MATIC’s recovery faces headwinds – Can bulls prevail?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The bulls seem to have fronted a recovery on the charts

- CVD (Cumulative Volume Delta) fell and could affect bulls’ efforts

While the bears have controlled MATIC’s market since mid-February, bulls only gained considerable leverage on 10 March. At the time, while the price action rebounded from $0.943, it has since faced stiff resistance levels.

Read Polygon [MATIC] Price Prediction 2023-24

Additionally, Bitcoin [BTC] faced rejection around the $26K zone and dropped below $25K, further undermining the rest of the altcoin’s market recovery in the short-term. However, a retest of BTC’s latest highs could lead the altcoin market into a renewed recovery process.

MATIC’s recovery at stake – Can bulls push forward?

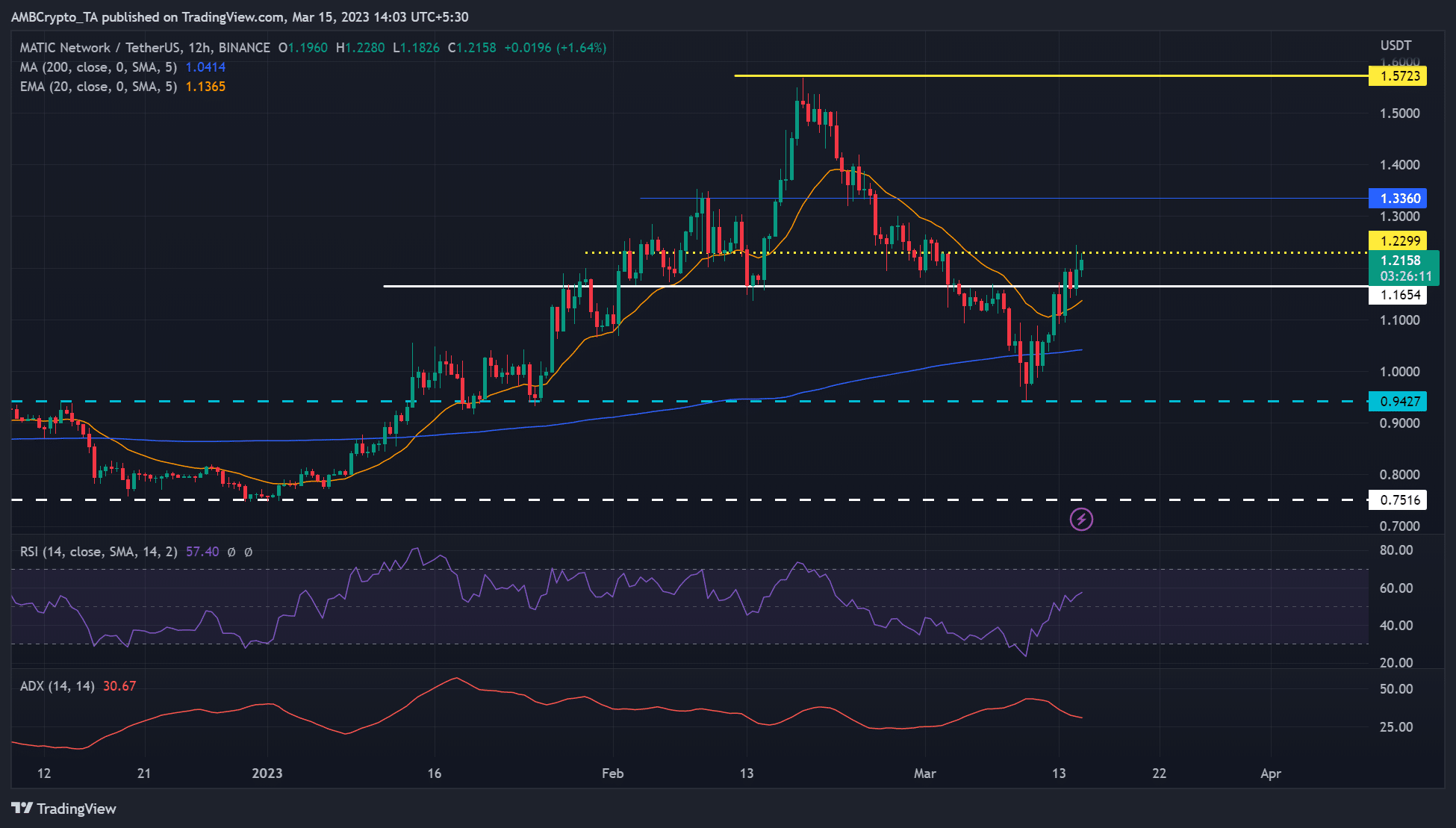

MATIC’s drop since mid-February was successfully stopped by the $.9427 support. The support was also crucial in January. Bulls cleared the hurdle at 200-period MA (Moving Average), the 20 EMA (Exponential Moving Average), and the $1.1654-resistance level. At press time, MATIC was struggling to bypass the obstacle at $1.23, partly due to BTC’s price fluctuations.

