MATIC struggles as only THESE holders see profits

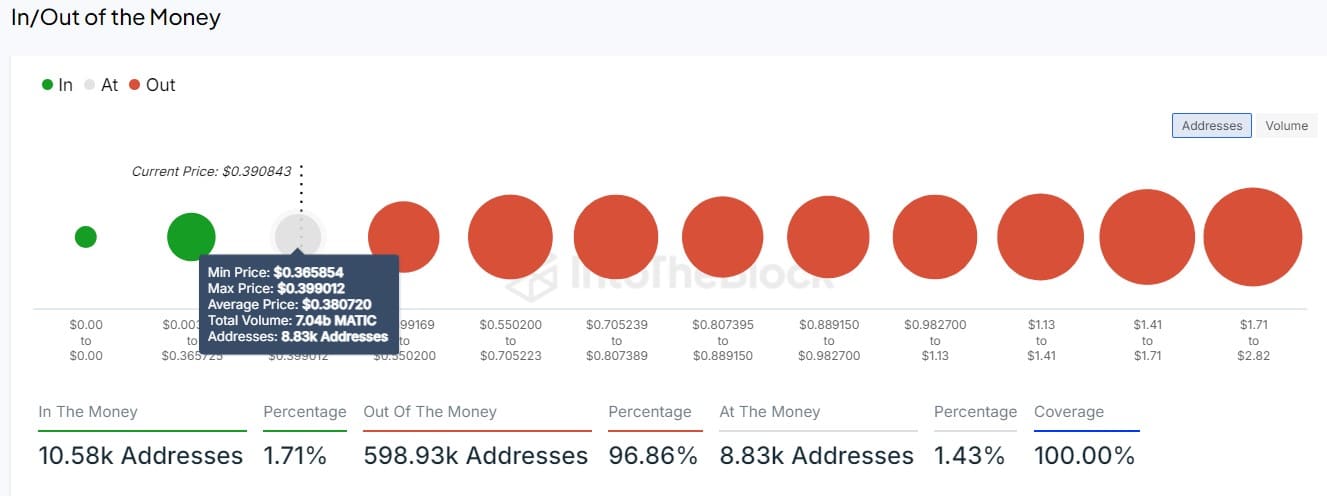

- MATIC holders in profit currently stands at 2%, marking a concerning low for investors.

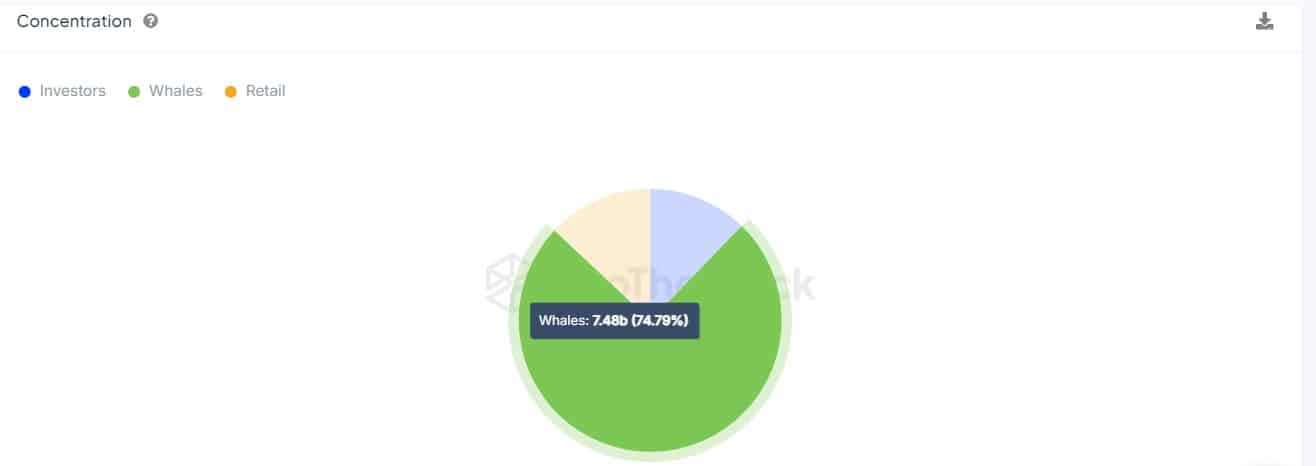

- Whales control 74.79% of MATIC total supply.

Polygon [MATIC] has experienced a sharp dip in profitability, with only 2% of its holders currently in profit, according to data from IntoTheBlock. This is the lowest percentage recorded, indicating that a majority of the investors are holding at a loss until market conditions stabilize.

The current MATIC price range between $0.36 and $0.40 has trapped many holders in a hard spot. The price levels have seen around 7 billion tokens held by 8.83K addresses, further explaining the pull-and-tug faced by most holders.

Source: IntoTheBlock

Whale dominance in play

Concentration of tokens held by whales usually stands out among the key sentiments affecting the MATIC market dynamics. The distribution of Polygon ownership structure indicates that big market players hold 74.79% of the total supply.

Normally, highly concentrated whale ownership results in wild price swings, which makes the market quite unpredictable for the smaller retail investor.

This whale’s dominance suggests short-term volatility in the market, given that their large supply can sometimes move the market with just a few of their trades.

For retail traders, this high concentration will raise red flags over liquidity and potential wild price swings.

Source: IntoTheBlock

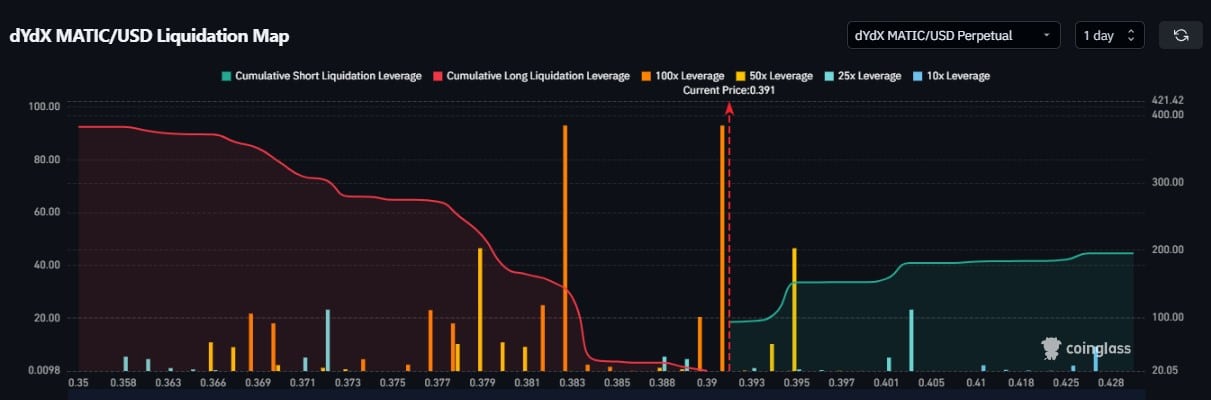

Similarly, AMBCrypto analysis on the Coinglass liquidation map data indicates that MATIC has a spike of liquidations between the addressed range of 0.37$-0.40$.

This suggests that the prices may range in this region for sometime before a significant movement.

Source: Coinglass

What next for MATIC holders?

With only 2% of holders in profit and whales controlling the market, the MATIC outlook still paints a challenging picture.

Is your portfolio green? Check out the MATIC Profit Calculator

The aforementioned high whale concentration could result in massive swing price movements if the prices continue to fluctuate between the $0.36 and $0.40 range.

Retail investors will have a hard time while navigating through these choppy waters as the asset battles the pressure of the market.