Memecoins’ revival on Solana’s network – Why and how can it happen?

- Solana’s short-term outlook was bullish even as it stared down a key resistance

- Network activity has soared in recent weeks, majorly driven by memecoins

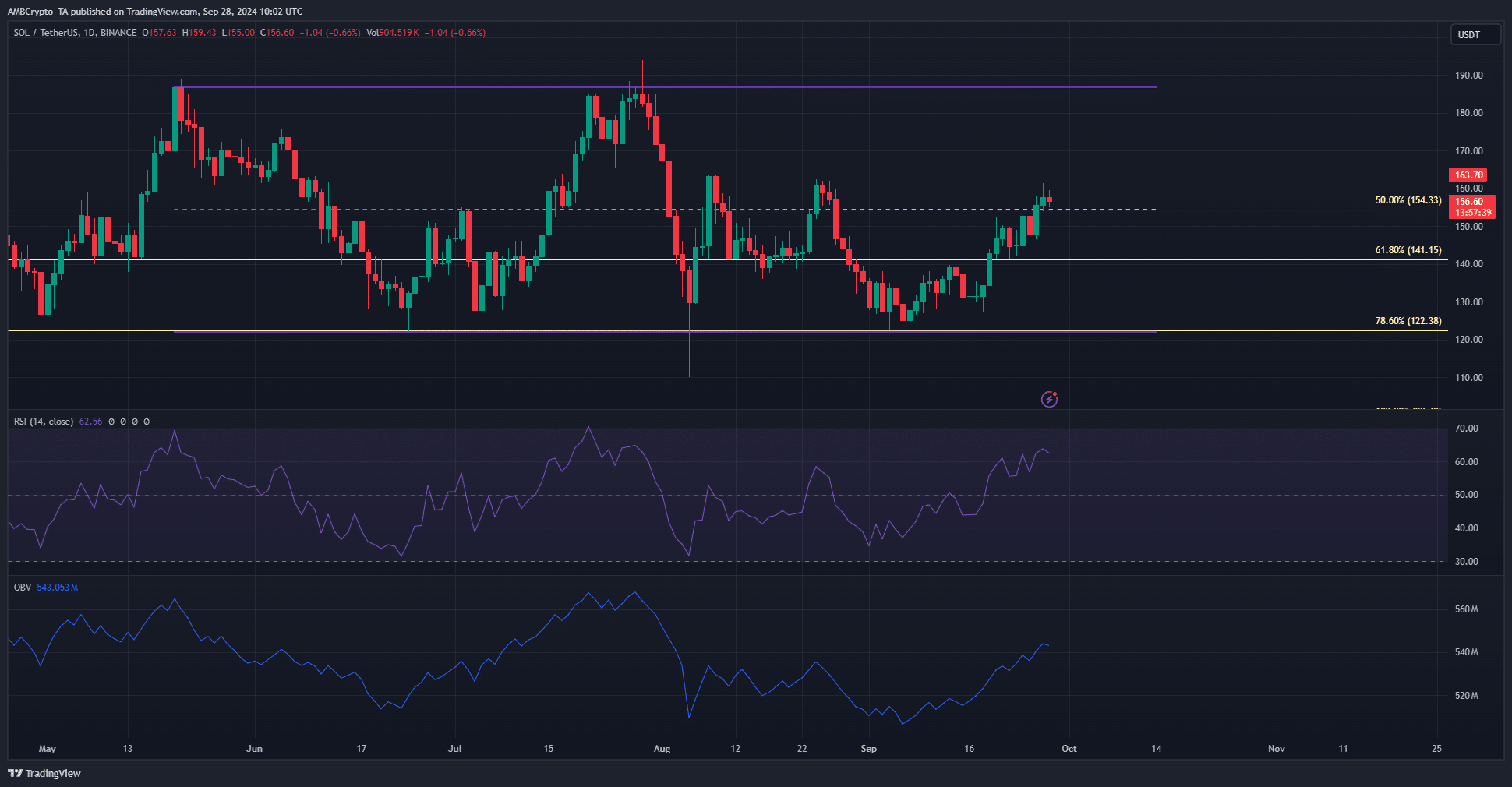

Since the retest of the range lows at $120 on 6 September, Solana [SOL] has gained by 30% in price. At the time of writing, it was on the cusp of a two-month resistance zone around $162-$165, with short-term sentiment around the token strongly bullish too.

