MATIC price’s 34% monthly fall – Here’s why it’s not all bad news

- Polygon’s NFT sales spiked 9.6% in the last 24 hours

- Whales were busy accumulating MATIC at discounted prices

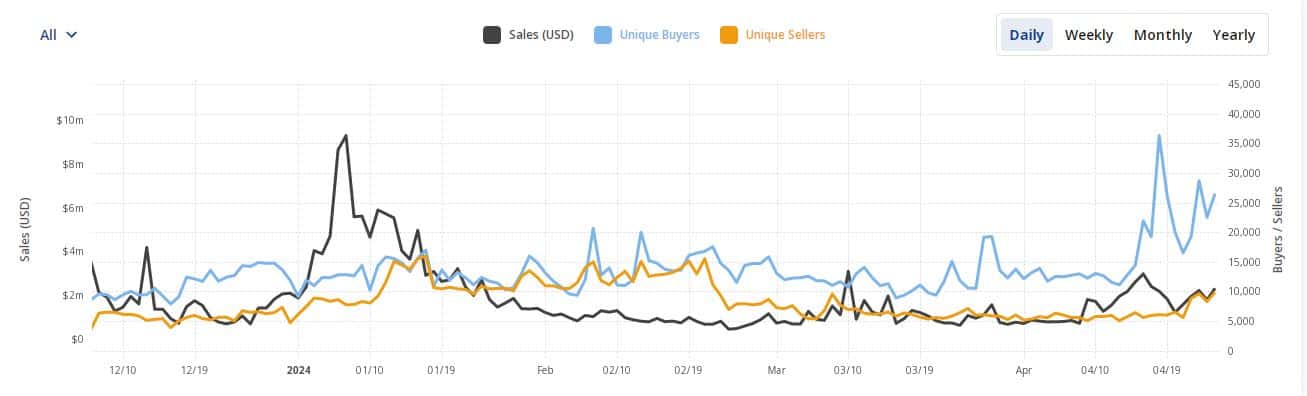

Despite how MATIC may be doing on the price front, Polygon remains the leader on a very important front. Namely, non-fungible token (NFT) activity on Ethereum Virtual Machine (EVM)-based blockchains in April.

Tracking Polygon’s NFT market

According to AMBCrypto’s examination of a Dune Analytics dashboard, Polygon handled around 3.4 million transactions on 15 April, a number that was nearly 1o% higher than the one a week prior. Polygon’s dominance could be gauged by the fact that the second-best performer, BNB Chain, could only clock 1.9 million transactions, nearly half of Polygon’s count.

While Polygon clearly dominated EVM rankings, its overall market performance was equally impressive. Polygon stood as the fourth-largest chain in NFT trading volume over the last 24 hours at press time, with a 9.6% spike pushing sales past $2.5 million, as per CryptoSlam data.

In fact, the network has been holding the fourth position for more than a month now, trailing top Layer-1 (L1) chains like Ethereum, Bitcoin, and Solana.

High NFT activity boosting burn rate?

MATIC, like many other cryptos, derives value from the transaction activity on the parent chain. A portion of fees paid in MATIC is burned after every transaction, having a deflationary effect on the coin.

According to burntracker.io, about 48,865 MATICs went up in smoke in the last 24 hours. While it couldn’t be said with conviction, but MATIC marginally reacted to the event, rising by 1% in the 24-hour period, according to CoinMarketCap.

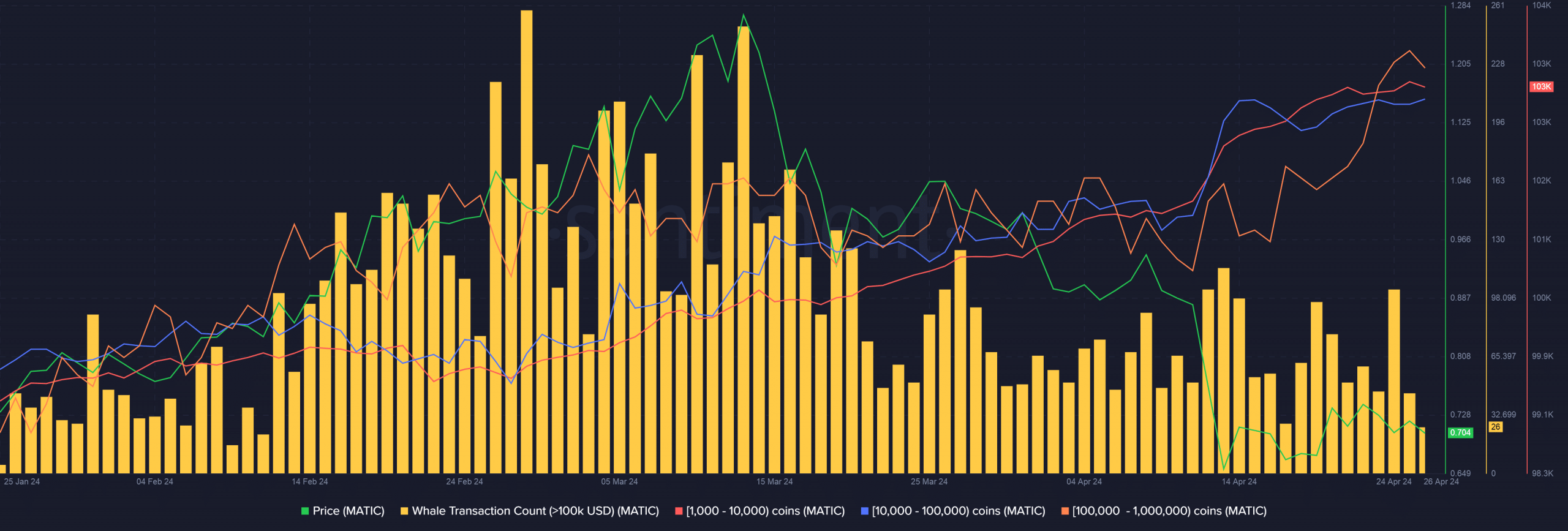

Over a broader timeframe though, MATIC struggled, plummeting by nearly 34% in just over the month.

Is your portfolio green? Check out the MATIC Profit Calculator

Whales bag MATIC at discount

Meanwhile, MATIC whales utilized the negative price action to add to their positions. User cohorts holding between 1,000 and 1 million coins steadily increased in number while the price retraced, AMBCrypto found using Santiment data.

This indicated that wealthy investors have been confident in MATIC’s medium-term prospects, and are hence going on an accumulation spree.