MATIC’s 35% staking drop follows 27% price fall – What next?

- Apart from staking, MATIC’s price also dropped by double digits last month

- Buying pressure on the token increased slightly, hinting at a possible price hike

Polygon [MATIC] has been shedding a substantial amount of its market capitalization over the past several months. That’s not all though, with latest data revealing that things in the staking ecosystem haven’t looked good either. Is this happening because investors are losing confidence in the token?

Staking on the decline

Polygoninans, a popular X handle that shares updates related to the Polygon ecosystem, recently posted a tweet highlighting the state of the blockchain’s staking ecosystem. As per the the same, total staked MATIC this week hit a figure of 3.4 billion – A 35% drop compared to the previous week.

AMBCrypto checked Staking Rewards’ data to better understand MATIC staking. We found that the number of staked MATIC rose until 3 July. However, since then, its figures have started to drop, signaling a decline in investors’ interest.

Are investors not confident in MATIC?

CoinMarketCap’s data revealed that, like staking, MATIC’s price also witnessed an over 27% drop.

At the time of writing, MATIC was trading at $0.4035 with a market capitalization of over $4 billion, making it the 22nd largest crypto. And, because of the massive price drop, only 2% of MATIC investors remained in profit, as per IntoTheBlock’s data.

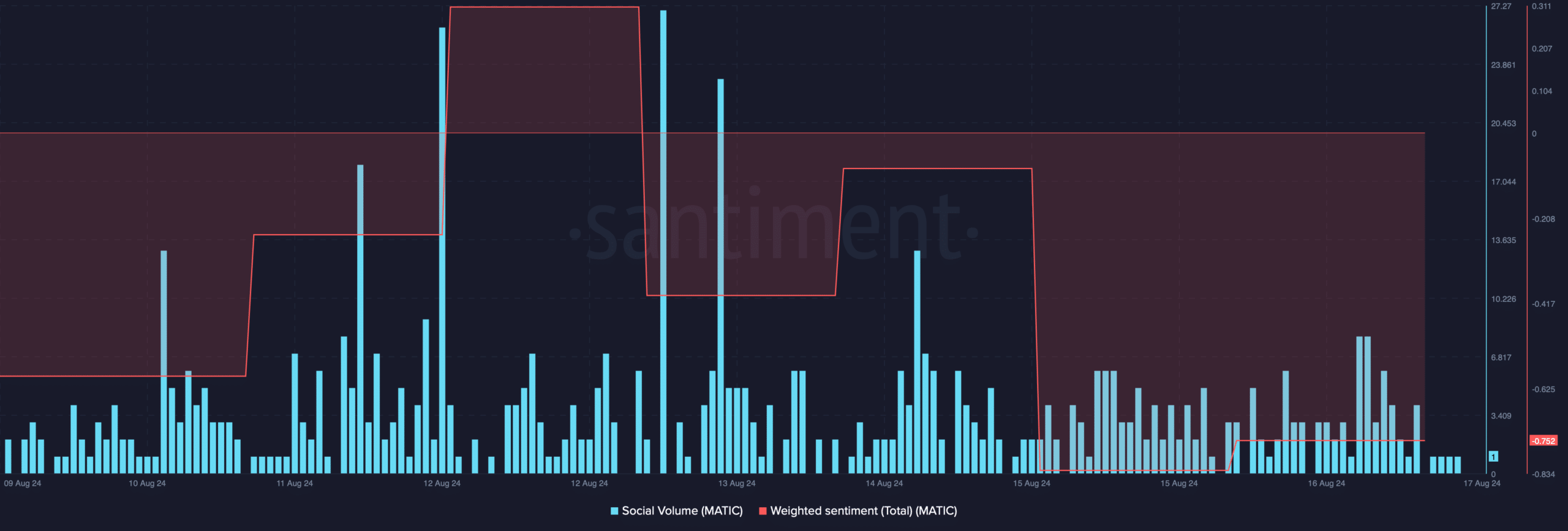

AMBCrypto then assessed MATIC’s on-chain data to better understand investors’ sentiment around the token. As per our analysis, the altcoin’s weighted sentiment was in the negative zone.

