MAYC, BAYC, and other NFTs take a hit, will APE follow suit?

- Interest in NFTs starts to wane across the crypto sector. Yuga Labs’ BAYC and MAYC get severely impacted.

- ApeCoin’s price declines significantly, and network growth and velocity follow suit.

The introduction of Bitcoin Ordinals sparked a rally in the NFT market, leading to significant growth of various NFT collections. These included the Yuga Labs cohort. However, at the press time, there appeared to be a decline in interest within the NFT sector.

Realistic or not, here’s APE’s market cap in BTC’s terms

It’s all crashing down

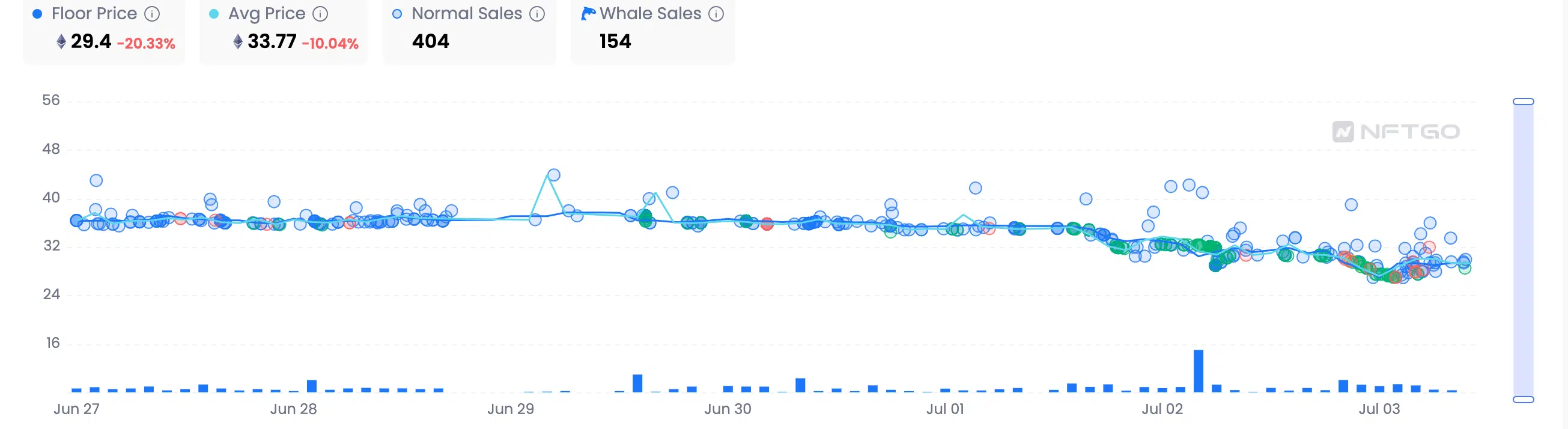

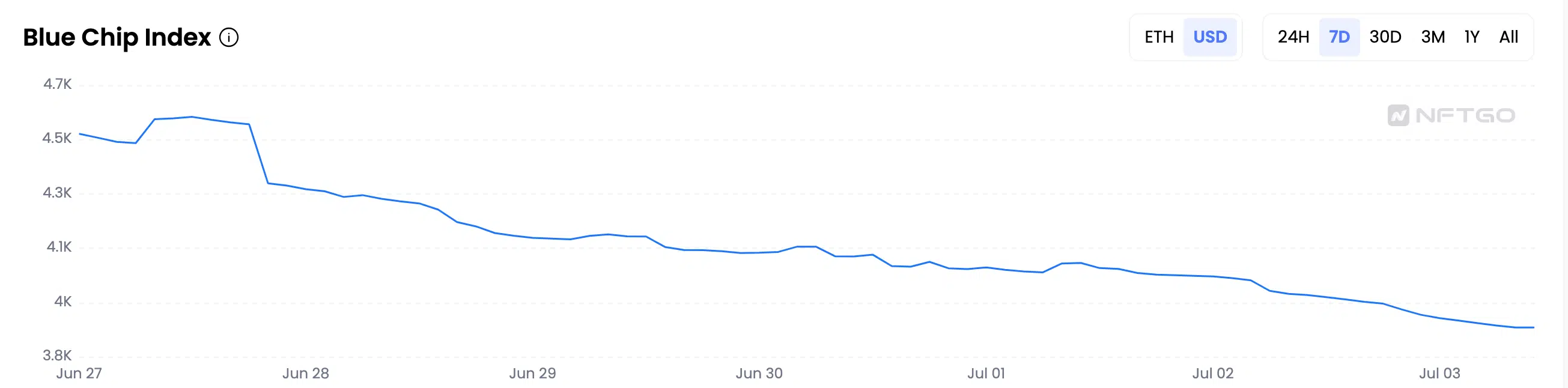

Based on NFTGO’s data, the NFT market experienced a significant decline within the past 24 hours, primarily influenced by the Azuki incident. Since Azuki’s Elemental collection dropped, the overall Azuki collection experienced an 11% decline in floor price, falling below 6 ETH.

Moreover, Bored Ape Yacht Club (BAYC) witnessed a 16% decrease, dropping below the 30 ETH mark in terms of its floor price. On the other hand, Mutant Ape Yacht Club (MAYC) fell by 20%, falling below 5 ETH.

In terms of volume, BAYC’s collection observed a decline of 36.50% in the last 24 hours. Whereas the MAYC collection saw a similar decline in the number of whale addresses holding the collection. Over the last week, the number of whales holding the MAYC collection fell by 13.83%.

Due to these factors, the overall market value of the NFT sector plunged by 53% over the past year. This reached a total of 3.33 million ETH.

