Memecoin boom? Why these tokens could rally this November!

- Memecoins are leading altcoins, signaling a possible “meme-driven” cycle after the elections.

- However, one key condition must be met for this to materialize.

Memecoin dominance, now approaching 3%, mirrors the mid-March levels when Bitcoin [BTC] soared to its all-time high of $73K, coinciding with a total market cap nearing $2.7 trillion.

By early April, the market share of meme tokens peaked at 4%, fueled by investors reallocating their capital into high-cap tokens.

With elections approaching, BTC is set to attract significant liquidity, prompting speculation about whether memecoins are primed for a substantial rally. If historical patterns hold, we could see the memecoin cycle peak by mid-November.

Memecoins are outperforming altcoins

With 60% of the top 10 memecoins in the green, it’s evident that memecoins are drawing liquidity from Bitcoin, while altcoins continue to struggle to capture similar interest.

Leading the pack is DOGE boasting a weekly gain of over 24%, securing its spot as the top performer over the past seven days. Generally, spikes like these suggest that the current cycle may be reaching its peak, as retail investors begin to hedge against volatility.

However, this market cycle is seeing greater influence from macroeconomic factors, especially with elections less than a week away.

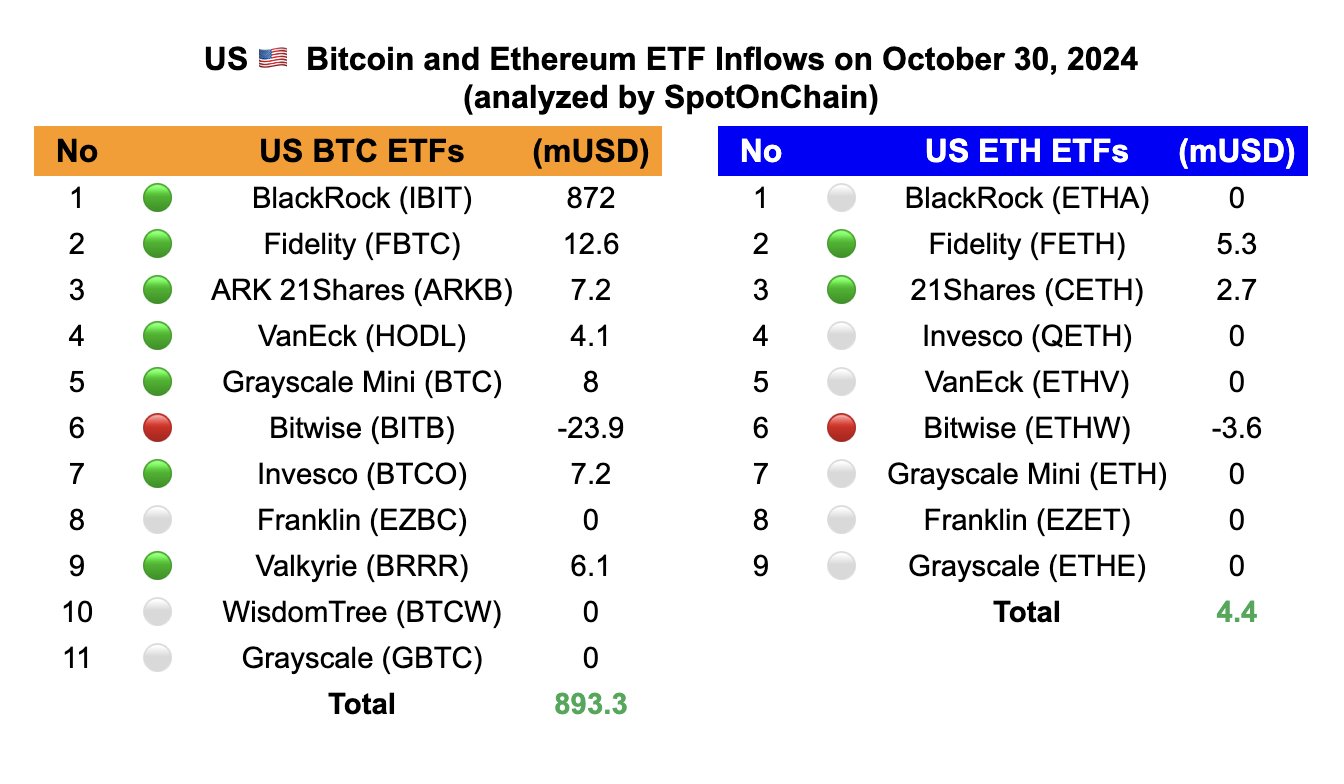

A major catalyst for Bitcoin’s rise toward its ATH has been BlackRock’s inflow of $872 million in a single day, setting a record for the highest daily inflow. ETH ETFs, by contrast, saw a modest $4.4 million inflow, reflecting quieter interest.