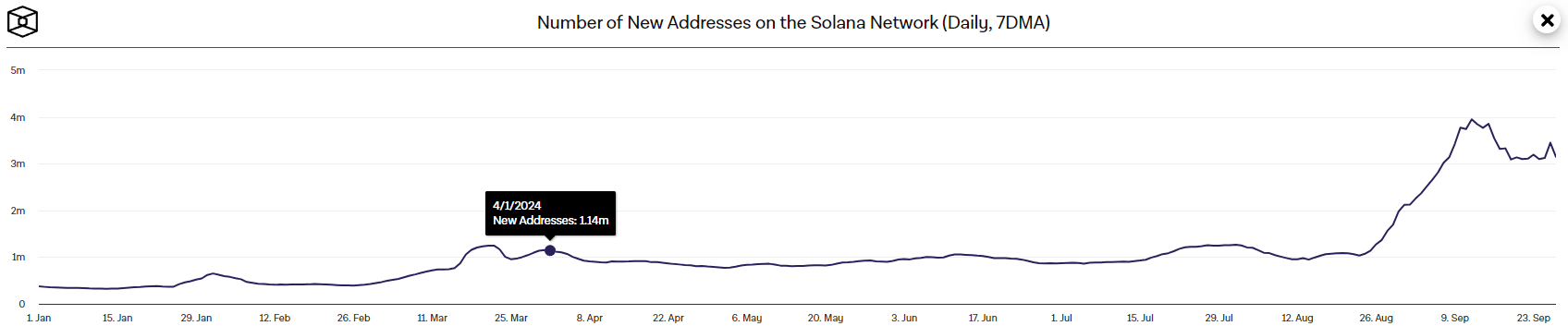

On-chain activity also seemed to be on the rise, a recent AMBCrypto report noted. In fact, the network activity growth appeared to be fueled primarily by the popularity of SOL-based mem coins, but it was not yet as frenzied as it got in April.

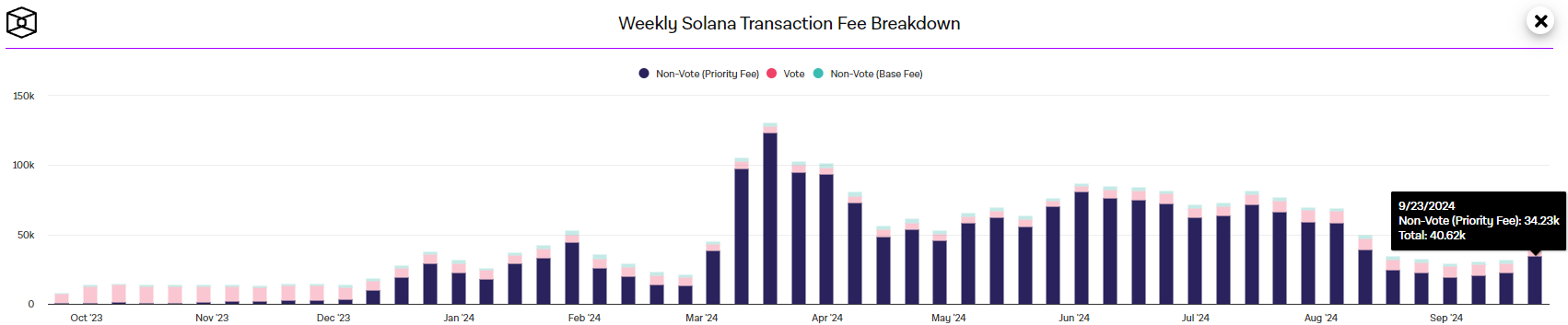

Clues from SOL’s transaction fee trends

Source: The Block

In April, the number of new addresses on the Solana network was 1.14 million (7-day moving average). On 9 September, this number was as high as 3.95 million. The rapid increase in August was sustained in September.

