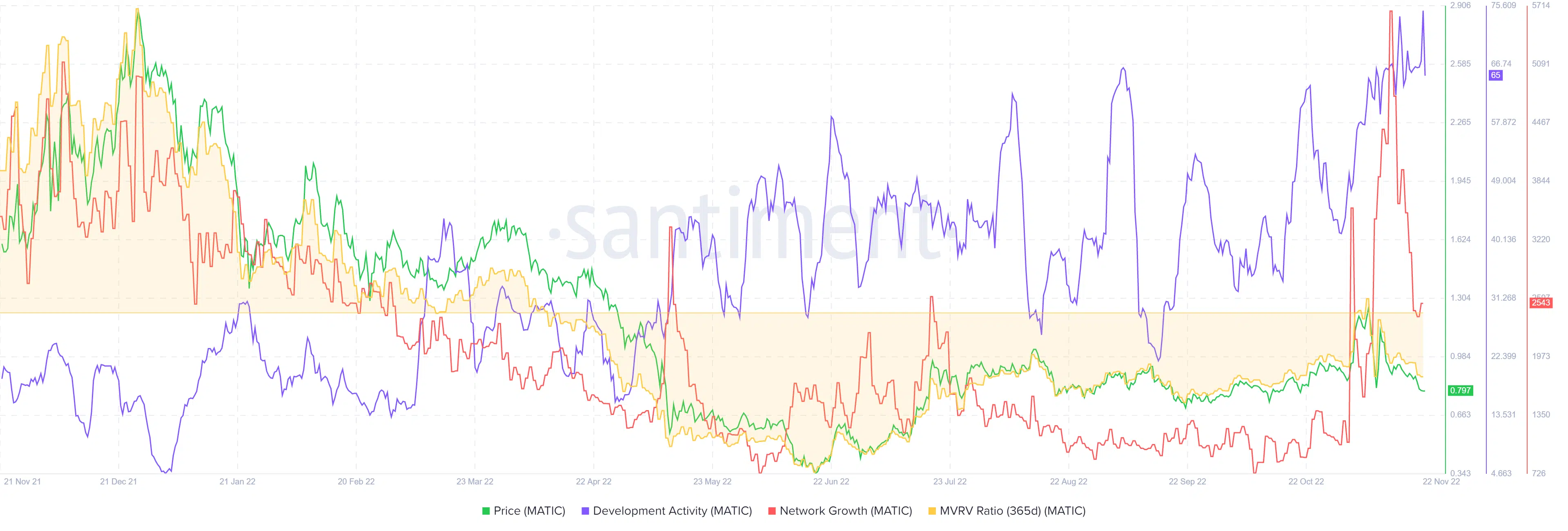

Development activity on the rise over the past year, and network growth also witnesses a huge surge

Source: Santiment

In November, the network growth metric and the development activity both reached their highest points in the past year. These are metrics that longer-term investors pay some attention to, hence a bullish long-term case can be made for MATIC.

The 365-day Market Value to Realized Value (MVRV) witnessed a surge since May but was not yet in positive territory. It briefly breached the 0 mark on 7 November, but the subsequent selling pressure put longer-term holders at a loss once more.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)