What this means is that bearish sentiment around the token has remained dominant in the market. After a spike, its social volume also noted a decline, reflecting a dip in its popularity.

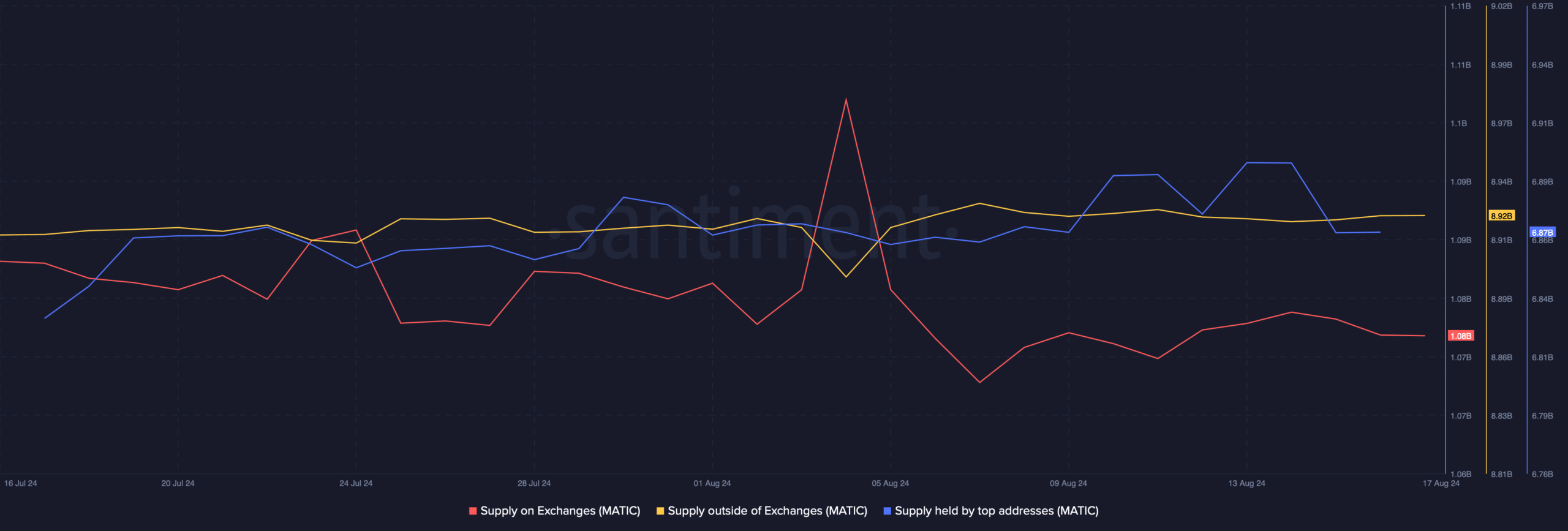

Alas, upon closer inspection, a different story was revealed. Over the last 30 days, MATIC’s supply on exchanges declined slightly.

While this happened, its supply outside of exchanges moved up. This suggested that a few investors have been considering accumulating MATIC.

The supply held by top addresses also moved up marginally – A sign of whales exerted buying pressure on the altcoin. By extension, this also meant that several expected MATIC’s price to climb in the coming days.