The daily net flows were also positive and as per AMBCrypto’s report, the memecoin sector is one of the biggest factors behind this trend.

Source: The Block

Although new addresses increased remarkably, weekly transaction fees were lower than in April 2024. This was when the memecoin boom occurred on the Solana network, before a relatively quiet summer drained many of the memecoins’ rapid gains.

The priority fee was a third of the peak it reached in April. This suggested that the memecoin frenzy has not reached the Solana network. Q4 2024, widely anticipated to be bullish, could see a memecoin revival, but not all market participants would be thrilled by this development.

Assessing the sentiment behind the token

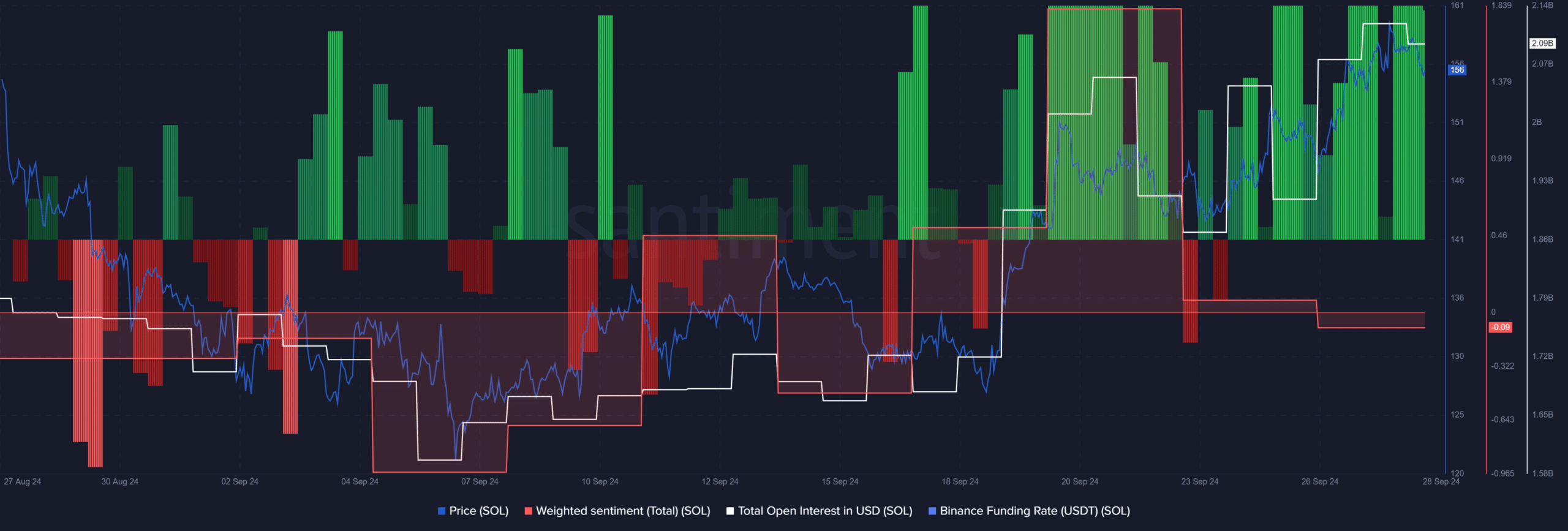

Source: Santiment

Network activity seemed to be burgeoning, with the whale activity also encouraging long-term investors to hold on. An analysis of the short-term sentiment revealed that the bulls were the overwhelming majority in the Futures market.

Realistic or not, here’s SOL’s market cap in BTC’s terms

The funding rate was high and the Open Interest has trended higher since mid-September, alongside the market-wide sentiment shift following a Bitcoin [BTC] move past $60k. However, social media engagement, at press time, was slightly negative – Giving mixed signals over the past ten days.