MATIC’s 8% surge: Is Polygon’s booming network behind it?

- Activity on the Polygon network grew materially over the last week.

- NFT and DEX volumes also surged, indicating a growing ecosystem.

Polygon [MATIC] recently fell out of the social media conversations in the crypto space as L2s and meme coins gained popularity.

But despite the spotlight being moved away from Polygon, the activity on the network continued to soar.

Polygon users on the rise

According to recent data, Polygon’s Proof of Stake (PoS) network has consistently surpassed 1 million daily active addresses for a continuous period of 25 days.

Daily active addresses represent the number of unique user wallets interacting with the network on a given day. Consistently surpassing 1 million suggests a significant and sustained increase in network usage.

A sustained increase in active addresses is indicative of a growing user base and potential network growth.

This surge in activity was caused by the popularity of the Polygon ecosystem. Both the NFT and the DeFi ecosystem witnessed a massive surge in interest over the last few weeks.

According to AMBCrypto’s analysis of Dune Analytics’ data, the volume at which NFTs were trading at had grown significantly in the last few days.

With each NFT transfer incurring fees, a higher volume translates to more revenue for validators who secure the network. This can create a sustainable income stream that fuels the network’s growth.

In the DeFi sector, it was seen that Polygon managed to see growth in terms of both DEX (Decentralized Exchanges) and in terms of revenue generated.

However, despite these factors, the TVL (Total Value Locked) by the network declined significantly during this period.

This suggests new users and trading activity wasn’t translating into users locking more funds into Polygon’s DeFi protocols. Several factors could explain the decline in TVL.

Users might be moving their funds to DeFi platforms offering better yields or features, or they might be withdrawing locked assets for profit-taking or use elsewhere.

Read Polygon’s [MATIC] Price Prediction 2024-25

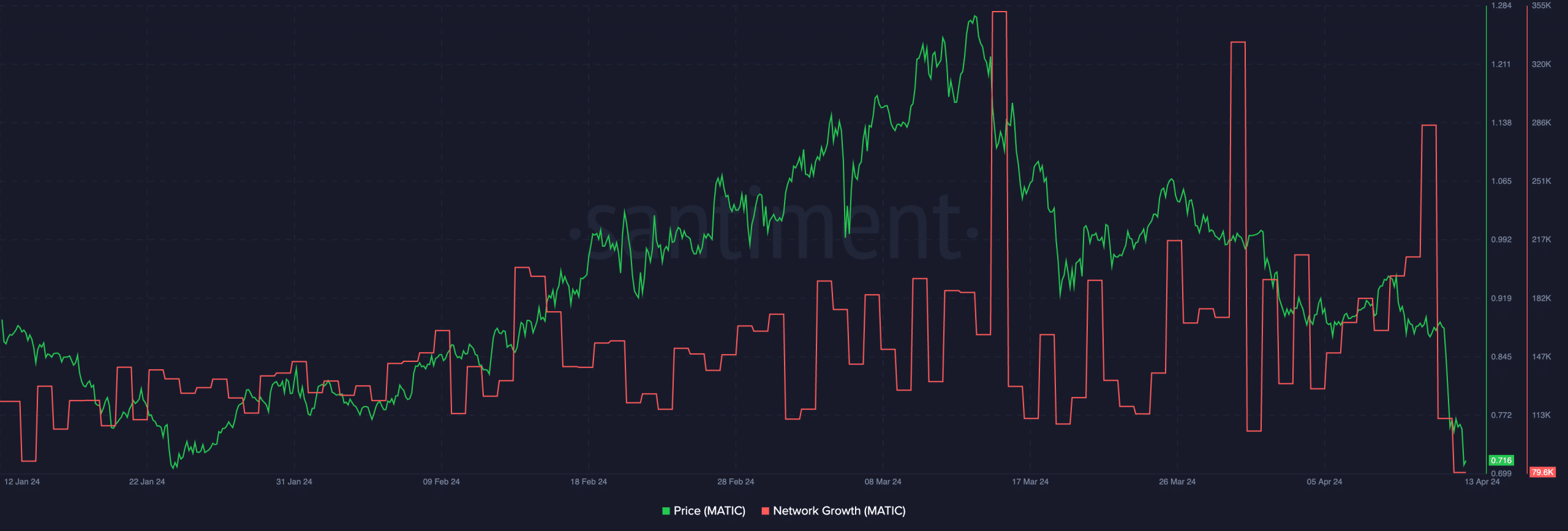

At press time, MATIC was trading at $0.7453 and its price had grown by 8.52% in the last 24 hours. Additionally, the volume at which it was trading at had declined by 47.34% during this period.

Its network growth had also fallen during this period, suggesting that new addresses were losing interest in MATIC.