Memecoins

Memecoin mania returns: Can WIF extend the 65% recovery?

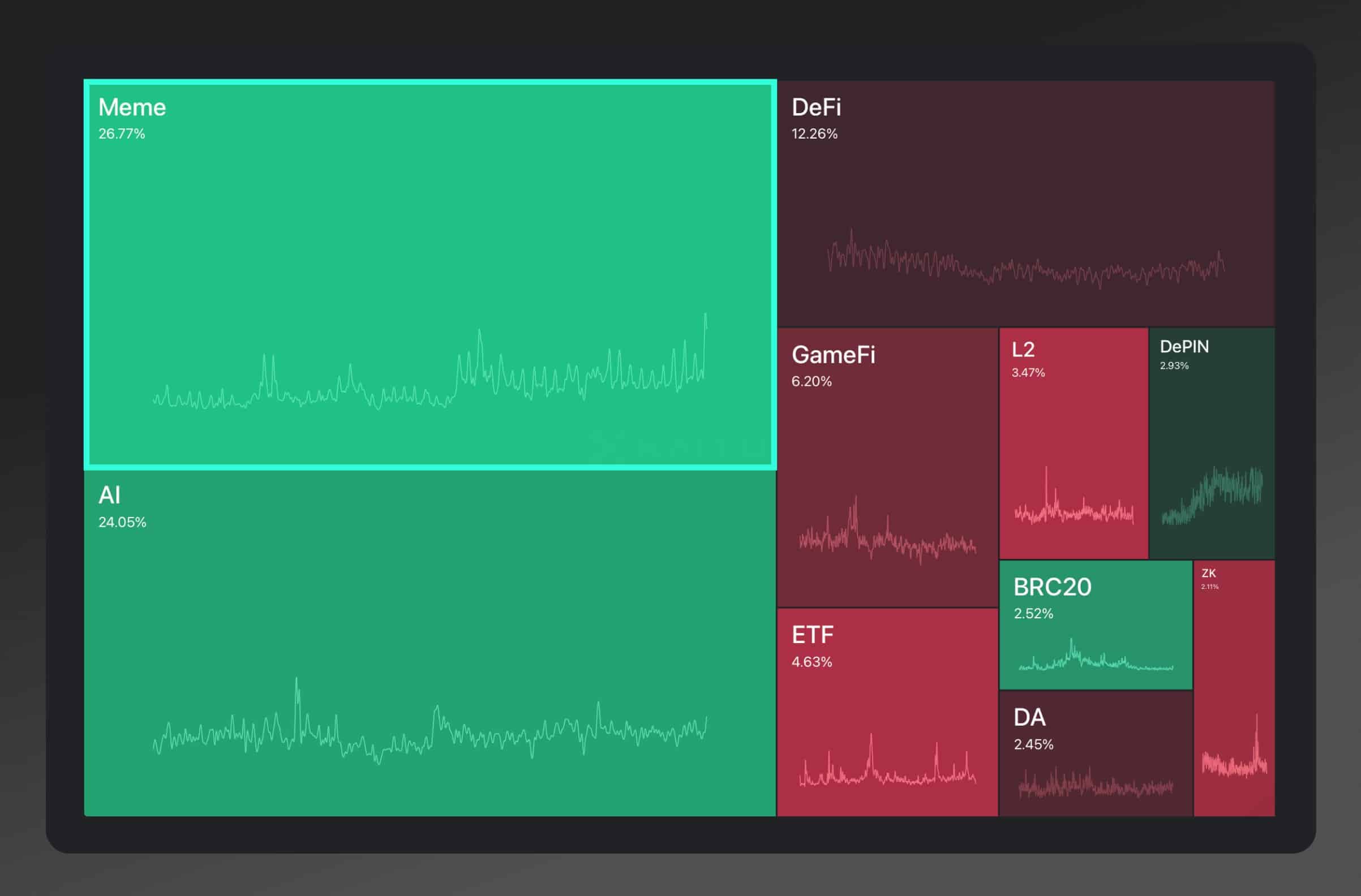

Which direction will WIF take as memecoin narrative tops the chart in terms of market interest?

- Memecoin mania likely to be back per recent narrative mindshare data.

- Will WIF recovery benefit from the renewed market interest?

Dogwifhat [WIF] was among the best-performing memecoins in the first half of 2024. But its momentum lost traction at the beginning of H2. WIF shed over 60% in July and August and dropped to $1.0.

However, it has recovered 65% and nearly hit $2 during the recent market rebound. Recent data showed that the memecoin narrative has regained interest.

‘Memecoins at the No.1 spot for mindshare. The dethroning of AI’

Will the memecoin surge boost WIF?

AMBCrypto’s evaluation of the WIF’s Futures market showed that it ranked third in terms of Open Interest (OI) at the time of writing.

Per Coinglass data, WIF’s OI was $251 million, indicating that it received the third highest liquidity flow amongst the memecoins.

That meant that a surge in overall meme coin traction could also trickle into WIF. By extension, the positive uptick in OI also suggested a bullish sentiment amongst WIF speculators in the derivatives market.

However, despite the slightly bullish sentiment in the derivatives market, overall weighted sentiment in the spot market was somewhat neutral.

Per Santiment data, the weighted sentiment sharply dropped from recent positive peaks to the neutral level, per readings at the time of writing.

This meant WIF’s price could go in any direction. That said, what are the key levels to watch out for in the short term?

Let’s explore the 4-hour chart for some clues.

WIF’s price action

A Fibonnaci retracement tool (yellow) was plotted between July highs and August lows. Based on the tool, the 61.8% Fib level ($1.7) acted as short-term support during the sideway movement over the weekend.

If the meme coin renewed interest in pumping WIF, the immediate bullish targets would be 50% and 38.6% Fib levels. If they are hit, that would translate to 12% and 23% potential gains, respectively.

On the lower side, the 78.6% Fib level and the breaker block area, marked white (near $1.6), would be key support levels to consider in the short term.

Realistic or not, here’s WIF’s market cap in BTC’s terms

WIF’s demand and flows stagnated, as shown by the movements of RSI (Relative Strength Index) and CMF (Chaikin Money Flow). This further reiterated that price could take any direction.

Ergo, tracking the above key levels and overall memecoins momentum could be crucial before making bets.