This trend reinforces AMBCrypto’s earlier hypothesis: as in past cycles, memecoins are outpacing altcoins in attracting capital during this bullish phase.

However, for a full memecoin cycle to take off, Bitcoin would likely need to hit a market top. Current net deposits on exchanges remain high, hinting at increased selling pressure, yet the bullish MACD crossover suggests room for further upside before any major correction.

With FOMO driving BTC up, a resistance level near $75K could come into play post-election. If Bitcoin peaks and then corrects, capital could flow into memecoins, potentially kicking off a memecoin cycle by mid-November, as suggested by AMBCrypto.

So, should you buy the dip?

As mentioned earlier, most memecoins are experiencing significant gains, with 6 out of the 10 top gainers in the past 30 days being memecoins.

However, for a full cycle to materialize, it’s crucial that enough holders support this theory by treating the current price as a solid buying opportunity.

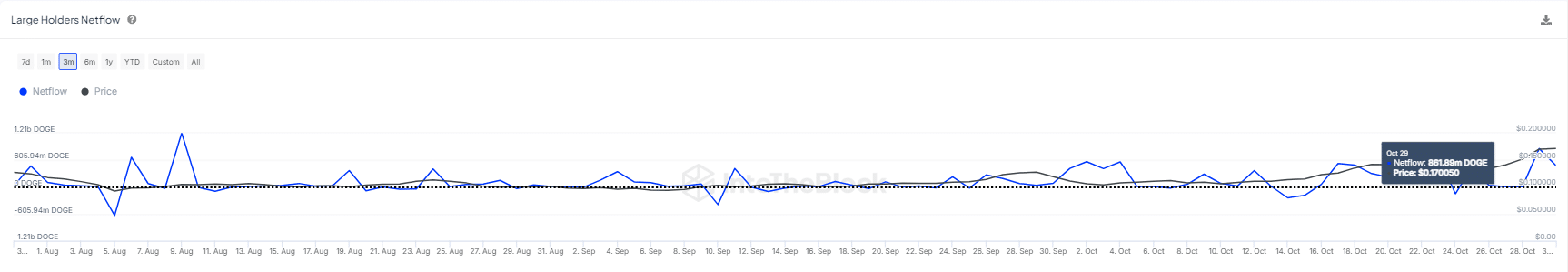

Interestingly, whales, who make up 62% of DOGE’s large cohorts, have been actively scooping up substantial amounts of DOGE tokens from exchanges over the past month.

Is your portfolio green? Check out the Dogecoin Profit Calculator

This strategy supports the theory of a forthcoming memecoin cycle, as they capitalize on the downturn in altcoins and the anticipated volatility increase once Bitcoin hits its peak.

Thus, the likelihood of a memecoin cycle emerging post-election looks promising. However, while these whales capitalize on gains, their long-term commitment is vital. With altcoins losing momentum, and if history serves as a guide, memecoins could be primed for a solid rally ahead.