APE continues to fight the bears

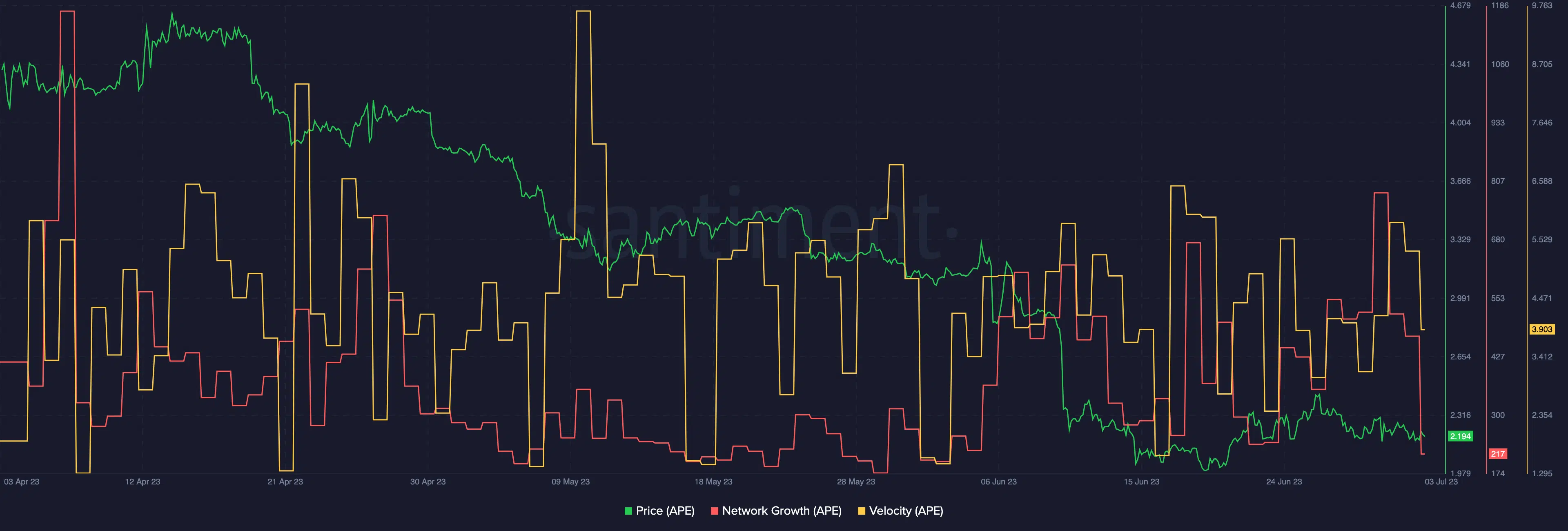

The aforementioned factors have severely impacted the token linked closely to the Yuga Labs NFT cohort, APE. Over the last three months, the price of APE fell significantly. In tandem with APE’s price, the velocity of APE also fell which indicated that the frequency with which APE was being traded amongst addresses had declined materially.

Additionally, the network growth of APE also fell during this period. A low network growth suggested that new addresses were not interested in APE at press time.

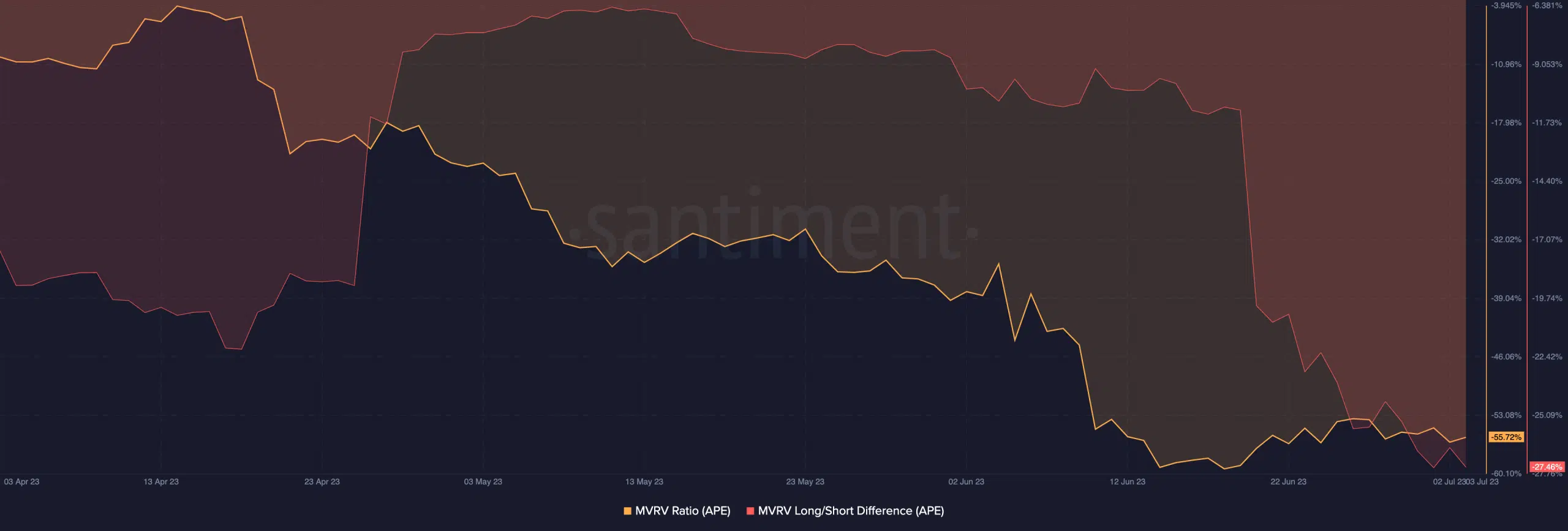

Additionally, the Market Value to Realized Value (MVRV) ratio of APE declined alongside its price. This decline indicated that a majority of APE holders were not experiencing profitability at the current time. This reduced their motivation to sell their holdings.

Is your portfolio green? Check out the ApeCoin Profit Calculator

However, several addresses holding APE tokens were short-term holders, as evidenced by the negative long/short ratio. Short-term holders are more prone to making exit from their positions once they become profitable. This could represent a negative indication for APE.