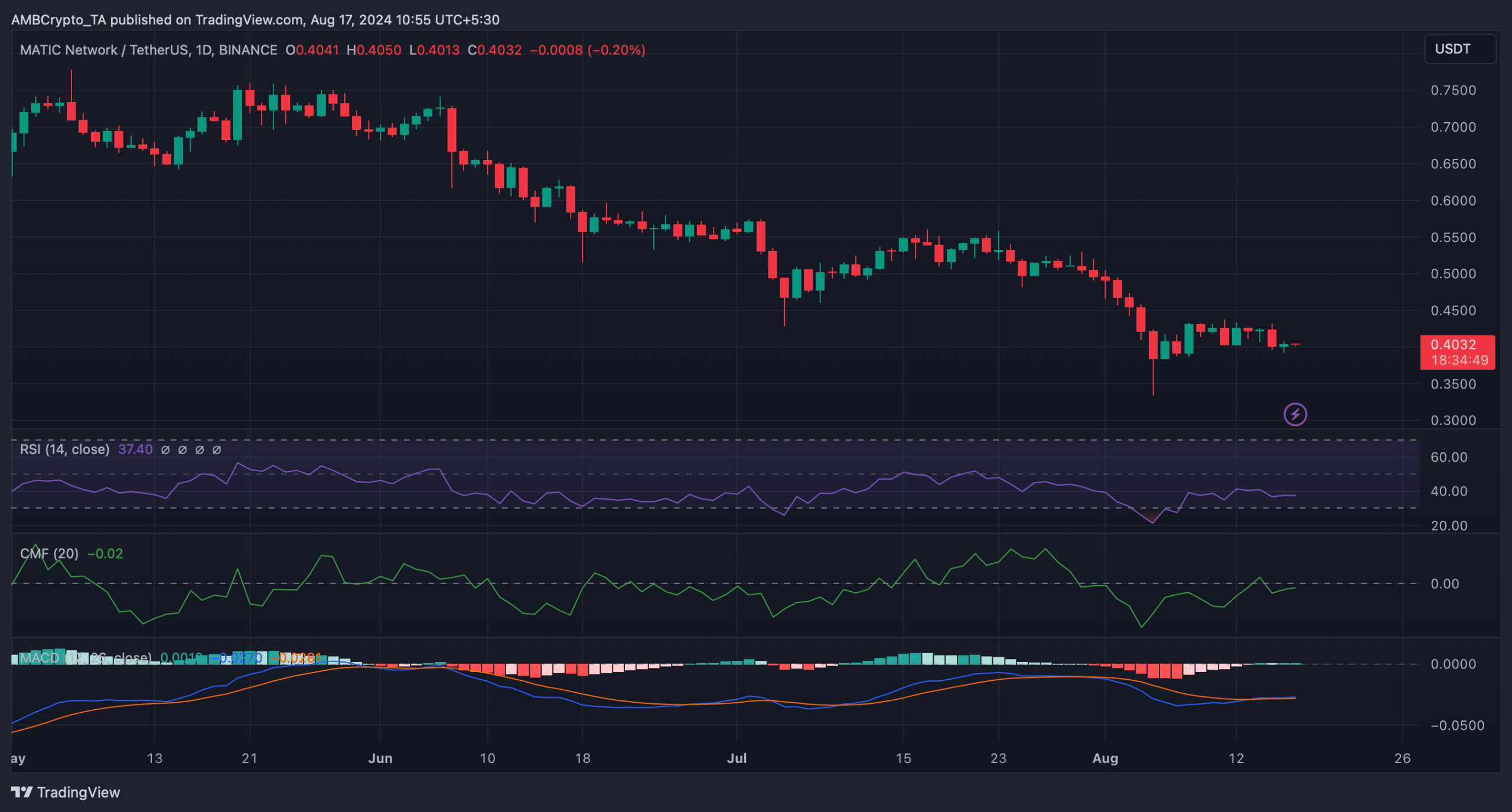

Therefore, AMBCrypto took a look at the token’s daily chart to see what market indicators suggested. The technical indicator MACD displayed a bullish crossover. MATIC’s Chaikin Money Flow (CMF) also registered an uptick and was heading towards the neutral mark at press time.

Both of these indicators highlighted that there were chances of MATIC gaining bullish momentum on the charts.

Read Polygon’s [MATIC] Price Prediction 2024-25

However, it might take some more time for MATIC to turn bullish as the Relative Strength Index (RSI) was moving sideways too.