Bulls could attempt to clear the $1.23 hurdle if BTC surges above $25K. A close above the hurdle could push the price towards the overhead resistance of $1.5723, especially if the obstacle at $1.34 is cleared too.

On the contrary, BTC fluctuations could set MATIC into a consolidation range of $1.17 – $1.23 if 20 EMA remains steady. However, MATIC could sink to the new low of $0.943 if bears clear the obstacle at 200 MA ($1.0414).

The Relative Strength Index (RSI) retreated from the oversold territory – Evidence of increased buying pressure over the past few days. However, the Average Directional Index (ADX) slope hadn’t moved north, indicating a weak uptrend direction which should caution bulls.

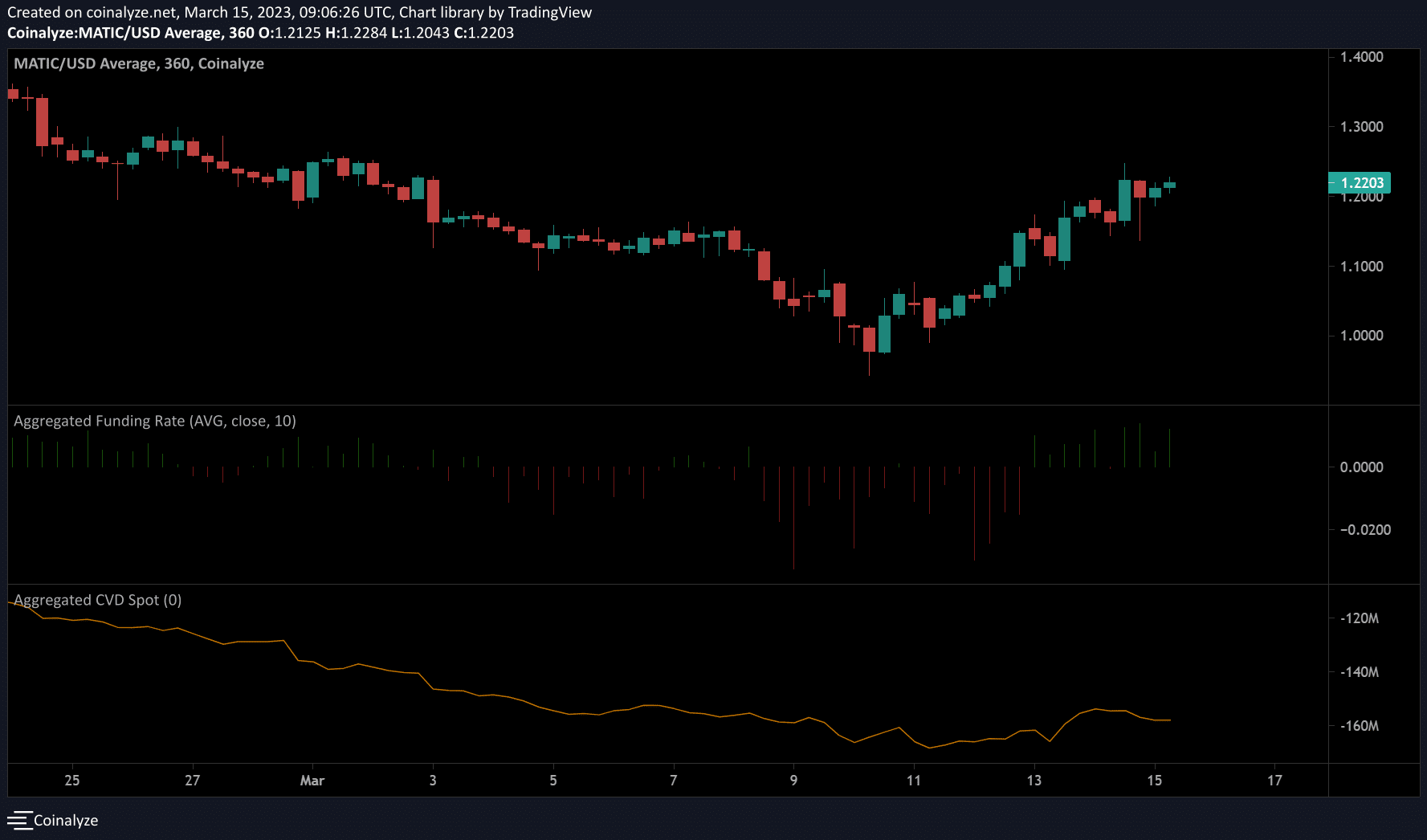

Funding rate was positive, but CVD fell

According to the crypto-derivatives data platform Coinalyze, MATIC’s funding rates have been positive since March 13. It underlined increased demand for MATIC in the derivatives market, which helped bypass the $1.1654-hurdle.

Is your portfolio green? Check out MATIC Profit Calculator

However, the CVD (cumulative volume delta) fell with a negative slope, indicating sellers were gaining leverage in the market. If the CVD was flat, it would mean neither buyers nor sellers had absolute leverage. On the contrary, a positive slope and growth would suggest buyers’ greater market influence. The negative slope, therefore, could complicate the recovery.